Please use a PC Browser to access Register-Tadawul

US Market Preview | PCE Data Meets Expectations; Morgan Stanley Warns of Continued Stock Decline; Nvidia Buys Back $3.7B in Stock

Powell Max Limited PMAX | 0.00 | |

ARB IOT GROUP LIMITED ARBB | 0.00 | |

Interactive Strength, Inc. (FORME) TRNR | 0.00 | |

Nvni Group Ltd Ordinary Shares NVNI | 0.00 | |

Sacks Parente Golf, Inc. SPGC | 0.00 |

Top News

- US January Core PCE Price Index Meets Expectations;

- NVIDIA Corporation Repurchases $3.7 Billion in Stock Amid Market Turmoil;

- AppLovin Corporation Defends Against Short Seller Allegations; UBS Sees Buying Opportunity;

I. Market Report

Stock futures rose slightly on Friday as investors looked to the end of a losing week.

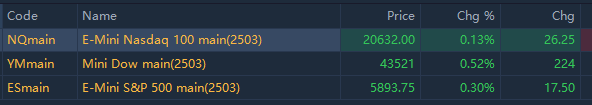

As of 04:39 PM Riyadh Time, Dow Jones Industrial Average futures climbed 224 points, or 0.52%. S&P 500 futures and Nasdaq-100 futures gained 0.3% and 0.13%, respectively.

Here are some stocks moving in pre-market trading as of 04:25 PM Riyadh Time.

Change | Price(US$) | Ticker (🌙 means "Shariah Compliant") | Additional Information |

72.8% | 0.62 | 🌙 Powell Max Limited(PMAX.US) | Will acquire Miracle Media Production. |

43.7% | 0.69 | 🌙 ARB IOT GROUP LIMITED(ARBB.US) | - |

43.1% | 2.19 | Interactive Strength, Inc. (FORME)(TRNR.US) | Stock appreciated significantly by 22.4% on last trading day |

-71.3% | 0.57 | Nvni Group Ltd Ordinary Shares(NVNI.US) | - |

-49.6% | 0.2 | 🌙 Sacks Parente Golf, Inc.(SPGC.US) | Stock leaped by 44.5% on last trading day |

Read more: Pre-Bell Movers | ARBB Higher by 87.5%; Here Are 20 Stocks to Watch Premarket

II. Flash Headlines

US January Core PCE Price Index Meets Expectations

The US January Core PCE Price Index rose by 2.60% year-over-year, aligning with expectations. This marks a decrease from the previous value of 2.90%.

| Event | Actual | Previous | Consensus | Forecast |

|---|---|---|---|---|

| Core PCE Price Index MoM JAN | 0.3% | 0.2% | 0.3% | 0.4% |

| Personal Income MoM JAN | 0.9% | 0.4% | 0.3% | 0.3% |

| Personal Spending MoM JAN | -0.2% | 0.8% | 0.1% | 0.3% |

| Goods Trade Balance Adv JAN | $-153.26B | $-122.01B | $-114.7B | $-116.0B |

| PCE Price Index MoM JAN | 0.3% | 0.3% | 0.3% | 0.4% |

| PCE Price Index YoY JAN | 2.5% | 2.6% | 2.5% | 2.5% |

| Retail Inventories Ex Autos MoM Adv JAN | 0.4% | -0.1% | - | 0.1% |

| Wholesale Inventories MoM Adv JAN | Waiting for Release | -0.5% | 0.1% | 0.2% |

| Core PCE Price Index YoY JAN | 2.6% | 2.9% | 2.6% | 2.7% |

| Chicago PMI FEB | - | 39.5 | 40.6 | 42 |

S&P 500 Faces Continued Sell-Off as Morgan Stanley Warns of $40B CTA Liquidation

Morgan Stanley warns that the sell-off in S&P 500 INDEX(SPX.US) is far from over, with an anticipated $40 billion in CTA-driven stock sales over the next week. The $SPX's dip below the critical 5887-point level has triggered mid-term liquidation signals for CTAs, indicating more turbulence ahead for investors.

Bitcoin Plummets Over 25% from All-Time High Amid Market Sell-Off

Bitcoin faced a sharp sell-off, dropping 5.8% on Friday to below $80,000. This marks a decline of over 25% from its record high less than six weeks ago. The fall intensified as investors sought safe-haven assets following the latest trade threats from Trump.

