Please use a PC Browser to access Register-Tadawul

US Penny Stocks To Consider In January 2025

Marchex, Inc. Class B MCHX | 0.00 |

As we step into January 2025, the U.S. stock market is experiencing a downturn with major indices like the S&P 500 and Nasdaq Composite sliding due to rising Treasury yields and mixed economic data. In this climate, investors often look for opportunities in less conventional areas such as penny stocks, which can offer growth potential at lower price points despite their historical reputation as high-risk investments. While the term "penny stock" may seem outdated, these smaller or newer companies can still present valuable opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7975 | $5.81M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.39 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $105.8M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.9352 | $11.7M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.57 | $48.06M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.63 | $32.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.02 | $93.54M | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Alpha Tau Medical (NasdaqCM:DRTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alpha Tau Medical Ltd. is a clinical-stage oncology therapeutics company focused on the research, development, and commercialization of its diffusing alpha-emitters radiation therapy (Alpha DaRT) for treating solid cancer in Israel and the United States, with a market cap of $221.66 million.

Operations: Alpha Tau Medical Ltd. has not reported any revenue segments.

Market Cap: $221.66M

Alpha Tau Medical Ltd., with a market cap of US$221.66 million, remains a pre-revenue entity focused on advancing its Alpha DaRT technology for cancer treatment. The company has been accepted into the FDA's Total Product Life Cycle Advisory Program, potentially accelerating market access for its innovative therapies. Despite reporting net losses and being unprofitable, Alpha Tau maintains a robust cash position exceeding both short and long-term liabilities, providing a runway of over two years if current cash flow trends persist. Recent board changes include the appointment of Maya Netser, bringing significant experience in technology leadership and commercialization to the team.

Marchex (NasdaqGS:MCHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marchex, Inc. is a conversation intelligence company that offers conversational analytics and related solutions across the United States, Canada, and internationally, with a market cap of $87.93 million.

Operations: The company generates revenue of $48.59 million from its Conversational Analytics and Related Solutions segment.

