Weekly Watch | Red Sea (4230) Schedules Extraordinary General Meeting; BANAN (4324) Eligibility for Cash Dividend; US Jobs Report in Focus

CATRION 6004.SA | 131.40 | Delist |

PURITY 9614.SA | 22.18 | +0.82% |

ALINMA RETAIL REIT 4345.SA | 4.78 | -3.04% |

BANAN 4324.SA | 6.75 | -3.02% |

ALINMA HOSPITALITY REIT 4349.SA | 8.21 | -3.53% |

"Weekly Watch" provides a snapshot of the key events, economic data, and earnings reports expected to influence the financial markets in the US and Saudi Arabia over the upcoming week, allowing you to stay ahead and capture market opportunities in advance.

Saudi Market Overview

As the new trading week approaches, Saudi market participants should prepare for significant corporate actions, dividend distributions, and macroeconomic updates that could shape market sentiment and investment decisions.

Note: All dates provided are estimates or based on company announcements, and are subject to change at any time, whether advanced or delayed.

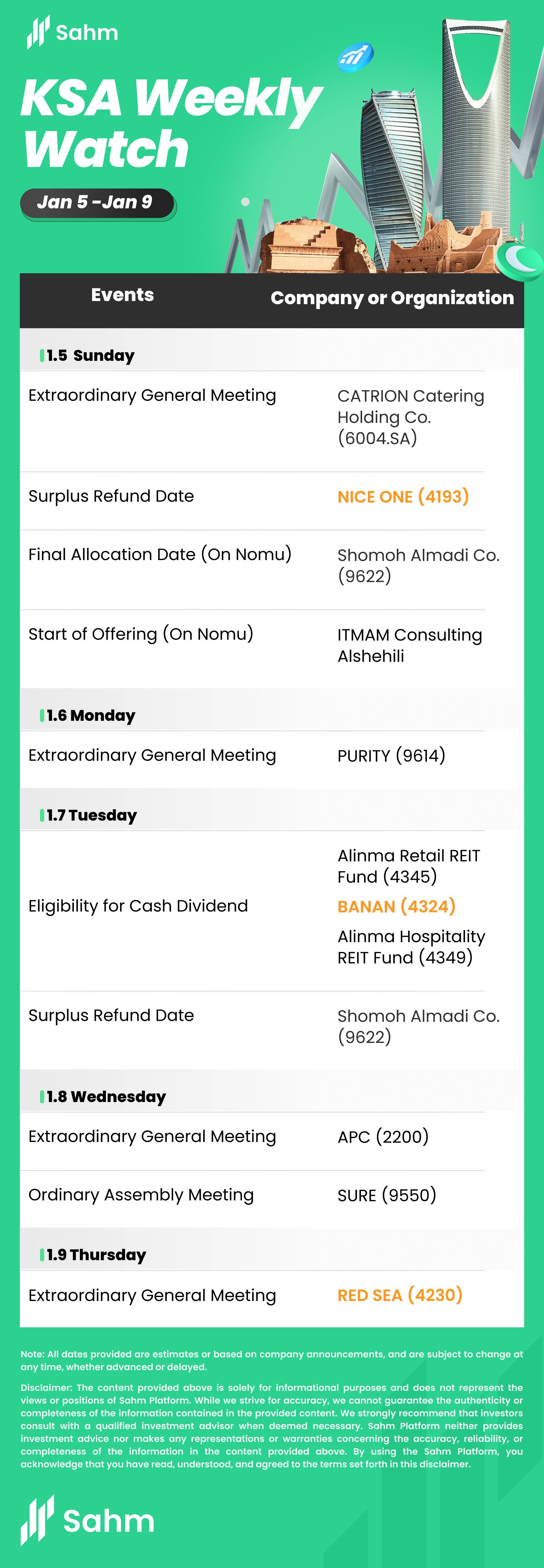

January 5, Sunday

CATRION Catering Holding Co.(6004.SA) will hold an extraordinary general meeting.

In the IPO sector, NICE ONE (4193) will conduct a surplus refund on the TASI market. On the Nomu market, Shomoh Almadi Co. ( 9622) will reach its final allocation date, and ITMAM Consulting Alshehili will commence its initial public offering.

January 6, Monday

Purity for Information Technology Co.(9614.SA) will hold an extraordinary general meeting.

January 7, Tuesday

Alinma Retail REIT Fund(4345.SA), Banan Real Estate Co.(4324.SA), and Alinma Hospitality REIT Fund(4349.SA) will be eligible for a cash dividend. Shomoh Almadi Co. (9622) will proceed with a surplus refund.

January 8, Wednesday

Arabian Pipes Co.(2200.SA) will hold an extraordinary general meeting and Sure Global Tech Co(9550.SA) will convene for an ordinary assembly meeting.

January 9, Thursday

Red Sea International Co.(4230.SA) will hold an extraordinary general meeting.

U.S. Market Overview

Key earnings reports and financial events in the US to monitor are as follows:

Monday

Economic Data: S&P Global Composite PMI (Dec), Factory Orders (MoM) (Nov), 3-Month Bill Auction, 6-Month Bill Auction

Key Events: 2025 International Consumer Electronics Show (CES) in Las Vegas. NVIDIA Corporation(NVDA.US) CEO Jensen Huang will deliver a keynote speech, expected to unveil the new generation GeForce RTX 50 series GPUs, manufactured using Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US)'s 4NP custom process.

Earnings: No notable earnings

Tuesday

Economic Data: FOMC Member Barkin Speaks, Imports (Nov)/ Exports (Nov), ISM Non-Manufacturing Employment (Dec), ISM Non-Manufacturing PMI (Dec), JOLTS Job Openings (Nov)

Earnings: No notable earnings

Wednesday

Economic Data: ADP Nonfarm Employment Change (Dec), Fed Waller Speaks, 10-Year Note Auction, FOMC Meeting Minutes

Earnings: Albertsons Companies, Inc.(ACI.US) , UniFirst Corporation(UNF.US), Jefferies Financial Group Inc.(JEF.US)

Thursday

Economic Data: Initial Jobless Claims, Continuing Jobless Claims, 30-Year Bond Auction, Atlanta Fed GDPNow (Q4), FOMC Member Bowman Speaks, Fed's Balance Sheet

Earnings: No notable earnings

Friday

Economic Data: Nonfarm Payrolls (Dec), Unemployment Rate (Dec), Average Hourly Earnings (MoM) (Dec), Participation Rate (Dec)

Earnings: Delta Air Lines, Inc.(DAL.US), Walgreens Boots Alliance Inc(WBA.US)

Good luck with your trading!