The Marcus Corporation's (NYSE:MCS) P/S Is Still On The Mark Following 28% Share Price Bounce

Marcus Corporation MCS | 21.70 21.70 | +1.64% 0.00% Post |

The Marcus Corporation (NYSE:MCS) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 32%.

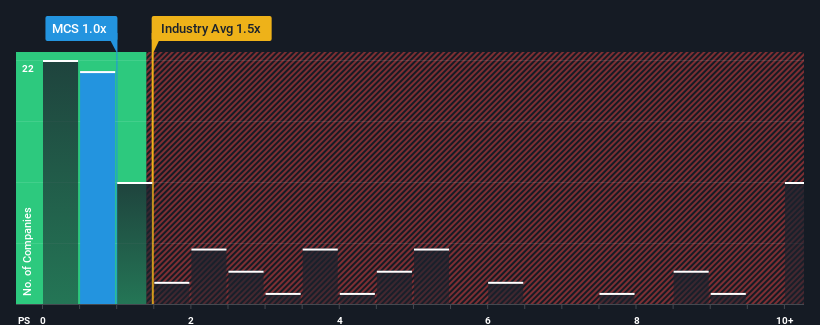

Even after such a large jump in price, there still wouldn't be many who think Marcus' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in the United States' Entertainment industry is similar at about 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Marcus Performed Recently?

While the industry has experienced revenue growth lately, Marcus' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Marcus will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Marcus?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Marcus' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.2% decrease to the company's top line. Still, the latest three year period has seen an excellent 116% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 13% as estimated by the two analysts watching the company. With the industry predicted to deliver 12% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Marcus is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Marcus appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Marcus' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Entertainment industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Marcus with six simple checks will allow you to discover any risks that could be an issue.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.