Market Cap: $87.93M

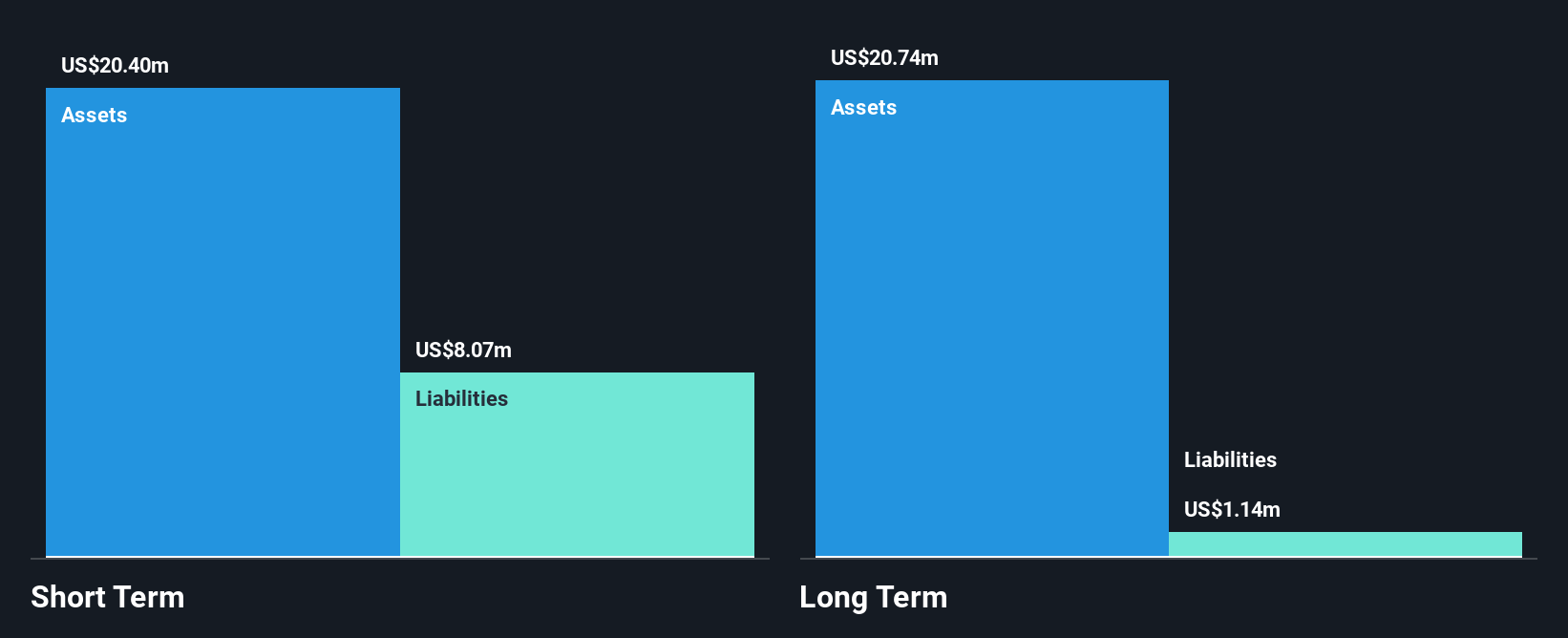

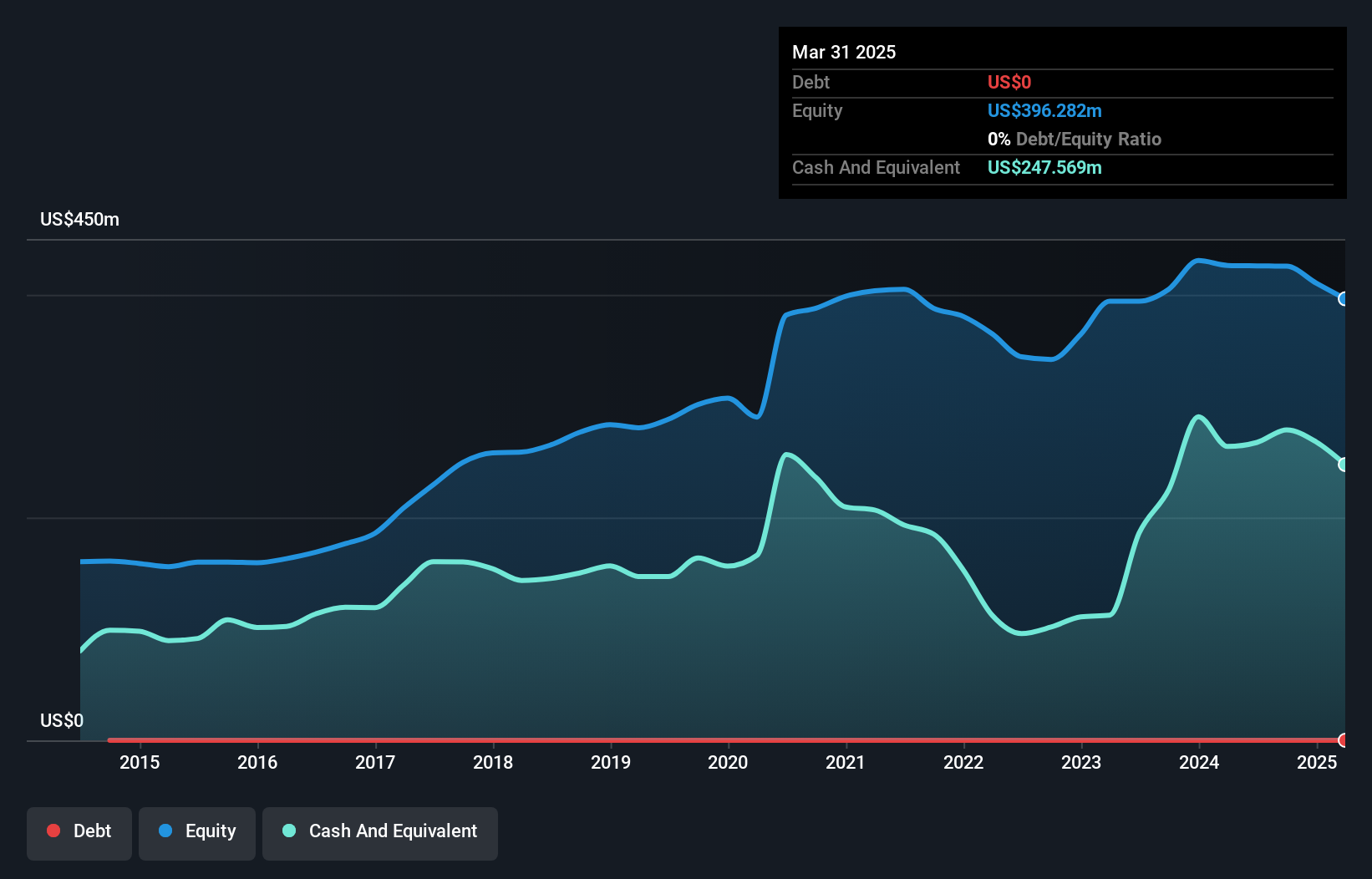

Marchex, Inc., with a market cap of US$87.93 million, is leveraging its position in conversational analytics by joining the Microsoft Cloud AI Partner Program, enhancing visibility and sales channels via Azure Marketplace. Despite being unprofitable and not expected to achieve profitability in the next three years, Marchex has no debt and sufficient cash runway for over three years if cash flow trends continue. Recent initiatives include launching AI solutions tailored for specific industries like automotive and medical services to optimize marketing efforts. While earnings growth remains challenging, the company has reduced losses significantly over five years.

