Unpacking the Latest Options Trading Trends in 3M

3M Company MMM | 129.28 | +1.69% |

Financial giants have made a conspicuous bullish move on 3M. Our analysis of options history for 3M (NYSE:MMM) revealed 26 unusual trades.

Delving into the details, we found 57% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $104,301, and 24 were calls, valued at $1,551,736.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $90.0 and $150.0 for 3M, spanning the last three months.

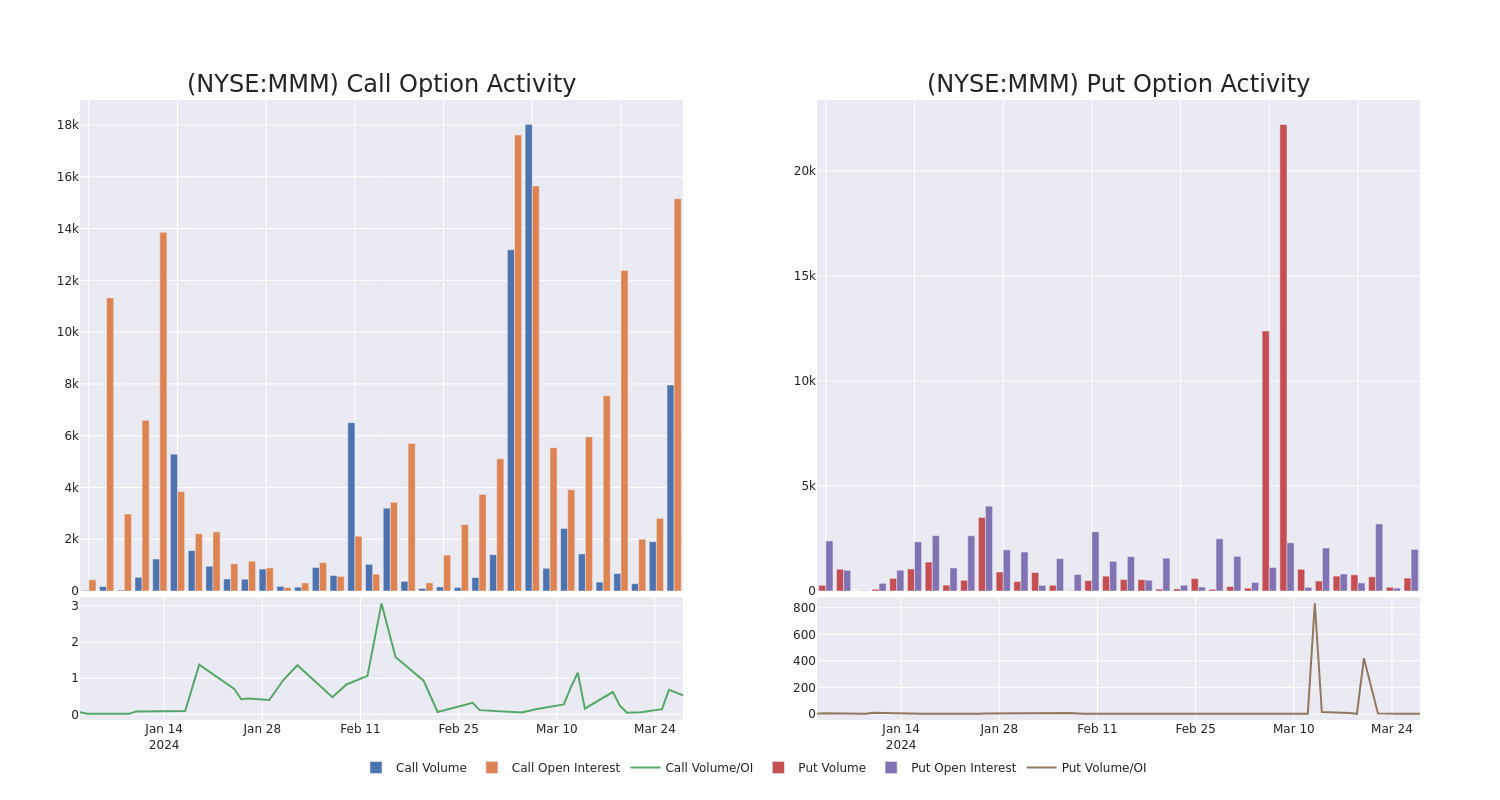

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for 3M's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of 3M's whale trades within a strike price range from $90.0 to $150.0 in the last 30 days.

3M Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MMM | CALL | TRADE | BULLISH | 04/19/24 | $2.99 | $2.89 | $2.99 | $105.00 | $261.6K | 5.9K | 1.2K |

| MMM | CALL | TRADE | BULLISH | 04/19/24 | $10.9 | $10.75 | $10.88 | $95.00 | $212.1K | 1.9K | 443 |

| MMM | CALL | SWEEP | BULLISH | 04/19/24 | $10.9 | $10.85 | $10.92 | $95.00 | $204.1K | 1.9K | 230 |

| MMM | CALL | TRADE | NEUTRAL | 12/19/25 | $3.5 | $2.86 | $3.18 | $150.00 | $88.7K | 358 | 279 |

| MMM | CALL | SWEEP | BEARISH | 05/17/24 | $12.35 | $11.95 | $12.09 | $95.00 | $69.8K | 948 | 865 |

About 3M

3M is a multinational conglomerate that has operated since 1902, when it was known as Minnesota Mining and Manufacturing. The company is well known for its research and development laboratory and it leverages its science and technology across multiple product categories. As of 2020, 3M is organized into four business segments: safety and industrial, transportation and electronics, healthcare, and consumer. Nearly 50% of the company's revenue comes from outside the Americas, with the safety and industrial segment constituting a plurality of net sales. Many of the company's 60,000-plus products touch and concern a variety of consumers and end markets.

Following our analysis of the options activities associated with 3M, we pivot to a closer look at the company's own performance.

3M's Current Market Status

- With a volume of 2,504,075, the price of MMM is up 0.02% at $104.61.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 26 days.

Expert Opinions on 3M

5 market experts have recently issued ratings for this stock, with a consensus target price of $102.0.

- An analyst from Barclays upgraded its action to Overweight with a price target of $126.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on 3M with a target price of $111.

- An analyst from Mizuho persists with their Neutral rating on 3M, maintaining a target price of $105.

- An analyst from RBC Capital has revised its rating downward to Underperform, adjusting the price target to $84.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Underperform rating for 3M, targeting a price of $84.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for 3M, Benzinga Pro gives you real-time options trades alerts.