Please use a PC Browser to access Register-Tadawul

US Market Preview | Futures, ORCL, NFLX Soar, Trump ‘Stargate’ Venture With ORCL, OpenAI; Ark Invest Focuses on Defense, Energy

Procter & Gamble Company PG | 170.23 170.74 | +1.81% +0.30% Pre |

Johnson & Johnson JNJ | 162.30 162.55 | +1.64% +0.15% Pre |

Abbott Laboratories ABT | 134.92 135.11 | +1.31% +0.14% Pre |

Progressive Corporation PGR | 266.19 267.80 | -0.55% +0.60% Pre |

Amphenol Corporation Class A APH | 67.58 68.01 | -2.58% +0.64% Pre |

Top News

- Oil Prices Fall Amid Uncertainty Over Trump's Energy Policies

- Trump's EV Tax Credit Plan Sparks Mixed Reactions for Tesla

- Netflix Q4 Earnings Surpass Expectations, Shares Surge

I. Market Report

Equity futures rose on Wednesday as the S&P 500 approached a new high.

Technology stocks like Oracle (Oracle Corporation(ORCL.US)) and Nvidia (NVIDIA Corporation(NVDA.US)) surged on AI optimism, while Netflix (Netflix, Inc.(NFLX.US)) and Procter & Gamble (Procter & Gamble Company(PG.US)) gained following strong quarterly results.

Despite tariff concerns, stocks have rallied this year on optimism about the new administration.

As of 09:23 AM, ET, the blue-chip Dow Jones Futures are up 0.33%, the broad-based S&P 500 Futures escalate by 0.50% to 6,113, the tech-heavy Nasdaq Futures pick up 0.89%.

Top pre-market movements are as follows:

| Tickers | Change | Names |

| BLBX | 82.84% | Blackboxstocks Inc.(BLBX.US) |

| NEHC | 55.1% | New Era Helium Inc. Ordinary Shares(NEHC.US) |

| USEG | 38.78% | U.S. Energy Corp.(USEG.US) |

| UTSI | 36.86% | UTStarcom Holdings Corp.(UTSI.US) |

| ASST | 36.66% | Asset Entities Inc.(ASST.US) |

| HUBC | -25.45% | Hub Cyber Security Ltd Ordinary Shares(HUBC.US) |

| GBBKR | -25.93% | Global Blockchain Acquisition Corp.(GBBK.US) |

| LSTA | -35.13% | Lisata Therapeutics, Inc. - Common Stock(LSTA.US) |

| HEPA | -60.35% | HEPION PHARMACEUTICALS INC(HEPA.US) |

| STFS | -85.2% | Star Fashion Culture Holdings Ltd.(STFS.US) |

II. Flash Headlines

Oil Prices Fall Amid Uncertainty Over Trump's Energy Policies

Oil prices have dropped for four consecutive days following President Trump's declaration of a national energy emergency, raising concerns about increased U.S. production. Analysts cited policy uncertainties and oversupply fears as key factors. Sanctions and OPEC+ production delays may sustain the market's strength, but weak demand and global oversupply pressures persist.

IEA Reports Record Global Natural Gas Consumption in 2024

The International Energy Agency announced that global natural gas consumption reached a record 421.2 billion cubic meters in 2024, up 2.8% from 2023. Natural gas accounted for 40% of new energy demand, with further growth expected in 2025, driven by Asia. Geopolitical tensions and tight supplies may fuel price volatility.

Saudi Aramco Projects Global Oil Demand Rising to 106 Million BPD

Saudi Aramco CEO Amin Nasser predicts global oil demand will rise by 1.3 million barrels per day in 2025, reaching 106 million barrels daily, surpassing the IEA's 105-million-barrel estimate. He cites strong demand growth from China and India, driving 40% of global consumption. U.S. sanctions on Russian oil may further tighten supply.

III. Stocks To Watch

Trump's EV Tax Credit Plan Sparks Mixed Reactions for Tesla

President Trump signed an executive order halting $7,500 EV tax credits, previously aiding Tesla Motors, Inc.(TSLA.US)and rivals. Elon Musk suggested this shift could harm competitors but benefit Tesla long-term. A poll revealed 40.4% see the move as bullish for Tesla, emphasizing its market resilience.