OraSure Technologies (NasdaqGS:OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. operates in the United States, Europe, and internationally by offering point-of-care and home diagnostic tests, specimen collection devices, and microbiome laboratory and analytical services with a market cap of approximately $278.98 million.

Operations: The company generates revenue primarily from its Diagnostics and Molecular Solutions segment, which amounted to $224.26 million.

Market Cap: $278.98M

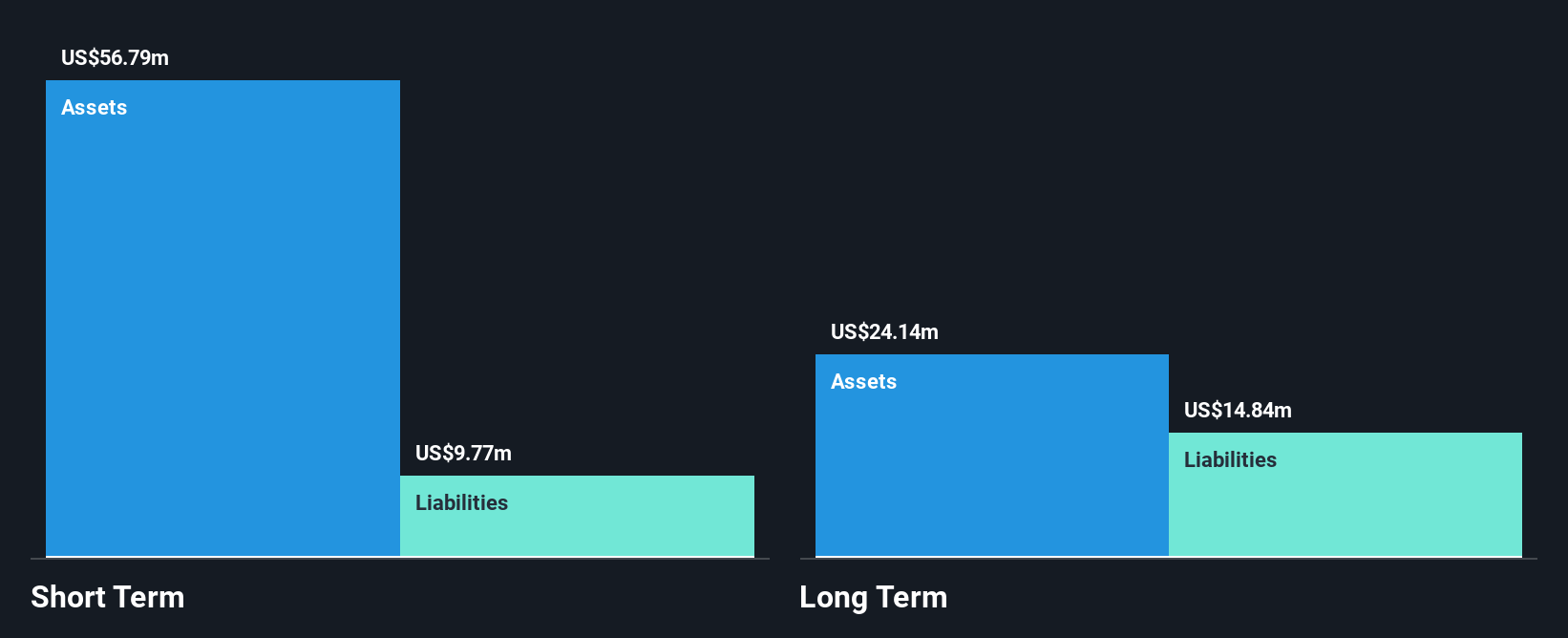

OraSure Technologies, Inc., with a market cap of approximately US$278.98 million, is navigating challenges in the penny stock realm by focusing on its Diagnostics and Molecular Solutions segment, which generated US$224.26 million in revenue. The company recently received FDA approval for expanding the age range of its OraQuick HIV Self-Test, potentially increasing market reach among adolescents. Despite stable weekly volatility and no debt burden, OraSure faces declining earnings forecasts over the next three years and reported a significant one-off loss impacting recent financial results. However, it maintains strong liquidity with short-term assets exceeding liabilities significantly.

Make It Happen

- Reveal the 724 hidden gems among our US Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.