MediaCo Holding Inc.'s (NASDAQ:MDIA) 46% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

MEDIACO HOLDING INC MDIA | 1.20 1.20 | +2.13% 0.00% Post |

To the annoyance of some shareholders, MediaCo Holding Inc. (NASDAQ:MDIA) shares are down a considerable 46% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 100%, which is great even in a bull market.

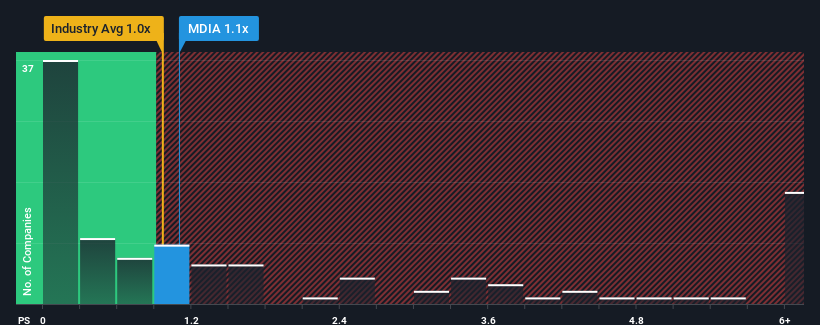

Even after such a large drop in price, there still wouldn't be many who think MediaCo Holding's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in the United States' Media industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does MediaCo Holding's Recent Performance Look Like?

MediaCo Holding has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for MediaCo Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is MediaCo Holding's Revenue Growth Trending?

MediaCo Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 3.9% shows it's noticeably less attractive.

In light of this, it's curious that MediaCo Holding's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On MediaCo Holding's P/S

With its share price dropping off a cliff, the P/S for MediaCo Holding looks to be in line with the rest of the Media industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that MediaCo Holding's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.