With A 25% Price Drop For ICON Public Limited Company (NASDAQ:ICLR) You'll Still Get What You Pay For

ICON Plc ICLR | 213.26 213.26 | +1.54% 0.00% Pre |

Unfortunately for some shareholders, the ICON Public Limited Company (NASDAQ:ICLR) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 15% share price drop.

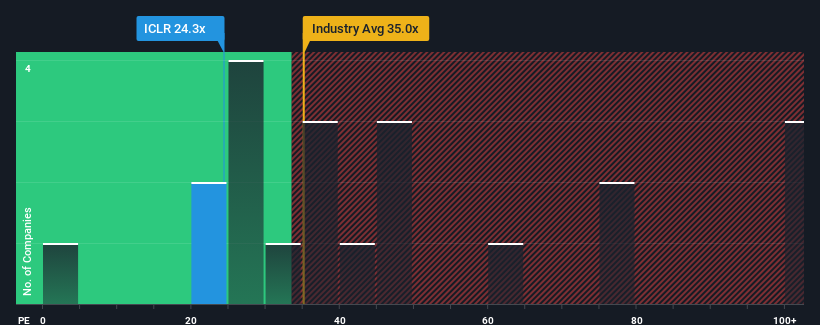

In spite of the heavy fall in price, ICON may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.3x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

ICON certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is ICON's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as ICON's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 44%. The strong recent performance means it was also able to grow EPS by 205% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why ICON is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On ICON's P/E

There's still some solid strength behind ICON's P/E, if not its share price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ICON maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for ICON with six simple checks.

If these risks are making you reconsider your opinion on ICON, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.