Vimeo And 2 Other US Penny Stocks To Consider

TETRA Technologies, Inc. TTI | 3.53 3.53 | +1.44% 0.00% Post |

As the U.S. stock market experiences fluctuations with major indices slipping ahead of significant tech earnings, investors are keenly observing economic indicators and corporate performance. Amidst this backdrop, penny stocks—though often overlooked—remain a compelling segment for those seeking potential growth in smaller or newer companies. Despite their historical reputation as speculative investments, penny stocks can offer substantial opportunities when they exhibit strong financial health and resilience. Let's examine three U.S. penny stocks that may combine robust balance sheets with promising long-term potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.799 | $5.75M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.19 | $534.34M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.12B | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.41 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.575 | $50.82M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.01 | $99.68M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $97.93M | ★★★★☆☆ |

Let's dive into some prime choices out of the screener.

Vimeo (NasdaqGS:VMEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vimeo, Inc., along with its subsidiaries, offers video software solutions globally and has a market cap of approximately $807.43 million.

Operations: The company generates revenue of $421.08 million from its Internet Software & Services segment.

Market Cap: $807.43M

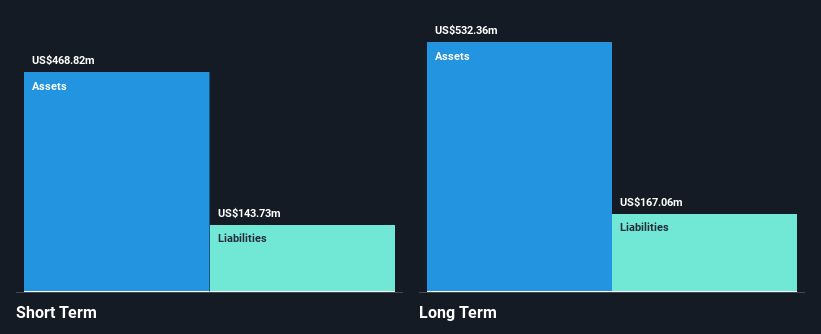

Vimeo, Inc. presents a unique proposition in the penny stock landscape with its recent profitability and debt-free status. The company reported US$104.38 million in sales for Q2 2024, reflecting modest revenue growth from the previous year, alongside improved net income and earnings per share. Vimeo's strategic focus on AI integration is exemplified by their innovative video translation solutions, which could enhance market reach and operational efficiency for businesses globally. Recent executive appointments aim to bolster product development and marketing capabilities as the firm continues to navigate competitive pressures within the Internet Software & Services sector.

Oil States International (NYSE:OIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oil States International, Inc. operates through its subsidiaries to provide engineered capital equipment and products for the energy, industrial, and military sectors globally, with a market cap of approximately $266.63 million.

Operations: The company generates revenue through three primary segments: Well Site Services ($204.75 million), Downhole Technologies ($80.92 million), and Offshore/Manufactured Products ($470.52 million).

Market Cap: $266.63M

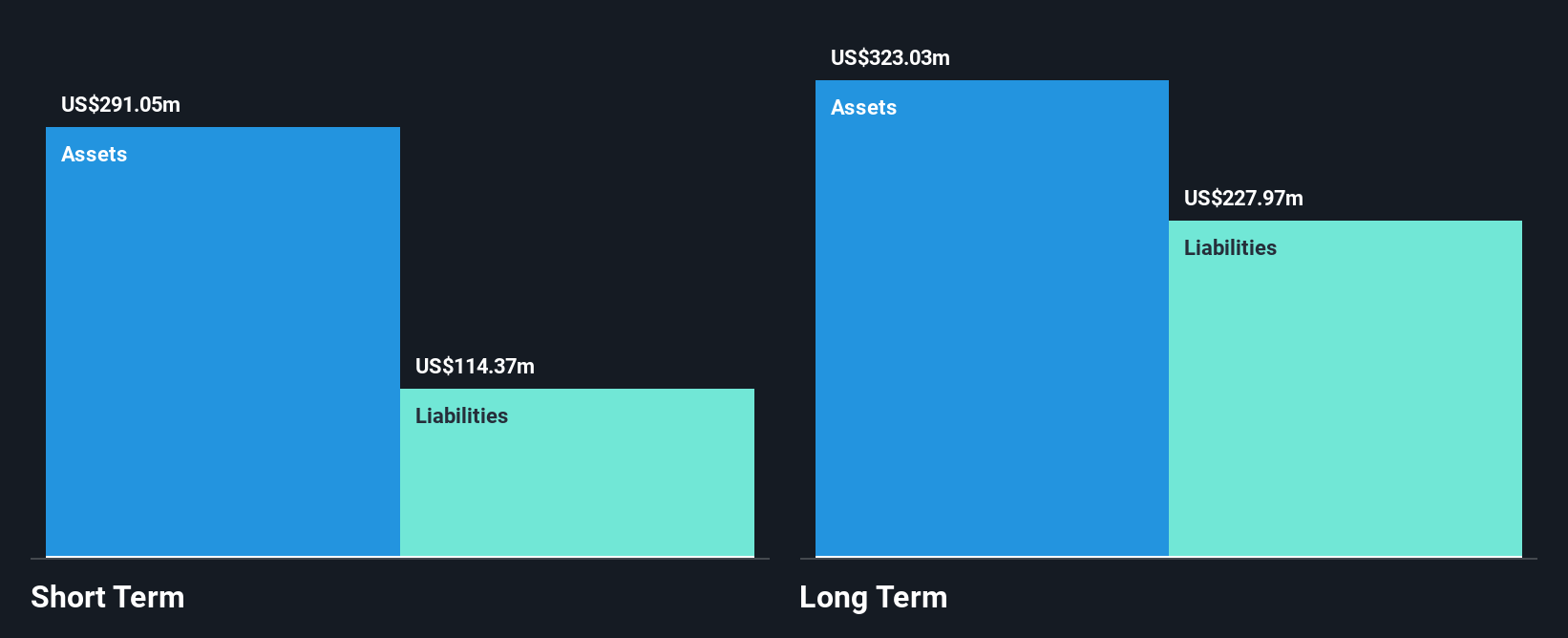

Oil States International, Inc. is navigating the penny stock terrain with a focus on strategic collaborations and financial restructuring. Despite reporting a net loss of US$14.35 million for Q3 2024, the company is actively managing its financial health through a US$50 million share repurchase program and debt reduction efforts, with the debt-to-equity ratio decreasing to 18.1%. The collaboration with Seadrill Limited aims to enhance offshore drilling efficiency using Oil States' advanced MPD Integrated Riser Joint system. While unprofitable, Oil States has reduced losses over five years by 56.7% annually and maintains sufficient liquidity to cover liabilities.

TETRA Technologies (NYSE:TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc., along with its subsidiaries, operates as an energy services and solutions company with a market cap of $388.84 million.

Operations: TETRA Technologies, Inc. does not report specific revenue segments.

Market Cap: $388.84M

TETRA Technologies, Inc. is navigating the penny stock landscape with a mixed financial outlook. The company reported a net loss of US$3 million for Q3 2024, contrasting sharply with a net income of US$5.42 million in the same period last year, amid declining revenues to US$141.7 million from US$151.46 million year-over-year. Despite this setback, TETRA's debt to equity ratio has significantly improved over five years and its short-term assets exceed liabilities, indicating some financial stability. However, interest payments remain poorly covered by earnings and profit margins have decreased compared to the previous year’s performance.

Make It Happen

- Click through to start exploring the rest of the 753 US Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.