Please use a PC Browser to access Register-Tadawul

How to find out the margin rate for margin trading and short selling?

The information of margin rate can be found on "Margin info" page, and you can perform the following steps:

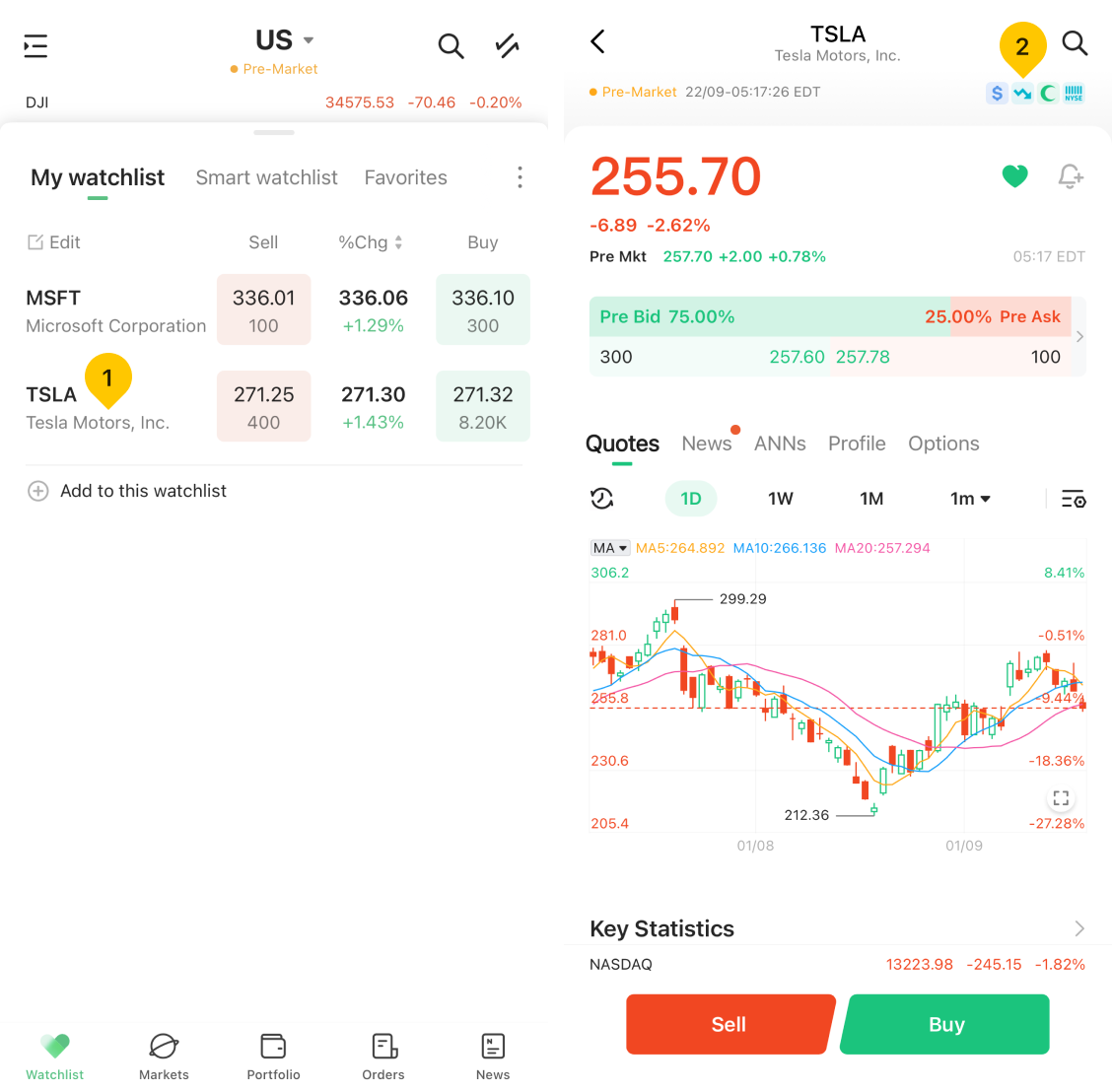

- Enter the stock detail page.

- Tap "$" icon on the upper right of the page.

- Tap "Marginable" to enter Margin info page.

