Refreshing Morning Brief | Saudi Arabia and China Ink $6.9bn Currency Swap Deal; US AI Stocks Soar, Fueled by OpenAI Buzz

Microsoft Corporation MSFT | 460.77 | +0.32% |

Dow Jones Industrial Average DJI | 39308.00 | -0.06% |

Tadawul All Shares Index TASI.SA | 11658.66 | +0.55% |

Parallel Market Capped Index (NomuC) NOMUC.SA | 25909.95 | +0.64% |

NAQI 2282.SA | 64.30 | -0.31% |

Key Takeaways

- Saudi Arabia and China Ink $6.9bn Currency Swap Deal;

- Foreign Investment in Saudi Capital Market Surges 300% in Five Years;

- Crude Oil Rises as OPEC+ Considers Further Supply Cuts;

- OpenAI Board Proposes Merger with Anthropic, Eyes CEO Replacement;

- US AI Stocks Soar, Fueled by OpenAI Buzz;

I. Market Recap

Gulf stock markets declined on Monday, reflecting investor caution before the release of the U.S. Federal Reserve's November meeting minutes. These minutes, anticipated on Tuesday, are keenly awaited for insights into future U.S. interest rate directions. This is particularly significant for the Gulf Cooperation Council (GCC) countries, whose monetary policies and currency pegs are closely aligned with the U.S. Federal Reserve's decisions.

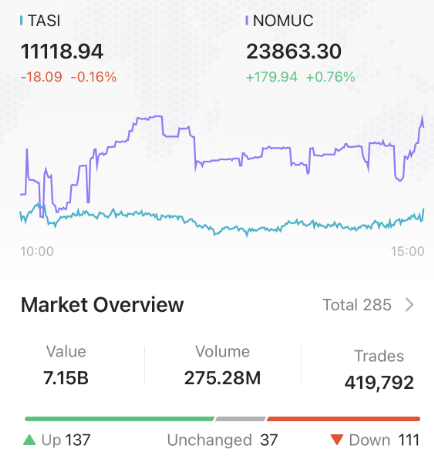

The Tadawul All Shares Index(TASI.SA) experienced a slight decline, closing at 11,118.94 points, down 0.16% or 18.09 points. Similarly, the MSCI Tadawul 30 Index fell by 4.06 points or 0.28%, ending at 1,442.87 points. Meanwhile, the Parallel Market Capped Index (NomuC)(NOMUC.SA) saw a 0.76% increase, rising by 179.94 points to 23,863.30.

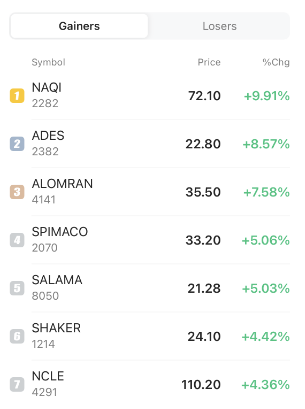

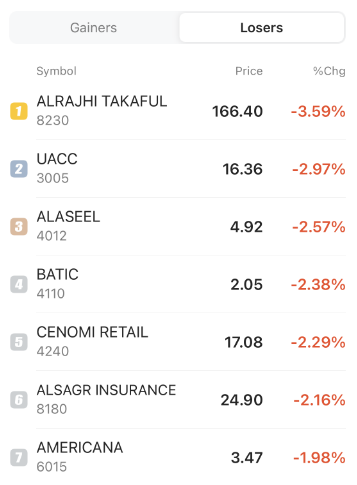

Naqi Water Co.(2282.SA) emerged as the session's top performer, witnessing a 9.91% surge in its share price. In contrast, Al-Rajhi Company for Cooperative Insurance(8230.SA) faced headwinds, recording a 3.59% decline, ending as the day's most significant laggard in the main market.

TASI Gainers | TASI Losers |

|  |

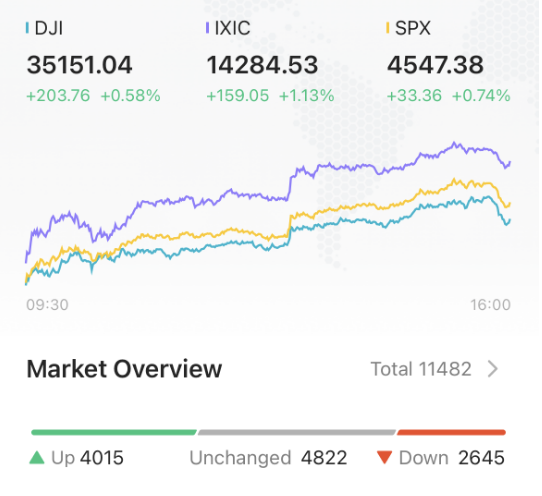

During regular trading in the US market, the Dow Jones Industrial Average(DJI.US) ended the session higher by 0.58%. The S&P 500 index(SPX.US) rose 0.74% to settle at 4,547.38 on Monday, and the NASDAQ(IXIC.US) 1.13% to end the session at 14,284.53.

II. Flash Headlines

Saudi Arabia and China Ink $6.9bn Currency Swap Deal

The Saudi Central Bank (SAMA) and the People’s Bank of China have formalized a SAR26 billion ($6.93 billion) local currency swap agreement, bolstering financial cooperation. This three-year pact, reflecting the growing collaboration between the two nations, may be extended beyond its initial term, as mentioned in a separate media release issued by China’s central bank China's central bank.

Foreign Investment in Saudi Capital Market Surges 300% in Five Years

Saudi Arabia's capital market has seen a significant 300% increase in foreign investments, reaching SR347.01 billion ($92.53 billion) in 2022, up from SR86.86 billion in 2018. This surge, attributed to the Kingdom's economic diversification efforts, represents 14.2% of the total free float value in the primary market.

