US Stock Markets Open Mixed with Light Trading Expected This Week

S&P 500 index SPX | 5881.63 | -0.43% |

NASDAQ IXIC | 19310.79 | -0.90% |

Dow Jones Industrial Average DJI | 42544.22 | -0.07% |

Apple Inc. AAPL | 250.42 | -0.71% |

NVIDIA Corporation NVDA | 134.29 | -2.33% |

On Monday morning, US stock markets opened with mixed results as investors prepared for a holiday-shortened trading week with an expected decline in trading activity.

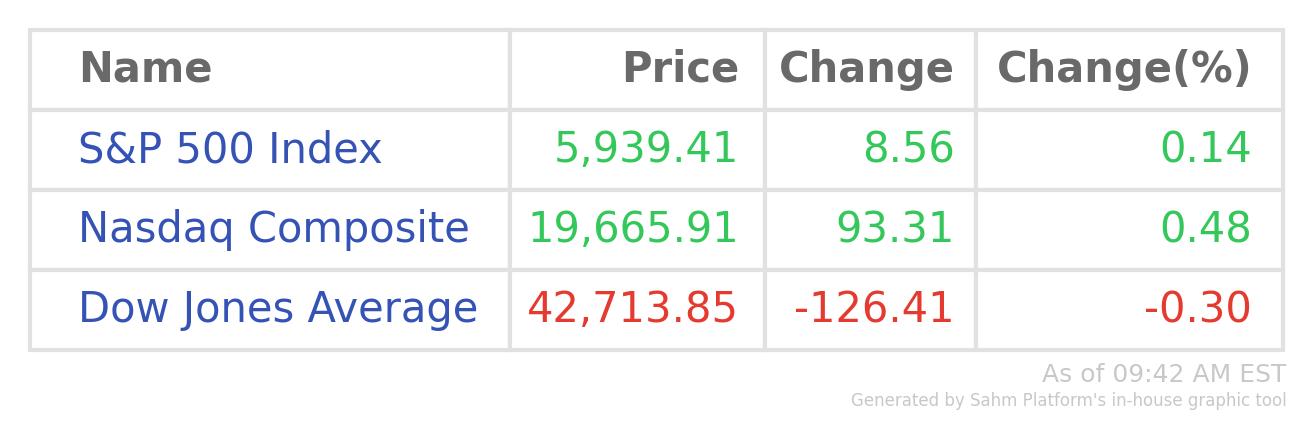

As of 09:42 AM, EST (or 05:42 PM in Riyadh), the broad-based S&P 500 index(SPX.US) moves higher by 9 points or 0.14% to 5,939, the tech-heavy NASDAQ(IXIC.US) ascends by 93 points or 0.48% to 19,666, and the blue-chip Dow Jones Industrial Average(DJI.US) wanes by 126 points or 0.3% to 42,714.

Wednesday, December 25, marks the Christmas holiday in the US, and financial markets will be closed. The New York Stock Exchange will close early on Christmas Eve, shutting down at 1 PM ET Tuesday. This week's trading is anticipated to be relatively subdued.

1/3

Expected Winning Streak in History Accordance

Investors are looking forward to a potential "Santa Claus rally" to end 2024 on a positive note after last week's significant turbulence. According to “Stock Trader's Almanac,” the S&P 500 has historically gained an average of 1.3% during the last five trading days of the year and the first two trading days of January since 1969.

Data from Bank of America suggests that the latter half of December is typically the second strongest period for US stocks. In presidential election years, the S&P 500 has risen 83% of the time in December.

Piper Sandler's chief market technician, Craig Johnson, indicated that the main upward trend in the market remains intact, predicting this year's Christmas rally could benefit the US economy and Wall Street alike.

The US stock market is rebounding from a rollercoaster period. From December 5 through December 18, the Dow Jones experienced its longest losing streak since 1974, dropping for ten consecutive days.

The Dow plummeted more than 1,100 points last Wednesday after the Federal Reserve hinted at a lower-than-expected rate cut for 2025. However, Friday’s release of November’s lower-than-expected PCE index from the US Labor Department raised speculation that the Fed might cut rates twice next year, partially recovering some losses.

Although last week's recovery was modest, it wasn't enough to offset the looming threat of a government shutdown and a hawkish Federal Reserve.

