US Stocks That May Be Trading Below Estimated Value In October 2024

Vertex Pharmaceuticals Incorporated VRTX | 405.76 | +0.76% |

As the U.S. stock market experiences a downturn amid anticipation of major tech earnings and mixed economic signals, investors are keenly observing opportunities that may arise from this volatility. In such an environment, identifying stocks that might be trading below their estimated value can offer potential for long-term growth, making them attractive to those looking to capitalize on market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $19.03 | $37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.27 | $168.24 | 49.9% |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | $22.73 | $44.35 | 48.7% |

| California Resources (NYSE:CRC) | $52.32 | $104.35 | 49.9% |

| UFP Technologies (NasdaqCM:UFPT) | $274.00 | $537.57 | 49% |

| WEX (NYSE:WEX) | $173.76 | $343.51 | 49.4% |

| Vitesse Energy (NYSE:VTS) | $25.12 | $49.46 | 49.2% |

| ChromaDex (NasdaqCM:CDXC) | $3.58 | $7.15 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | $216.60 | $419.13 | 48.3% |

| Rapid7 (NasdaqGM:RPD) | $41.30 | $81.71 | 49.5% |

Let's review some notable picks from our screened stocks.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $121.40 billion.

Operations: The company generates its revenue primarily from its Pharmaceuticals segment, which amounted to $10.34 billion.