Abdullah Binghannam of the Capital Markets Authority highlighted this growth as a sign of growing global confidence in the Saudi market, with aims to further enhance its regional and international presence.

He further noted that CMA aims to strengthen the Saudi capital market both regionally and internationally, emphasizing that diversifying the investor base is critical to achieving that goal.

Crude Oil Rises as OPEC+ Considers Further Supply Cuts

Crude oil futures experienced a rise on Monday, fueled by expectations that OPEC+ may implement deeper supply cuts. This anticipation aims to bolster oil prices, countering a four-week decline influenced by reduced concerns over Middle East supply disruptions, particularly amidst the ongoing Israel-Hamas conflict.

The Proshares Trust Ii Ultra Bloomberg Crude Oil(Post Rev Splt)(UCO.US) traded higher by 3.97% to $30/36 as of 16:00 ET post-market while United Sts Brent Oil Fd Lp Unit(BNO.US) was up by 2.14% to $29.14 at its close.

OpenAI Board Proposes Merger with Anthropic, Eyes CEO Replacement

OpenAI's board, following the dismissal of CEO Sam Altman, approached Anthropic CEO Dario Amodei about a potential merger between the two AI companies. Anthropic, known for its chatbot Claude and a direct competitor in the large-language model space, declined the offer. This move by OpenAI's board aimed to not only merge with Anthropic but also to position Amodei as Altman's successor, though it remains unclear if the merger talks progressed significantly.

UAW Secures Significant Pay Raises and Benefits in New Contracts with Major Automakers

More from the U.S., The United Auto Workers (UAW) has successfully ratified new contracts with Ford, Stellantis, and General Motors. These agreements guarantee UAW members a minimum of 25% pay increase over four and a half years, alongside enhanced benefits. This marks a notable victory for the union in securing better compensation and working conditions for its members.

III. Stocks To Watch

SA snapshot

Saudi's First Milling Co. to Buy Shares for Employee Incentive Plan

First Milling Co.(2283.SA) announced plans to purchase up to 300,000 shares for its employee stock long-term incentive plan, a decision to be discussed in an upcoming extraordinary general assembly meeting. This initiative, in line with solvency conditions for listed joint stock companies, coincides with the company's stock price closing at SAR69.60, up by 3.11%.

Solutions Gets Green Light for 40% Acquisition of Devoteam Middle East

Arabian Internet and Communications Services Co.(7202.SA), popularly known as Solutions by STC, has secured approval from the General Authority for Competition for its strategic acquisition of a 40% stake in Devoteam Middle East. This move marks a significant expansion in the company's regional footprint.

Al Mujtama Pharmacy Set for Nov. 22 Trading Debut on Nomu

Tadawul has announced the upcoming listing of Al Mujtama Alraida Medical Co. (Al Mujtama Pharmacy) on the Nomu-Parallel Market. Trading under the symbol 9592, the shares will commence trading on November 22. Tadawul specifies daily and static price fluctuation limits of ±30% and ±10%, respectively, for the shares.

US snapshot

Microsoft Stock Closes at Record High After Onboarding Former OpenAI Heads Altman and Brockman to Lead New AI Research Team

Microsoft Corporation(MSFT.US)'s stock reached a new record high as the company announced the hiring of former OpenAI CEO Sam Altman and co-founder Greg Brockman. This follows Altman's recent dismissal from OpenAI.

Nadella: “We look forward to moving quickly to provide them with the resources needed for their success.”

Salesforce Welcomes OpenAI Researchers Amidst Company Turmoil

Following a tumultuous period at OpenAI, salesforce.com, inc.(CRM.US) CEO Marc Benioff announces on X (formerly Twitter) the company's readiness to match compensation for any OpenAI researchers willing to join Salesforce's Einstein Trusted AI team. This comes in the wake of a majority of OpenAI employees threatening to resign unless the board is restructured and former leaders reinstated.

Nvidia Stock Rises 2.25%, Hits 52-Week High Amid Strategic Collaborations

NVIDIA Corporation(NVDA.US)'s stock saw a significant uptick, closing at $504.2 on Monday, marking a 2.28% increase. This surge is attributed to Nvidia's collaborations with L&T Technology Services and SandboxAQ, alongside an investment from the Gates Foundation, strengthening its market standing.

Zoom Stock Climbs on Strong Q3 Earnings and Positive Outlook

Zoom Video Communications(ZM.US)' shares rose 2.93%, closing at $66, in response to its Q3 earnings surpassing expectations. The company reported earnings of $141.2 million, or 45 cents per share, significantly higher than last year's $48.4 million, or 16 cents per share, and above analysts' 28 cents per share forecast. Zoom's updated full-year revenue projection is around $4.5 billion, with adjusted earnings estimated between $4.93 and $4.95 per share.

Palantir's Stock Soars 4.15%, Fueled by AI Sector Buzz

Palantir Technologies(PLTR.US)' shares surged by 4.15%, closing at $21.34, amid heightened investor interest in AI-related stocks. This increase coincides with the company reaching a new 52-week high. The stock's performance has been notably influenced by recent significant developments in the AI sector, including events involving OpenAI and Microsoft Corporation.

IV. Upcoming Events

Economic Calendar

| Date | Market | Events | Previous |

| Tues Nov 21 | US | U.S. 20-Year Treasury Bond Auction | 5.25% |

| US | CFTC Speculative Net Position - Crude Oil | 236.0K | |

| US | CFTC Speculative Net Position - Gold | 166.2K | |

| US | U.S. existing home sales annualized monthly rate Oct | -2.0% | |

| US | Annualized total number of existing home sales Oct | 3.96M |

Earnings Calendar

[This newsletter is written and edited by Candice from Sahm News Team]