There's No Escaping Teekay Corporation's (NYSE:TK) Muted Earnings Despite A 30% Share Price Rise

Teekay Corporation TK | 8.22 8.22 | -2.26% 0.00% Pre |

Teekay Corporation (NYSE:TK) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 75%.

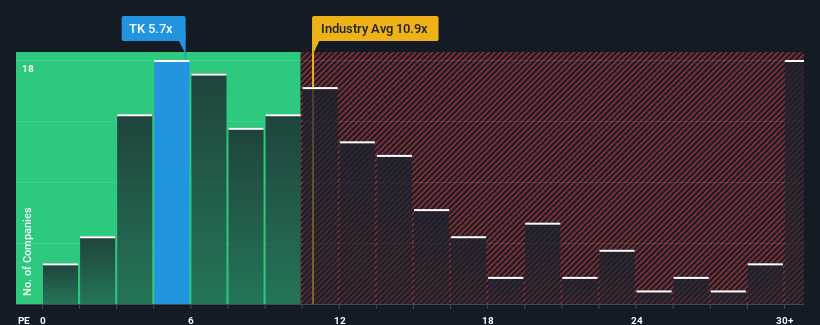

In spite of the firm bounce in price, Teekay may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.7x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for Teekay as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

How Is Teekay's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Teekay's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 35% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Teekay is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Teekay's P/E

Shares in Teekay are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Teekay revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Teekay with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Teekay, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.