High Insider Ownership Growth Companies On US Exchange May 2024

Allegiant Travel Company ALGT | 62.87 62.87 | -0.80% 0.00% Pre |

Amidst a backdrop of economic cooling and fluctuating market conditions, the U.S. stock market has shown resilience with signs that rate cuts could be on the horizon, potentially buoying investor sentiment. In this context, companies with high insider ownership can be particularly compelling as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

| Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| ZKH Group (NYSE:ZKH) | 17.7% | 104.4% |

| BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Here we highlight a subset of our preferred stocks from the screener.

Theravance Biopharma (NasdaqGM:TBPH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Theravance Biopharma, Inc. is a biopharmaceutical company focused on the discovery, development, and commercialization of respiratory medicines in the United States and Europe, with a market capitalization of approximately $409.01 million.

Operations: The company generates its revenue primarily through the discovery, development, and commercialization of human therapeutics, totaling $61.51 million.

Insider Ownership: 14.0%

Theravance Biopharma, a growth-focused biopharmaceutical company, has shown promising developments with a 24.4% forecasted annual revenue growth rate, outpacing the US market's 8.4%. Recent financials reveal an improving scenario: Q1 2024 revenues rose to US$14.5 million from US$10.42 million year-over-year and net losses decreased significantly. The firm has also demonstrated commitment to shareholder returns through substantial share repurchases totaling US$325 million since September 2022, underscoring high insider confidence and investment alignment despite ongoing challenges toward profitability within three years.

Verrica Pharmaceuticals (NasdaqGM:VRCA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Verrica Pharmaceuticals Inc. is a clinical-stage dermatology therapeutics company focused on developing medications for skin diseases in the United States, with a market capitalization of approximately $357.18 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling $8.91 million.

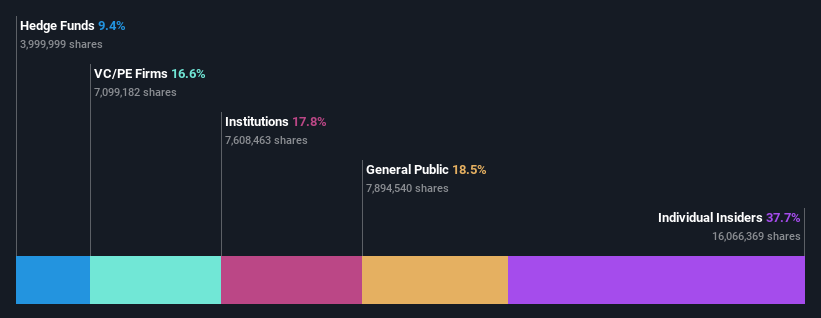

Insider Ownership: 38.3%

Verrica Pharmaceuticals, with high insider ownership, is poised for significant growth as it expands into the multibillion-dollar dermatological market. Recently amending its licensing agreement with Torii Pharmaceutical to equally share costs for a pivotal Phase 3 trial of YCANTH® for common warts—a market with no FDA-approved treatments—highlights strategic advancement. Despite a substantial net loss of US$20.33 million in Q1 2024 and ongoing financial challenges, Verrica's revenue growth is forecasted at an impressive 49.1% annually, outpacing the broader US market significantly.

Allegiant Travel (NasdaqGS:ALGT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allegiant Travel Company, a leisure travel company, offers services and products to residents of under-served cities in the United States with a market capitalization of approximately $863.09 million.

Operations: The company generates revenue primarily through its airline segment, which brought in $2.49 billion, and its Sunseeker Resort segment, which contributed $26.77 million.

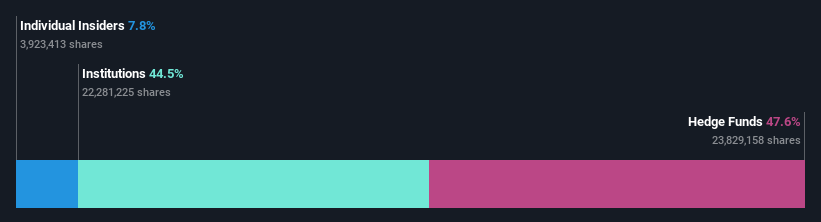

Insider Ownership: 17.2%

Allegiant Travel, characterized by high insider ownership, faces mixed prospects. While the company's earnings are expected to grow at a robust annual rate of 47.4%, surpassing broader market forecasts significantly, its revenue growth is modest at 9.3% annually. Recent operational results show a decline in passenger traffic and load factors year-over-year, which could signal challenges ahead. However, Allegiant maintains a competitive edge with a below-market Price-To-Earnings ratio of 14.9x and has recently ratified a favorable wage agreement boosting flight attendant morale and retention.

Seize The Opportunity

- Click through to start exploring the rest of the 174 Fast Growing US Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.