SoundHound AI, Inc.'s (NASDAQ:SOUN) 49% Jump Shows Its Popularity With Investors

SoundHound AI SOUN | 23.25 | +14.87% |

The SoundHound AI, Inc. (NASDAQ:SOUN) share price has done very well over the last month, posting an excellent gain of 49%. This latest share price bounce rounds out a remarkable 302% gain over the last twelve months.

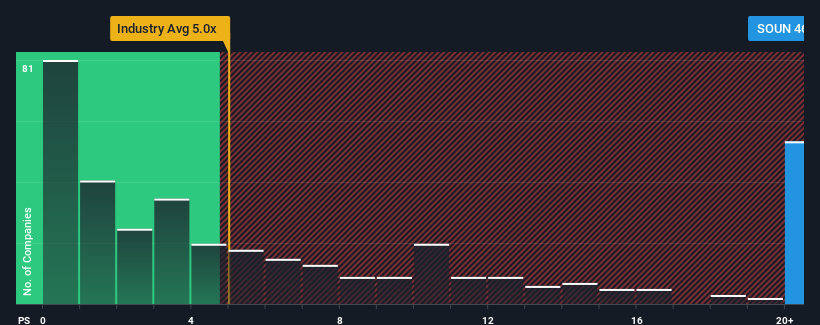

Following the firm bounce in price, SoundHound AI may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 46.6x, since almost half of all companies in the Software industry in the United States have P/S ratios under 5.1x and even P/S lower than 1.8x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has SoundHound AI Performed Recently?

With revenue growth that's superior to most other companies of late, SoundHound AI has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SoundHound AI.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, SoundHound AI would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. Pleasingly, revenue has also lifted 174% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 111% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why SoundHound AI is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does SoundHound AI's P/S Mean For Investors?

SoundHound AI's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that SoundHound AI maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.