Understanding Time & Sales for U.S stocks

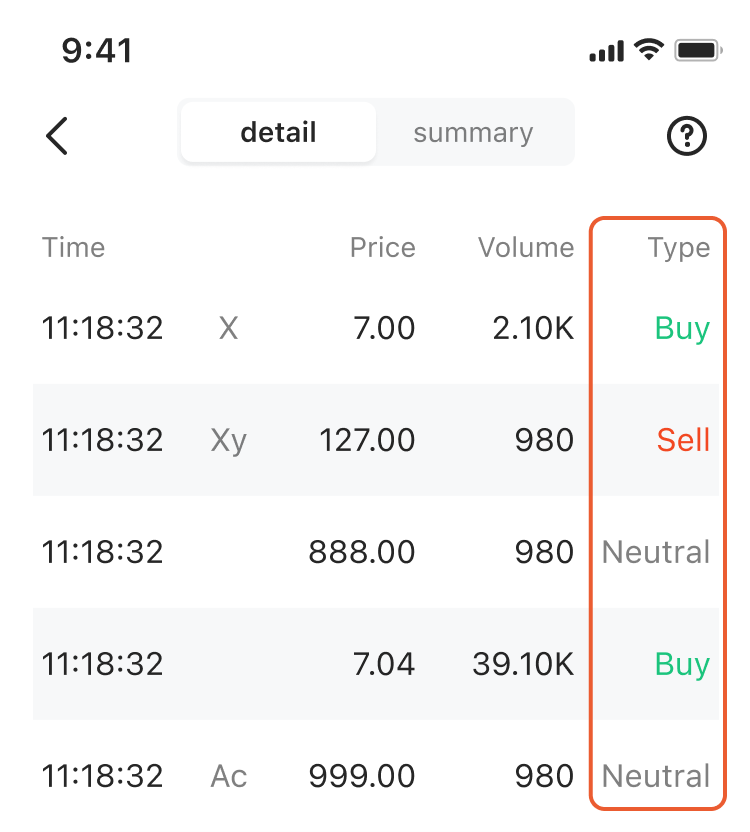

1. What is Direction of Trade?

The direction of trade in Time & Sales is a fundamental aspect of understanding the capital flow within the market. It helps in tracking liquidity and discerning the movement of funds in and out of securities. Three primary types of trade directions are outlined:

- Buy: It indicates trade belongs to inflow capital.

- Sell: It indicates trade belongs to outflow capital.

- Neutral: Neutral trades represent neutral capital flow.