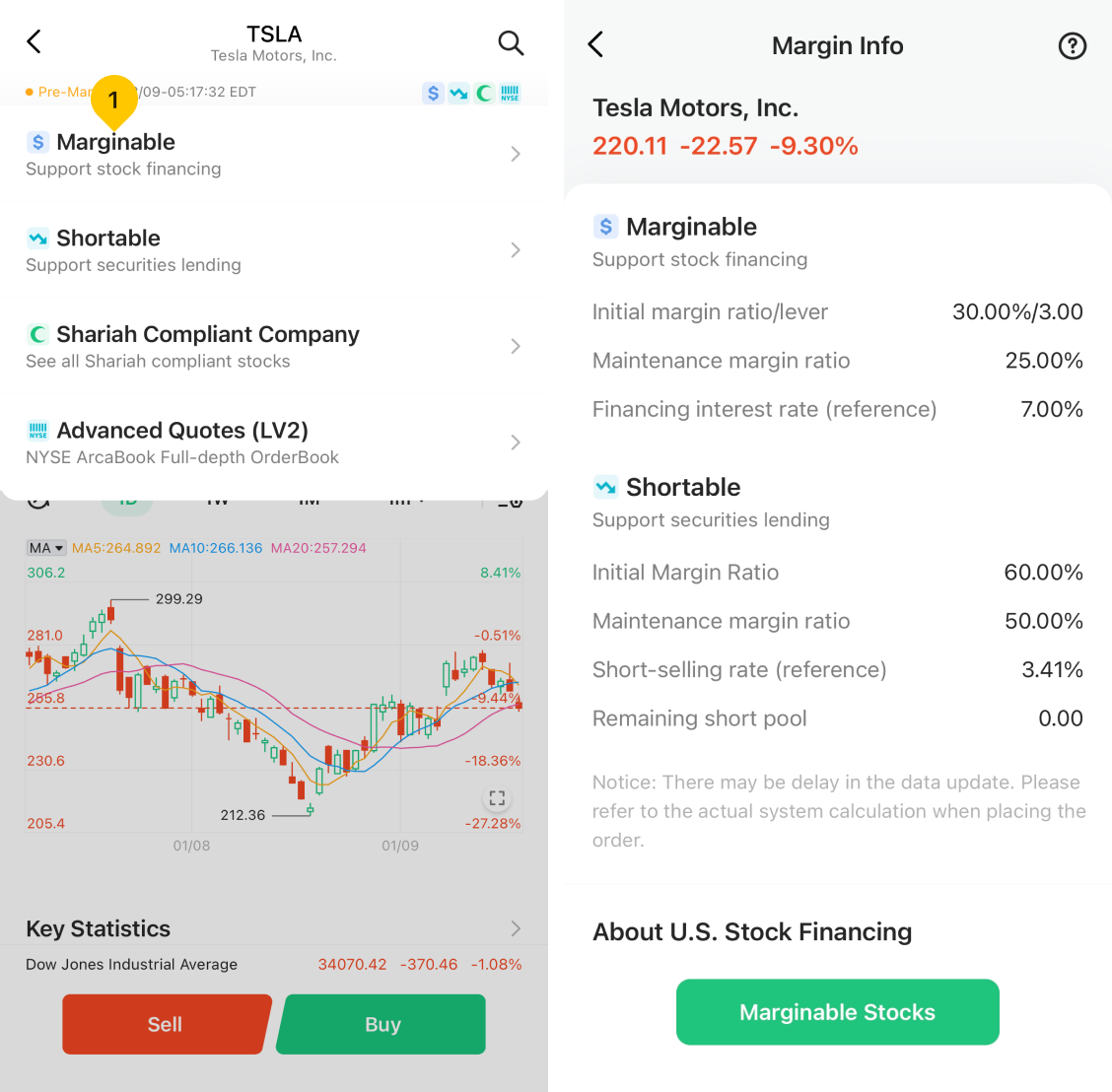

Initial Margin Ratio

Initial margin ratio is represented by a percentage of a purchase price that must be paid in cash when using a margin account.

Initial Margin Requirement = Shares x Price x Initial margin ratio

Assuming a user wants to purchase 10000 shares of stock for $50 each with an initial margin requirement of 80%, the initial margin equals $400,000 (10000 * $50 * 80% = $400,000). Therefore, the user can only open a position if his net assets are greater than $400,000; otherwise, the user cannot open a position.

Additionally, for US stocks, if the user's account does not have a sufficient amount of cash, the platform will utilize margin trading to complete the opening of a position. Assuming a user wants to short sell 10000 shares of stock priced at $50. When the initial margin ratio for the stock borrowing and selling is 85%, the margin requirement will be $425,000 (10000 * $50 * 85%= $425,000). Therefore, the short selling transaction can only be executed if the user's net asset value is greater than $425,000; otherwise, the user will not be able to open a short selling position.

Maintenance Margin

Maintenance margin is the total amount of funds that must be remained to keep the position open, and is a given percentage of the market value of the current position.

Maintenance margin = Market value of account holdings * Maintenance margin ratio