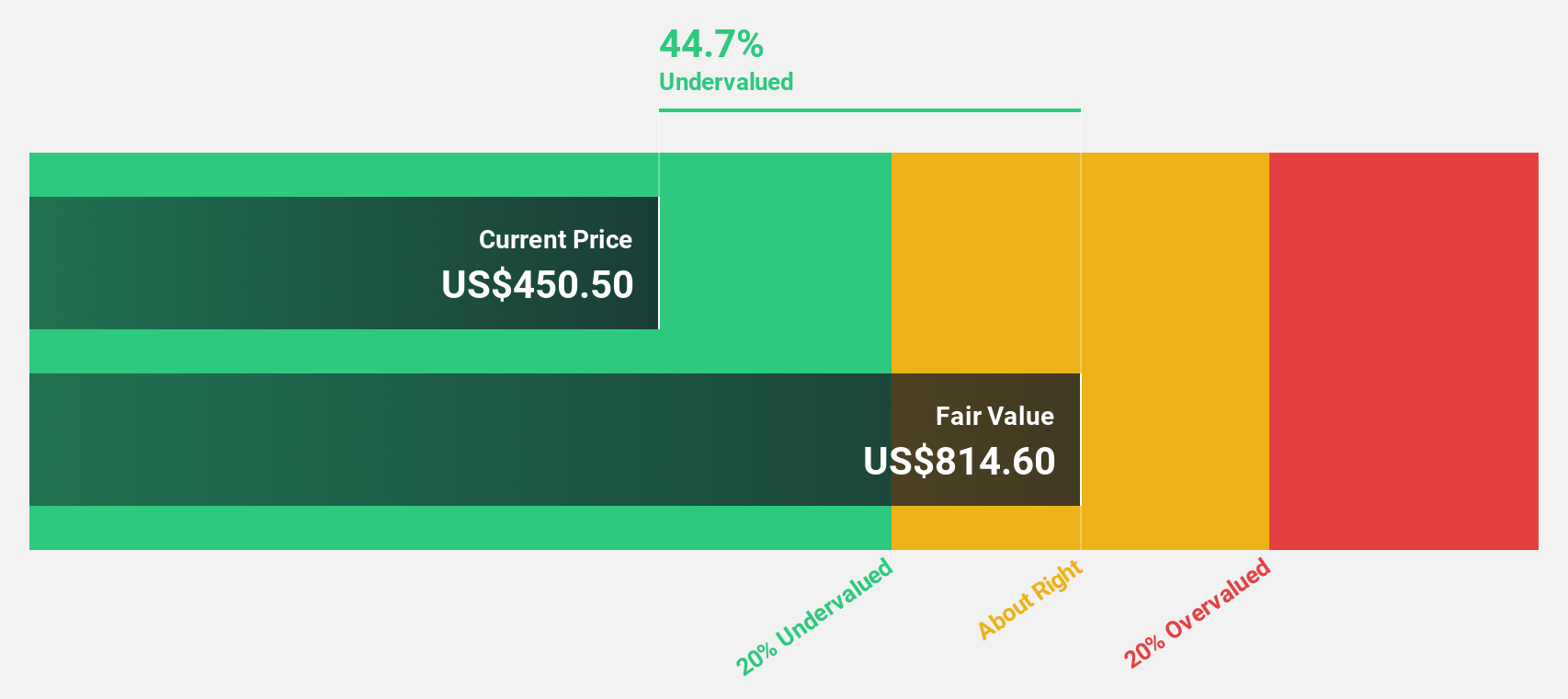

Estimated Discount To Fair Value: 44.3%

Vertex Pharmaceuticals is trading at a significant discount, approximately 44.3% below its estimated fair value of US$852.9, based on discounted cash flow analysis. Recent updates in their kidney disease pipeline, including positive data for povetacicept in IgA nephropathy and primary membranous nephropathy, highlight potential revenue drivers. Despite reporting losses recently, Vertex has raised its full-year revenue guidance to US$10.65 billion-US$10.85 billion, reflecting confidence in its product portfolio expansion and future profitability prospects.

Spotify Technology (NYSE:SPOT)

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $78.56 billion.

Operations: Spotify Technology S.A. generates its revenue through two main segments: Premium, which accounts for €12.68 billion, and Ad-Supported, contributing €1.79 billion.

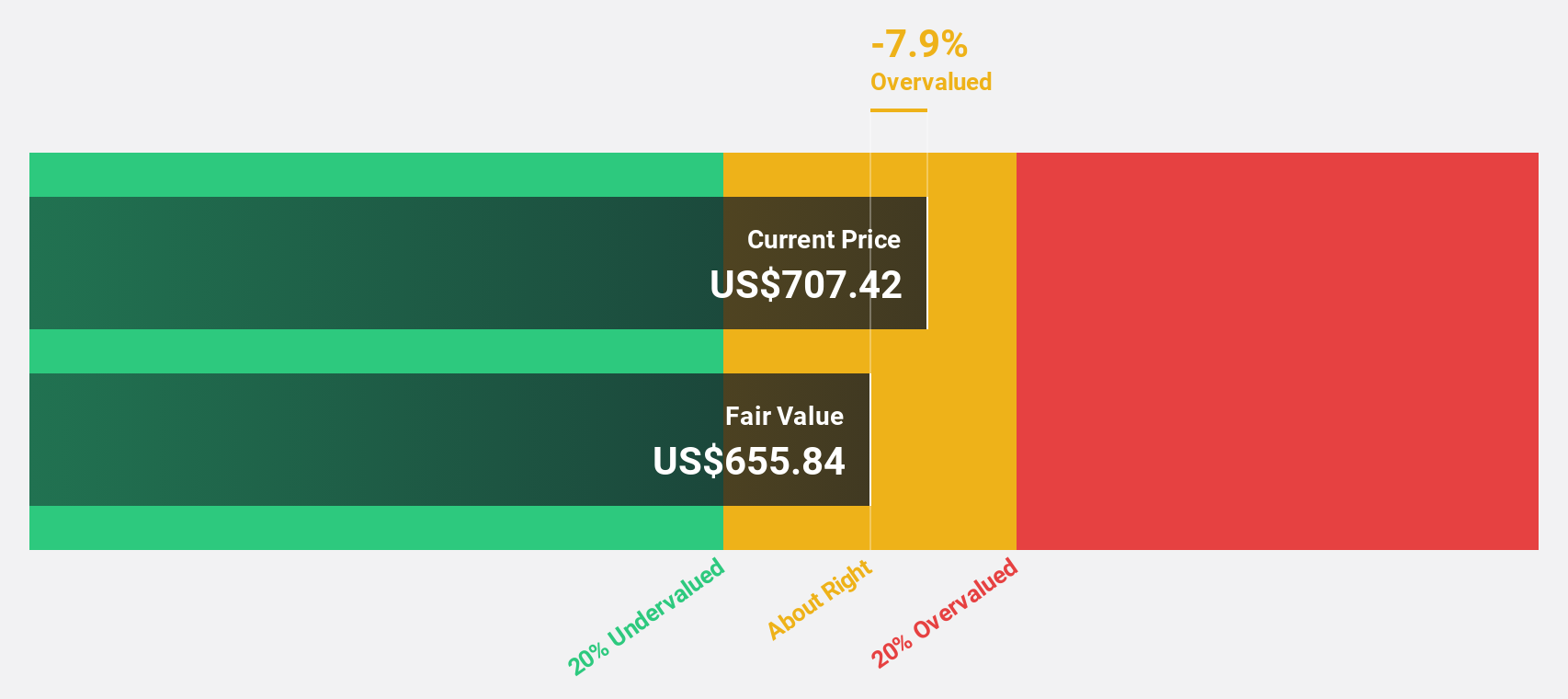

Estimated Discount To Fair Value: 13.5%

Spotify Technology is trading at US$394.02, below its estimated fair value of US$455.43, reflecting a 13.5% discount according to discounted cash flow analysis. Despite recent shareholder dilution and large one-off items impacting earnings quality, Spotify has become profitable this year with earnings expected to grow significantly over the next three years at 31.1% annually—outpacing both revenue growth and the broader US market's profit expansion rate.