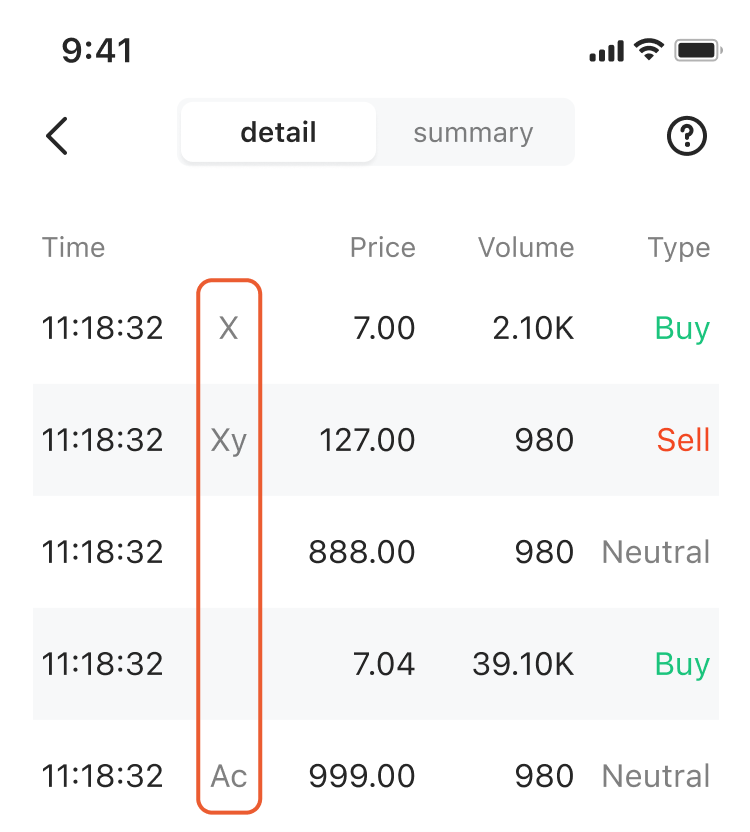

2. Different Trade Types in the U.S. Market

Every executed transaction on the exchange is classified by a specific trade type, with each category exerting a distinct influence on market dynamics. Here are the different trade types of U.S. stock and their implications:

- (Blank): Regular sale

- Ap: Average Price Trades do not affect the last recorded price or alter the Liquidity Distribution metric.

- Bs: It refers to Bunched Sold Trades. These trades update the last price only if they represent the first or the only last sale-eligible trade transaction of the business day and do not impact Liquidity Distribution.

- C: Cash Trade. A transaction that calls for the delivery of securities and payment on the same day the trade took place. These transactions do not update the last price. This type affects the delivery method of the trade and does not interfere with the determination of Liquidity, so the trade will be updated to the Liquidity Distribution as usual.

- Cl: It represents Consolidated Late Price transactions per listing packet, which do not affect volume, liquidity, or Liquidity Distribution metrics.

- Co: It refers to Contingent Trades, which neither update the last price nor the Liquidity Distribution.

- Cp: Closing Prints. These transactions do not update the Liquidity Distribution.

- D: Distribution. These transactions do not update the Liquidity Distribution.

- Dp: It signifies Derivatively Priced trades, updating the last price only if they are the first or only last sale-eligible trade of the business day, with no impact on the Liquidity Distribution.

- E: It identifies trades executed during Extended Trading Hours or sold out of sequence, neither of which updates the last price or the Liquidity Distribution.

- Ft: It is used for Form T trades that occur in pre-open and post-close ranges. These trades update the last price only during their respective pre-market and post-market ranges,and do not impact Liquidity Distribution.

- Mc: Market Center Close Price. These transactions do not update the last price, volume, or Liquidity Distribution.

- Mo: Market Center Open Price. These transactions do not update the last price andor volume. It also does not update the Liquidity Distribution.

- N: Next Day. These transactions do not update the last price. It also does not update the Liquidity.

- O: Opened. These transactions do not update the Liquidity Distribution.

- Ol: Odd Lot Trade. Odd lots are considered to be anything less than the standard units of trade. These transactions do not update the last price. This type affects the trading quantity and does not interfere with the determination of Liquidit Direction, so the trade will be updated to Liquidit Distribution.

- Oe: Odd lot execution. These transactions do not update the last price or Liquidity Distribution.

- Pv: It stands for Price Variation Trades that do not affect the last price.

- Pr: Prior Reference Price.Only update the last price if the trade is the first or only last sale eligible trade transaction of the business day. These transactions do not update the Liquidity Distribution.

- Qc: It refers to Qualified Contingent Trades, which do not update the last price or affect Liquidity Distribution.

- Ro: Re-Opening Prints. These transactions do not update the Liquidity Distribution.

- S: It represents Seller Sale transactions, which neither update the last price nor alter Liquidity Distribution.

- Sl: Sold Last. Only update last price if received prior to end of last sale eligibility control message at 16:01:30. These transactions do not update the Liquidity Distribution.

- So: It represents Sold (Out of Sequence) trades, updating the last price only if they are the first or only last sale-eligible transaction of the business day, with no effect on Liquidity Distribution.

- Ss: Stopped Stock – Regular Trade. These transactions do not update the Liquidity Distribution.

Was this article helpful?

You can also

contact Customer Services

for help.

Yes

No