Fed Urges Patience on Interest Rates

Federal Reserve officials, including Cleveland Fed President Beth Hammack, urge patience on interest rates, saying they are not at substantial limits and should remain steady until inflation cools. Kansas City Fed President Jeff Schmid expresses concerns about growth, while Philadelphia Fed President Patrick Harker remains optimistic.

OpenAI Launches GPT 4.5 for Select Paid Users

OpenAI announced the release of its latest GPT 4.5 model, now available for global professional users and developers. The rollout will expand over the coming weeks, marking a significant advancement in generative AI technology.

III. Stocks To Watch

Trader Bets Big On NVDA Fall

A trader bought over 300,000 put options betting NVIDIA Corporation(NVDA.US) stock price would fall to $115 by March 7, a 12% drop from Wednesday's close, amid concerns about growth prospects and solid but not spectacular earnings.

NVIDIA Corporation Repurchases $3.7 Billion in Stock Amid Market Turmoil

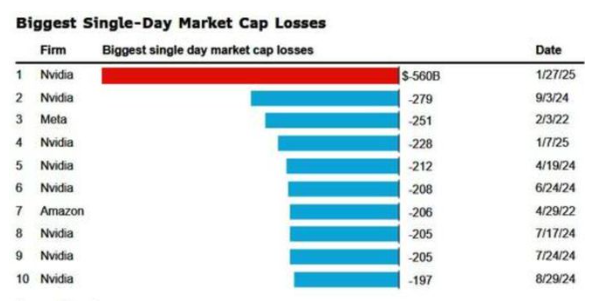

Following a 17% plunge in its stock price on January 27 due to concerns over DeepSeek's new technology, NVIDIA Corporation(NVDA.US) repurchased 29 million shares between January 27 and February 21. The total value of the buyback was approximately $3.7 billion, with an average purchase price of $127.59 per share.

AppLovin Corporation Defends Against Short Seller Allegations; UBS Sees Buying Opportunity

AppLovin Corporation(APP.US) responded to short-seller reports, stating they contain numerous falsehoods and misleading claims aimed at damaging the company's reputation and stock price for personal gain. UBS countered these reports, arguing that they exaggerate the importance of click/install volumes relative to ROAS. UBS sees the current market adjustment as an excellent buying opportunity.

Tesla Applies for Autonomous Taxi Service Permit in California

California regulators reported that Tesla Motors, Inc.(TSLA.US) has applied for a permit related to driver-operated services. Additionally, Tesla Motors plans to launch an autonomous ride-hailing service in Austin, Texas, by June 2025.

Dell Technologies Q4 Mixed Results; AI Server Demand Strong

Dell Technologies Inc.(DELL.US) reported mixed Q4 results with revenue up 7.2% to $23.9 billion, missing expectations. Adjusted EPS of $2.68 beat forecasts. Infrastructure revenue was $11.4 billion, below the expected $11.8 billion, with AI server sales at $2.1 billion, missing the $2.77 billion forecast. PC revenue grew 1% to $11.9 billion, with consumer PC sales down 12% and commercial PC sales up 5% to $10 billion. For FY2026, Dell Technologies expects EPS of $9.30 and revenue between $101 billion and $105 billion.

Ark Invest Sells Spotify Stock

ARK Web x.0 ETF(ARKW.US) sold 6,629 shares of SPOTIFY TECHNOLOGY S.A.(SPOT.US) worth US$3.9 million amidst competition from YouTube, which surpassed Spotify's monthly active podcast users. Read in detail>>

IV. Calendar

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 04:30 PM | Core PCE Price Index MoM | 0.2% | 0.4% |

| 04:30 PM | Personal Income MoM | 0.4% | 0.3% |

| 04:30 PM | Personal Spending MoM | 0.7% | 0.3% |

| 04:30 PM | Goods Trade Balance Adv | $-122.11B | $ -116.0B |

| 04:30 PM | PCE Price Index MoM | 0.3% | 0.4% |

| 04:30 PM | PCE Price Index YoY | 2.6% | 2.5% |

| 04:30 PM | Retail Inventories Ex Autos MoM Adv | -0.1% | 0.1% |

| 04:30 PM | Wholesale Inventories MoM Adv | -0.5% | 0.2% |

| 04:30 PM | Core PCE Price Index YoY | 2.8% | 2.7% |

| 05:45 PM | Chicago PMI | 39.5 | 42 |

| 09:00 PM | Baker Hughes Oil Rig Count | 487 | |

| 09:00 PM | Baker Hughes Total Rigs Count | 592 |