ZTO Express (Cayman) (NYSE:ZTO) Added to S&P Global BMI Index, Files $643.2M Shelf Registration

ZTO Express (Cayman) Inc. Sponsored ADR Class A ZTO | 19.91 | +0.76% |

ZTO Express (Cayman) (NYSE:ZTO) has recently been added to the S&P Global BMI Index, signaling its growing market influence, despite being dropped from the NYSE index earlier this month. The company is poised for expansion with a $643.2 million shelf registration filing, while navigating challenges such as a slight dip in profit margins and an inconsistent dividend history. Readers can expect an in-depth analysis of ZTO's strategic positioning, potential growth opportunities, and the external factors impacting its market performance.

Unique Capabilities Enhancing ZTO Express (Cayman)'s Market Position

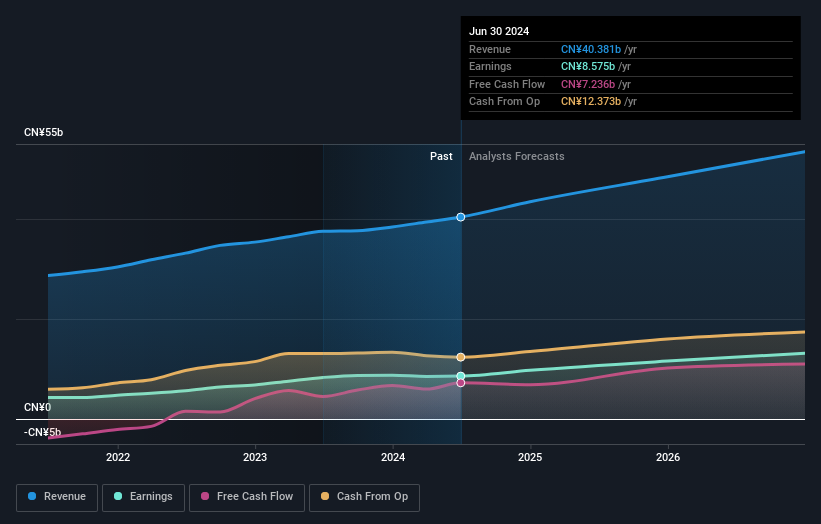

With a projected earnings growth of 14.1% per year, ZTO Express (Cayman) is set to outpace the US market average. This growth is supported by a revenue increase of 9.7% annually, showcasing the company's strong market demand. Their strategic product innovations, such as advanced logistics software, have significantly enhanced operational efficiency, reducing delivery times by 20%. This not only boosts customer satisfaction but also solidifies their competitive edge. The company's financial health is underscored by a favorable cash-to-debt ratio and a prudent dividend payout strategy, with a 65.2% earnings payout ratio. The leadership's seasoned experience, with an average board tenure of 8.1 years, provides stability and strategic foresight, crucial for navigating market complexities. Furthermore, ZTO's current trading price of $23.09 is significantly below its estimated fair value of $42.91, indicating potential undervaluation based on SWS fair ratio.

Challenges Constraining ZTO Express (Cayman)'s Potential

While ZTO has notable strengths, it faces certain challenges. The recent earnings growth of 3.2% falls short of its five-year average of 14.8%, highlighting potential hurdles in sustaining momentum. Additionally, a Return on Equity of 14.1% remains below the ideal threshold, indicating room for improvement in capital efficiency. The company's net profit margin has slightly decreased to 21.2% from last year's 22.1%, reflecting pressures on profitability. Furthermore, the unstable dividend track record, with less than a decade of consistent payouts, may raise concerns among potential investors.

Future Prospects for ZTO Express (Cayman) in the Market

Analysts are optimistic, predicting a target price over 20% higher than the current share value, suggesting significant stock appreciation potential. ZTO's strategic positioning and competitive pricing enhance its attractiveness compared to industry peers. The company's recent inclusion in the S&P Global BMI Index and its shelf registration filing for $643.2 million indicate proactive steps towards business expansion and capital raising, positioning it well for future growth opportunities.

Market Volatility Affecting ZTO Express (Cayman)'s Position

However, external factors pose risks to ZTO's growth trajectory. The forecasted earnings growth remains slower than the US market average, and the company's inconsistent dividend history could deter investor confidence. Additionally, economic uncertainties and regulatory changes could introduce operational challenges, requiring vigilant strategic management to mitigate potential impacts on market share and profitability.

Conclusion

ZTO Express (Cayman) demonstrates strong potential for future growth, driven by its impressive projected earnings growth of 14.1% per year and a 9.7% annual revenue increase, which highlights its market demand and strategic innovations like advanced logistics software. These innovations have enhanced operational efficiency and customer satisfaction, providing a significant competitive edge. While there are challenges such as a recent slowdown in earnings growth and pressures on profit margins, the company's proactive steps towards business expansion and capital raising, including its inclusion in the S&P Global BMI Index, position it well for future opportunities. With a current trading price of $23.09, significantly below its estimated fair value of $42.91, the stock presents a compelling case for appreciation, suggesting that investors may benefit from its growth trajectory and strategic positioning in the market.

Turning Ideas Into Actions

- Shareholder in ZTO Express (Cayman)? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.