Please use a PC Browser to access Register-Tadawul

What You Can Learn From Jumia Technologies AG's (NYSE:JMIA) P/S After Its 60% Share Price Crash

JUMIA JMIA | 0.00 |

Jumia Technologies AG (NYSE:JMIA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 60% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 77% in the last year.

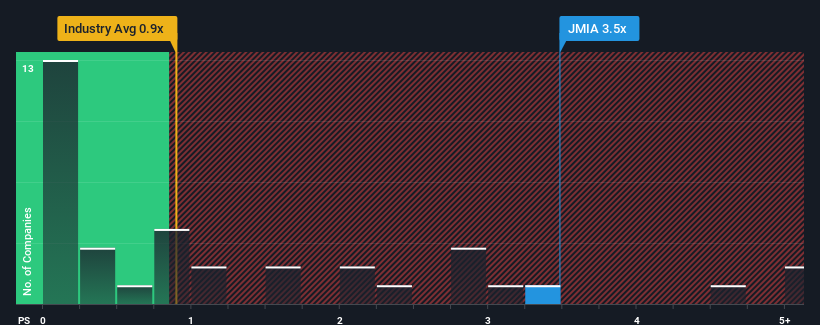

Even after such a large drop in price, when almost half of the companies in the United States' Multiline Retail industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Jumia Technologies as a stock not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Jumia Technologies' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Jumia Technologies has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jumia Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Jumia Technologies would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 18% as estimated by the two analysts watching the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this information, we can see why Jumia Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Jumia Technologies' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Jumia Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.