Please use a PC Browser to access Register-Tadawul

Verizon Vs. AT&T: Cash Flow Quality And Valuations Compared

AT&T Inc. T | 0.00 | |

T-Mobile US, Inc. TMUS | 0.00 | |

Verizon Communications Inc. VZ | 0.00 |

Verizon Communications Inc (NYSE:VZ) was recently upgraded by KeyBanc analyst, Brandon Nispel, citing multiple tailwinds and attractive valuation for the stock.

KeyBanc has a price target of $45 on the stock, indicating an upside of 13.74% from current price levels.

The telecommunications giant is one of the three dominant players in the Wireless Carriers sub-space. While Verizon commands just over $163 billion in market cap, AT&T Inc (NYSE:T) stands close with about $123 billion in market cap. T-Mobile US Inc (NASDAQ:TMUS) currently boasts the biggest market cap with $187 billion.

However, Verizon’s enterprise value (EV) trumps the other two. Verizon’s business commands $339 billion in enterprise value. AT&T has about $294 billion and T-Mobile around $296 billion.

See Also: Verizon Communications Analyst Turns Bullish, Expects Superior 2024 Performance Over T-Mobile, AT&T

In his note, KeyBanc analyst Nispel mentioned: “VZ has higher quality cash flows compared to T

given T’s cash flow from DIRECTV.” Verizon currently has a TTM Free Cash Flow/Share of $3.25. This figure is $2.76 in AT&T’s case. Let’s see how these stocks compare on performance.

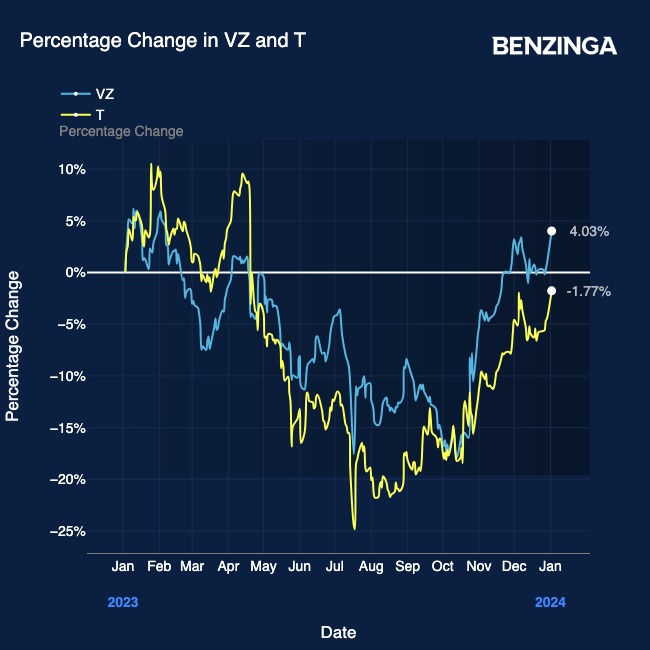

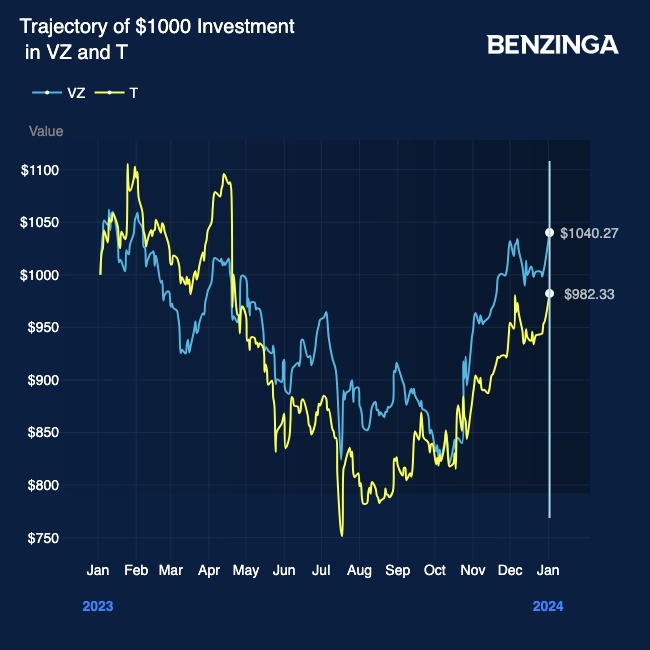

While AT&T stock is down 1.77% over the past 12-month period, Verizon stock is up 4.03%. So, if you’d invested $1000 in each of these stocks a year back, here’s how your investment would have fared.

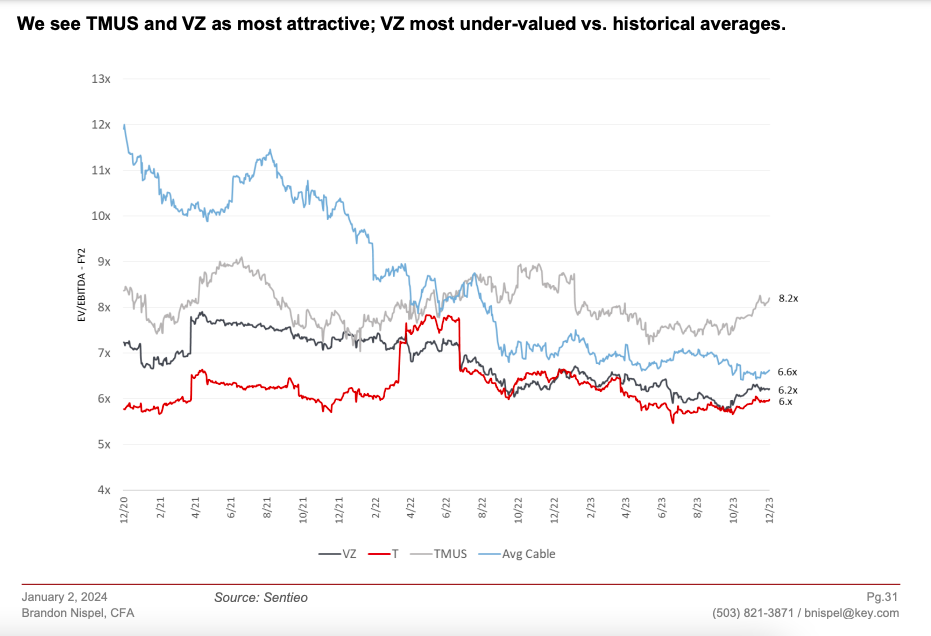

On the valuation front, Nispel believes that VZ stock is currently trading at historically low absolute/

relative EV/EBITDA.

Catalysts cited to work in Verizon’s favor include improving Wireless KPIs and financial metrics. KeyBanc believes “investors are likely to see a deleveraging story with the potential for share repurchases into

’25.”

On current parameters, however, AT&T stock may appear to be more attractively valued, relative to Verizon stock.

| Valuation | VZ | T | TMUS |

| EV/EBITDA (FWD) | 7.10 | 6.80 | 10.09 |

|---|---|---|---|

| EV/EBITDA (TTM) | 7.05 | 7.00 | 10.87 |

It’s not surprising thus, that BofA Securities’ analysts rank AT&T as their top telecom pick for 2024. The stock also features amid Citi's 9 buy-rated stocks in the Communication Services sector list.

Now Read: AT&T Emerges As Top Telecom Stock For 2024: Analyst’s ‘3 Big Reasons’