Vertiv Holdings Co (NYSE:VRT)

Overview: Vertiv Holdings Co designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments globally, with a market cap of approximately $42.72 billion.

Operations: The company's revenue segments include $4.30 billion from the Americas, $1.74 billion from the Asia Pacific, and $2.13 billion from Europe, the Middle East, and Africa.

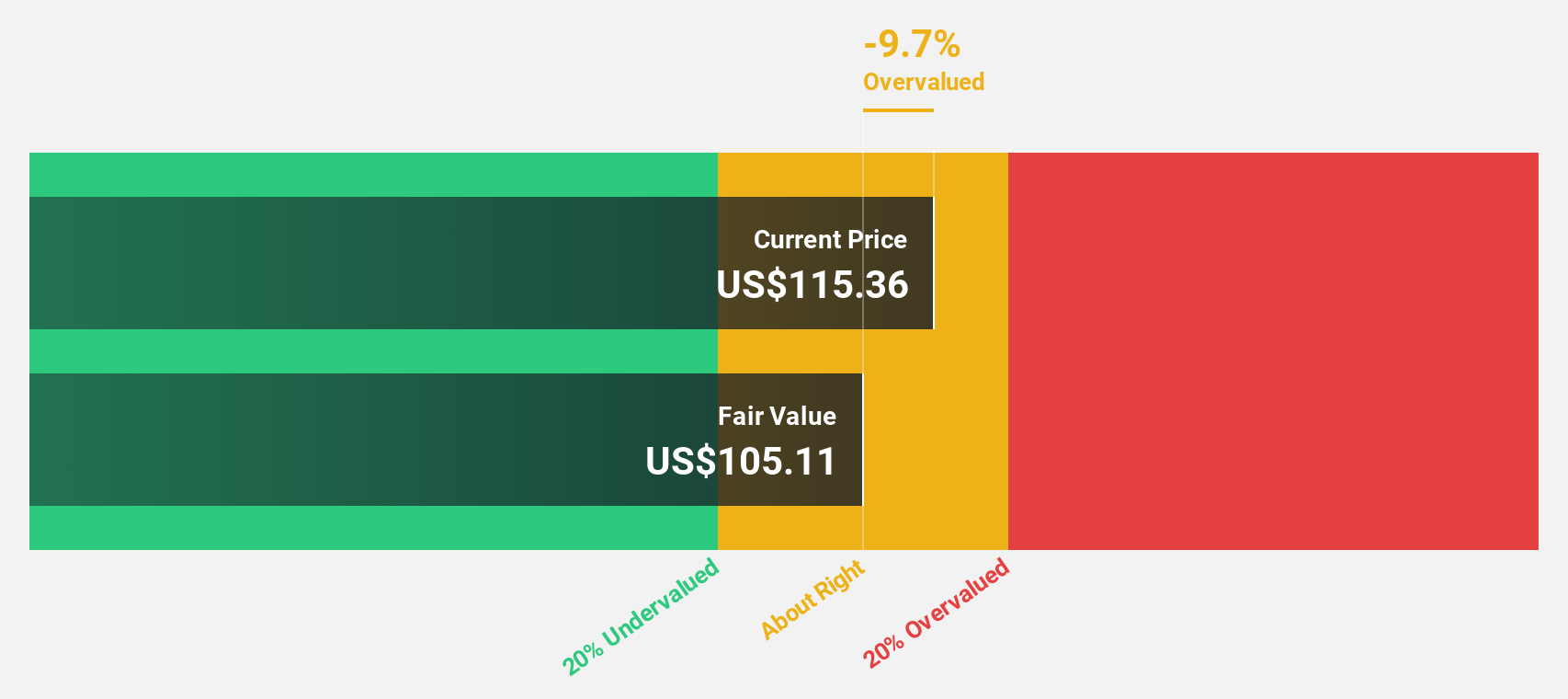

Estimated Discount To Fair Value: 26.9%

Vertiv Holdings Co is trading at US$112.45, significantly below its estimated fair value of US$153.80, implying it's highly undervalued based on cash flow analysis. Despite a high debt level, Vertiv has demonstrated robust earnings growth of 128.7% over the past year and is forecasted to continue growing at 30.8% annually—surpassing both revenue growth and the broader US market's profit expansion rate—supported by strategic M&A activities and innovative product developments in AI infrastructure solutions.

Next Steps

- Explore the 193 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.