Please use a PC Browser to access Register-Tadawul

"Gold Surging Toward $4,000!" 'The New Bond King' Gundlach Issues Bold Prediction As Gold Breaks $3,000 Barrier

SPDR Gold GLD | 0.00 | |

Gold Trust Ishares IAU | 0.00 | |

ETFS Gold Tr Physical Swiss Gold Shares Usd SGOL | 0.00 | |

Ultra Gold Proshares UGL | 0.00 | |

Ultrashort Gold Proshares GLL | 0.00 |

- Gold prices breaking through the $3,000 mark as investors seek safe havens amid growing economic concerns and trade tensions;

- Below explores the factors driving gold's rally;

- Provides context for investors considering exposure to this asset class;

Market Overview

Gold futures reached a historic milestone on Thursday, climbing above $3,000 per ounce with intraday gains exceeding $50. This represents an impressive year-to-date increase of more than 11%, with multiple record highs set since January.

The rally comes amid a significant market correction, with the S&P 500 INDEX(SPX.US) falling into technical correction territory after declining more than 10% over three weeks. The index has lost over $5 trillion in market capitalization since its February peak, while the tech-heavy NASDAQ-100(NDX.US) has dropped more than 10% from last month's high.

Key Drivers of Gold's Performance

1. Trade Tensions

Recent escalation in trade rhetoric has significantly impacted market sentiment. President Trump's threats to impose 200% tariffs on French and EU wines, champagnes, and other alcoholic beverages represent the latest development in brewing trade tensions. As Robert Yawger, head of the energy futures division at Mizuho Securities USA, noted: "Uncertainty related to tariffs is driving investors to flee to safety assets and pushing gold prices higher. We have nowhere to hide except in cash or gold, which is hitting historic highs."

2. Economic Growth Concerns

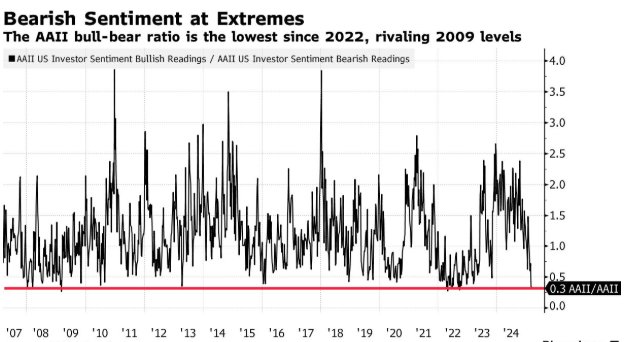

Despite recent data suggesting resilience in the US economy, investor sentiment has deteriorated. The speed of the market correction has been remarkable - data shows the S&P 500's decline from its February 19 high represents the seventh fastest correction since records began in 1929. Notably, three of the seven fastest selloffs have occurred during Trump's presidency (2018, 2020, and now).

3. Central Bank Buying

A significant factor supporting gold prices has been continued purchasing by central banks. According to Jeffrey Gundlach, CEO and Chief Investment Officer of DoubleLine, central bank gold holdings have increased substantially from $34 billion to $41 billion since 2010. While the absolute increase isn't large, the growth rate is steep, and Gundlach believes this trend will continue as central banks recognize gold's value as a store of wealth outside the traditional financial system, as stated in his latest macroeconomic outlook during the live broadcast.

4. Inflation Data and Interest Rate Expectations

Moderating inflation data has fueled speculation about potential Federal Reserve interest rate cuts this year, further supporting gold prices. Lower interest rates typically benefit non-yield-bearing assets like gold.

Investment Considerations

For investors considering gold exposure, several options are available, each with distinct characteristics:

Gold ETFs

| Target | Ticker | Tracking Target | Liquidity |

|---|---|---|---|

| Gold ETF-SPDR | SPDR Gold(GLD.US) | International Spot Gold Price | Good |

| Gold ETF-iShares | Gold Trust Ishares(IAU.US) | International Spot Gold Price | Very Good |

| Physical Gold ETF-abrdn | ETFS Gold Tr Physical Swiss Gold Shares Usd(SGOL.US) | International Spot Gold Price | Average |

| Double Long Gold ETF | Ultra Gold Proshares(UGL.US) | Bloomberg Gold Index | Average |

| Double Short Gold ETF | Ultrashort Gold Proshares(GLL.US) | Bloomberg Gold Index | Average |

| Micro Gold ETF-iShares | iShares Gold Trust Micro ETF(IAUM.US) | LBMA Gold Fixing Price | Average |

| Gold Miners ETF-VanEck | VanEck Vectors Gold Miners ETF(GDX.US) | NYSE Arca Gold Miners Index | Very Good |

| Junior Gold Miners ETF-VanEck | VanEck Vectors Junior Gold Miners ETF(GDXJ.US) | MVIS Global Junior Gold Miners Index | Average |

Gold-Related Stocks

| Ticker | Type |

|---|---|

| Barrick Gold Corp.(GOLD.US) | Gold Miner |

| Agnico-Eagle Mines Limited(AEM.US) | Gold Miner |

| BHP Billiton Limited Sponsored ADR(BHP.US) | Diversified Miner |

| EQUINOX GOLD CORP(EQX.US) | Gold Miner |

| Franco-Nevada Corporation(FNV.US) | Gold Miner |

| Newmont Mining Corporation(NEM.US) | Gold Miner |

| Wheaton Precious Metals Corp(WPM.US) | Diversified Miner |

| Gold Fields Limited Sponsored ADR(GFI.US) | Gold Miner |

Analyst Forecasts

Wall Street analysts have been rapidly revising their gold price targets upward:

- Macquarie Group: Marcus Garvey, head of commodity strategy, recently raised their Q3 2025 gold price forecast to $3,150 per ounce, with a peak price target of $3,500. "Gold has performed far beyond our expectations this year," Garvey noted in Thursday's report.

- BNP Paribas: Analyst David Wilson predicts gold will break through $3,100 per ounce by Q2 2025. In a Wednesday report, Wilson stated: "The Trump administration's frequent tariff threats and reshaping of international relations have further exacerbated uncertainty in global macroeconomics and geopolitics, significantly boosting the gold market."

- Goldman Sachs: Last month, the firm raised its year-end gold target to $3,100 per ounce for the end of 2025, up from their previous target of $2,890.

- Jeffrey Gundlach: The DoubleLine CEO has made a bold prediction that gold could reach $4,000 per ounce, citing financial system instability and increased recognition of gold's value as key factors. He is unsure if this level will be reached this year, but this is his calculated target based on Gold's long-term consolidation around $1,800.