Earnings Working Against MDU Resources Group, Inc.'s (NYSE:MDU) Share Price Following 44% Dive

MDU Resources Group, Inc. MDU | 18.25 | +0.03% |

MDU Resources Group, Inc. (NYSE:MDU) shareholders that were waiting for something to happen have been dealt a blow with a 44% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

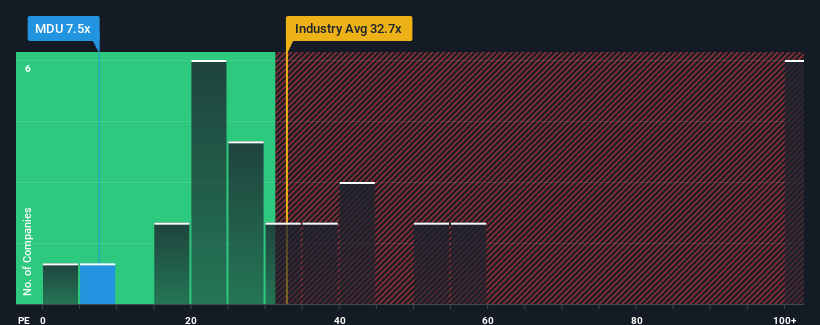

Even after such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may still consider MDU Resources Group as a highly attractive investment with its 7.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

MDU Resources Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Is There Any Growth For MDU Resources Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like MDU Resources Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.5% gain to the company's bottom line. Still, lamentably EPS has fallen 3.2% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 18% over the next year. That's not great when the rest of the market is expected to grow by 15%.

With this information, we are not surprised that MDU Resources Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, MDU Resources Group's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of MDU Resources Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

If these risks are making you reconsider your opinion on MDU Resources Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.