Does Upland Software (NASDAQ:UPLD) Have A Healthy Balance Sheet?

Upland Software, Inc. UPLD | 4.52 | +0.89% |

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Upland Software, Inc. (NASDAQ:UPLD) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Upland Software's Debt?

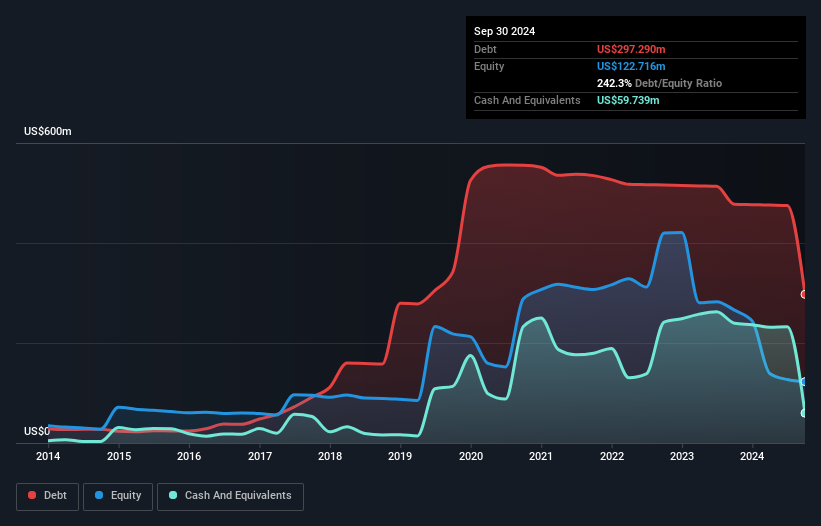

As you can see below, Upland Software had US$297.3m of debt at September 2024, down from US$477.5m a year prior. However, it does have US$59.7m in cash offsetting this, leading to net debt of about US$237.6m.

A Look At Upland Software's Liabilities

The latest balance sheet data shows that Upland Software had liabilities of US$119.0m due within a year, and liabilities of US$313.2m falling due after that. On the other hand, it had cash of US$59.7m and US$38.3m worth of receivables due within a year. So it has liabilities totalling US$334.2m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$60.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Upland Software would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Upland Software's ability to maintain a healthy balance sheet going forward.

Over 12 months, Upland Software made a loss at the EBIT level, and saw its revenue drop to US$279m, which is a fall of 8.4%. That's not what we would hope to see.

Caveat Emptor

Importantly, Upland Software had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable US$22m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of US$131m in the last year. So we think this stock is quite risky. We'd prefer to pass. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Upland Software is showing 3 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.