US Penny Stocks To Consider In November 2024

Glimpse Group, Inc. VRAR | 3.30 3.30 | -3.51% 0.00% Post |

As the U.S. stock market experiences a downturn with major indexes like the Dow Jones, S&P 500, and Nasdaq facing weekly losses, investors are reassessing their strategies amid fluctuating interest rates and economic indicators. In such times, penny stocks—often representing smaller or newer companies—can present unique opportunities for those willing to explore beyond well-known names. Despite being an outdated term, penny stocks remain relevant by potentially offering value through strong financial health and long-term potential in today's complex market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8155 | $5.95M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.05B | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.72 | $52.54M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $155.89M | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $81.58M | ★★★★☆☆ |

| Better Choice (NYSEAM:BTTR) | $1.80 | $3.56M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.17 | $512.97M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.70 | $127.43M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $83.45M | ★★★★★☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Glimpse Group (NasdaqCM:VRAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Glimpse Group, Inc. is an immersive technology company that offers enterprise-focused virtual reality, augmented reality, and spatial computing software and services in the United States, with a market cap of $12.72 million.

Operations: The company generates revenue from its Computer Services segment, amounting to $8.80 million.

Market Cap: $12.72M

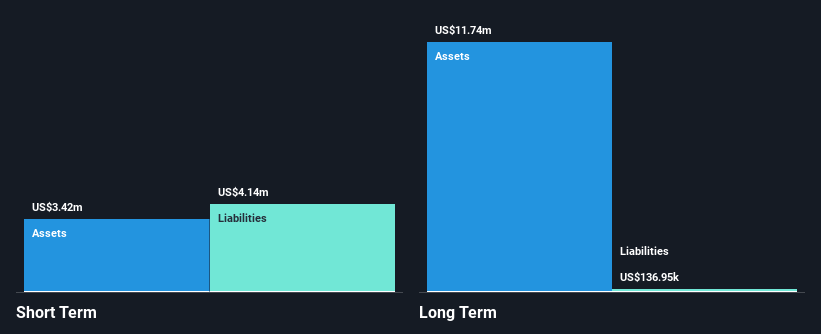

Glimpse Group, with a market cap of US$12.72 million, faces challenges as it remains unprofitable and has experienced shareholder dilution. Despite stable management and board experience, the company struggles with high volatility and a negative return on equity. Recent revenue guidance suggests growth driven by Spatial Core revenues, projecting US$11-12 million for fiscal 2025. However, Glimpse must address its Nasdaq listing compliance issue due to its stock trading below US$1.00 per share. The company's short-term assets exceed liabilities, but it has less than a year of cash runway if current cash flow trends persist.

Zedge (NYSEAM:ZDGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zedge, Inc. operates digital marketplaces and competitive games focused on self-expression content, with a market cap of $39.60 million.

Operations: The company generates revenue from its digital marketplaces, contributing $26.62 million, and competitive games, which bring in $3.48 million.

Market Cap: $39.6M

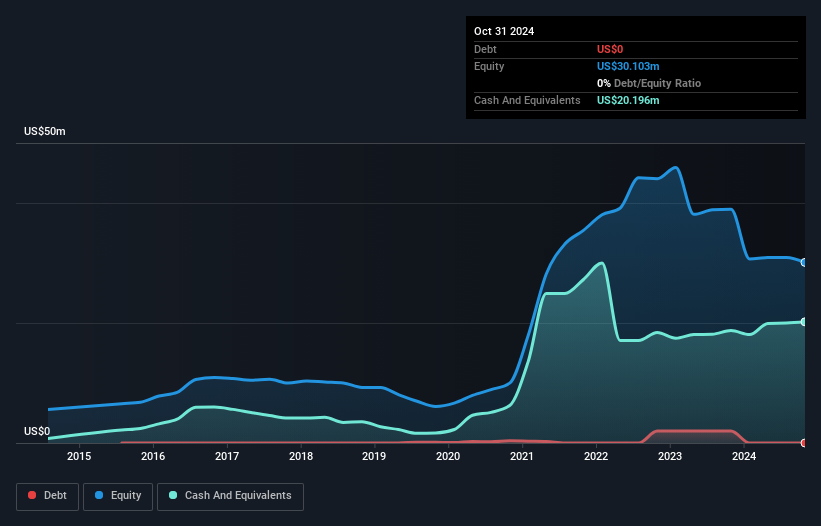

Zedge, Inc., with a market cap of US$39.60 million, is navigating challenges typical for penny stocks. Despite being unprofitable with increasing losses over the past five years, Zedge remains debt-free and has not diluted shareholders recently. Its short-term assets significantly surpass both short- and long-term liabilities, indicating financial stability in that regard. Recent enhancements to its marketplace website could bolster revenue by allowing direct purchases of premium wallpapers without third-party fees. The company is also capitalizing on consumer interest in AI-generated content, which may drive future growth despite current profitability struggles.

Integrated BioPharma (OTCPK:INBP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Integrated BioPharma, Inc. operates in the manufacturing, distributing, marketing, and sale of vitamins, nutritional supplements, and herbal products mainly in the United States and Luxembourg with a market cap of $9.63 million.

Operations: The company's revenue is primarily generated from Contract Manufacturing, accounting for $48.57 million, with an additional contribution of $1.75 million from Other Nutraceutical Businesses.

Market Cap: $9.63M

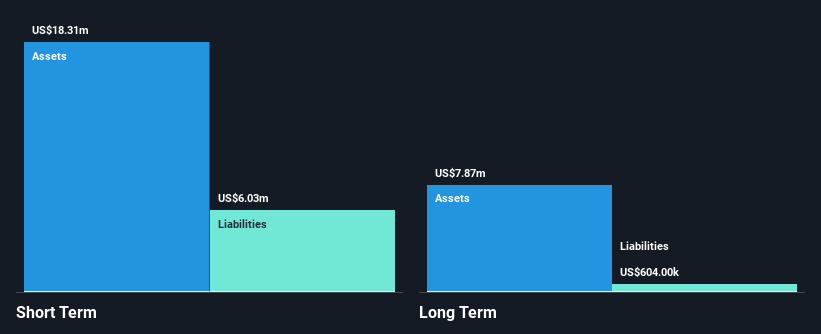

Integrated BioPharma, Inc., with a market cap of US$9.63 million, has recently transitioned to profitability, reporting a net income of US$0.259 million for the first quarter ended September 30, 2024. The company is debt-free and maintains financial stability with short-term assets of US$17.9 million exceeding both its short- and long-term liabilities. Revenue primarily stems from contract manufacturing totaling US$48.57 million annually, despite a slight decline in annual sales compared to the previous year. While earnings have declined by an average of 22.7% over five years, recent profitability marks a positive shift for this penny stock.

Next Steps

- Explore the 750 names from our US Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.