Month to date, the Dow has dropped 4.6%, while the S&P 500 has fallen 1.7%. In contrast, the tech-heavy Nasdaq Composite has gained 1.8%.

2/3

Fed Cut, Gov't Shutdown Impacts

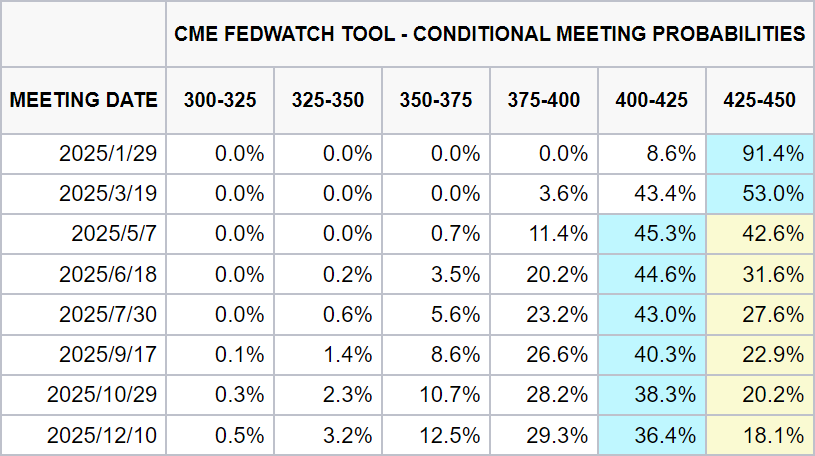

The market currently anticipates the Federal Reserve will cut rates twice next year, each by 25 basis points, adjusting the benchmark interest rate to between 3.75%-4.0%. Two weeks ago, this expectation was 3.50% to 3.75%.

This week’s market focus will be on the minutes from the latest monetary policy meeting, with fewer statements from Fed officials and reduced significance on US data.

SEB strategist Dana Malas noted in a report that hopes remain for a positive end to 2024, especially for US stocks. After two explosive weeks of central bank actions and news events, the market will need to recalibrate prediction models, preparing for the post-Trump inauguration era starting January 20.

The US federal government has narrowly averted a shutdown. President Joe Biden signed a short-term spending bill on Saturday, ensuring federal operations continue until March next year. The bill passed with an 85:11 vote but does not address President-elect Trump’s proposal to eliminate or raise the debt ceiling.

Recent data from the US Treasury Department shows that the total US debt exceeded US$36 trillion for the first time, hitting a historic high.

3/3

Stocks to Watch

- Apple Inc.(AAPL.US) is developing a new smart doorbell with Face ID, launching by the end of 2025.

- NVIDIA Corporation(NVDA.US) plans to establish an overseas headquarters in Taiwan.

- Japan’s Fair Trade Commission found Alphabet Inc. Class A(GOOGL.US) violating antitrust laws in Japan and ordered corrections.

- Tesla Motors, Inc.(TSLA.US) has recalled over 5 million (5,135,697) EVs this year, potentially surpassing Ford in 2024.

- Microsoft Corporation(MSFT.US) introduced new privacy settings for its Microsoft Edge browser.

- Amazon.com, Inc.(AMZN.US)’s India unit has partnered with India Post for last-mile delivery.

- Advanced Micro Devices, Inc.(AMD.US) dominated motherboard sales over Intel with a 90% market share last week.

- Honda Motor Co., Ltd. Sponsored ADR(HMC.US) and NISSAN MOTOR CO(NSANY.US) will begin merger talks.

- QUALCOMM Incorporated(QCOM.US) won a lawsuit over chip technology licensing.

- Starbucks Corporation(SBUX.US) expanded its US strikes to ten cities.

- Merck & Co., Inc.(MRK.US) will invest over EUR70 million in a new Japanese materials centre.

- Palantir Technologies(PLTR.US) and Anduril are teaming up to bid for a Pentagon contract.

- The US Commerce Department finalized a US$1.6 billion funding agreement for Texas Instruments Incorporated(TXN.US).

- SPOTIFY TECHNOLOGY S.A.(SPOT.US) executives sold US$1.25 billion in stock this year.

- STELLANTIS (STLA.US) postponed plans to lay off 1,100 workers at its Ohio Jeep plant.