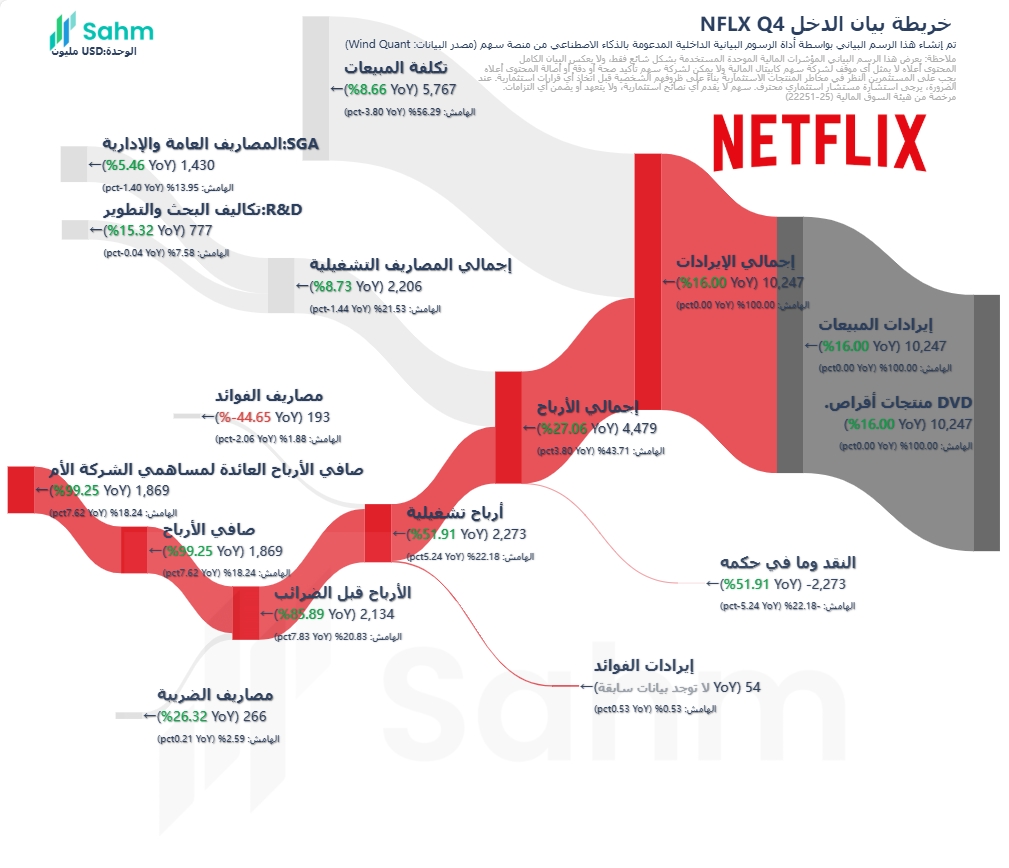

Netflix Q4 Earnings Surpass Expectations, Shares Surge

Netflix, Inc.(NFLX.US)'s Q4 revenue rose 16% YoY to $10.25B, with EPS of $4.27, exceeding estimates. The company added a record 19M paid subscribers, bringing the total to 302M. For 2025, Netflix forecasts revenue between $43.5B and $44.5B, with an operating margin of 29%. A $15B buyback plan was also approved. Shares jumped premarket to $995.5.

Read More: In One Chart | Why NFLX Surges Pre-Bell?

Oracle Soars Over 10% Pre-Market on AI Venture With OpenAI, SoftBank

Oracle Corporation(ORCL.US), OpenAI, and SOFTBANK CORP.(SFBQF.US) announced a $500 billion joint venture named Stargate, starting with $100 billion to bolster AI infrastructure. The initiative, unveiled by President Trump, aims to create 100,000 U.S. jobs, driving Oracle's pre-market a 7%+ surge.

Qualcomm Gains JPMorgan's Support Ahead of Earnings Announcement

QUALCOMM Incorporated(QCOM.US) was added to JPMorgan’s "Positive Catalyst Watch List" ahead of its Q1 earnings release on February 5. Analyst Samik Chatterjee rated Qualcomm "overweight" with a $200 price target, citing robust growth in China’s smartphone market, government subsidies, and potential gains from Samsung's Galaxy S25. Revenue diversification could drive a valuation re-rating.

Ark Invest Buys Defense, Energy Stocks

Cathie Wood's Ark Invest (ARK Innovation ETF(ARKK.US), ARK Industrial Innovation ET(ARKQ.US), ARK Genomic Revolution Multi(ARKG.US), ARK Space Exploration & Innovation ETF(ARKX.US)) buys shares in Accolade (Accolade(ACCD.US)), Deere (Deere & Company(DE.US)), Intellia (Intellia Therapeutics, Inc.(NTLA.US)), Cameco (Cameco Corporation(CCJ.US)), Oklo (Oklo Inc. Ordinary Shares - Class A(OKLO.US)), Illumina (Illumina, Inc.(ILMN.US)), Elbit (Elbit Systems Ltd(ESLT.US)), Absci (ABSCI CORPORATION(ABSI.US)). Sells UiPath (UiPath, Inc.(PATH.US)). Focus on defense, energy amid Trump policies.

MicroStrategy Stock Purchase Approved to Boost Bitcoin Holdings

MicroStrategy Incorporated Class A(MSTR.US) shareholders approved a 30-fold increase in authorized Class A common shares, enabling the company to fund more Bitcoin purchases. With $49 billion in Bitcoin on its balance sheet, MicroStrategy plans to raise $42 billion by 2027, continuing its strategy of acquiring Bitcoin. The approval supports its ongoing push to become a major "Bitcoin Agent."

IV. Calendar

Incoming Earnings:

Procter & Gamble Company(PG.US)

Progressive Corporation(PGR.US)

Amphenol Corporation Class A(APH.US)

Kinder Morgan Inc Class P(KMI.US)

Travelers Companies, Inc.(TRV.US)

Discover Financial Services(DFS.US)

Crown Castle International Corp(CCI.US)

Day's Expected IPO(s):

Toppoint Holdings Inc.(TOPP.US)

Maverick Lifestyle, Inc.(MVRK.US)

Please note that the timing of IPOs is subject to change at any time (including being advanced or delayed). Investors should therefore keep up-to-date with relevant news.

Day's Notable Event(s):

| Riyadh Time | Event | Previous Value | Forecast Value |

| 03:00 PM | MBA 30-Year Mortgage Rate | 7.09% | |

| 03:00 PM | MBA Mortgage Applications | 33.3% | |

| 03:00 PM | MBA Mortgage Market Index | 224.4 | |

| 03:00 PM | MBA Mortgage Refinance Index | 575.6 | |

| 03:00 PM | MBA Purchase Index | 162.0 | |

| 04:55 PM | Redbook YoY | 4% | |

| 09:00 PM | 20-Year Bond Auction | 4.686% | |

| 12:30 AM +1 | API Crude Oil Stock Change | -2.6M |