Undervalued Small Caps In United States With Insider Action For October 2024

PROS Holdings, Inc. PRO | 21.49 | -2.14% |

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 37% increase over the past year with anticipated earnings growth of 15% per annum in the coming years. In such an environment, identifying small-cap stocks that are potentially undervalued and exhibit insider action can be a strategic approach to uncovering opportunities for growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.2x | 0.9x | 44.27% | ★★★★★★ |

| Hanover Bancorp | 10.0x | 2.3x | 44.53% | ★★★★★☆ |

| HighPeak Energy | 11.0x | 1.4x | 40.20% | ★★★★☆☆ |

| Citizens & Northern | 13.4x | 2.9x | 43.81% | ★★★☆☆☆ |

| Guardian Pharmacy Services | 78.6x | 1.0x | 42.13% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -99.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -64.29% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -45.10% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.5x | -163.87% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider to the global travel and tourism industry, with a market cap of approximately $1.86 billion.

Operations: Sabre's revenue streams are primarily derived from Travel Solutions, contributing $2.70 billion, and Hospitality Solutions with $315.74 million. The company's cost structure includes a significant portion allocated to Cost of Goods Sold (COGS), which amounted to approximately $1.21 billion in the latest period, impacting its overall profitability. Notably, Sabre's gross profit margin has shown fluctuations over time, reaching 59.47% in the most recent quarter ending October 2024.

PE: -3.5x

Sabre Corporation, a player in the travel technology sector, has been making strategic moves to enhance its content distribution capabilities. Recent agreements with Premier Inn and World Travel highlight its focus on expanding lodging content and improving travel agency experiences. Despite facing higher risk funding from external borrowing, Sabre's partnerships with airlines like Riyadh Air demonstrate innovative use of AI for personalized offers. Insider confidence is evident with share purchases over the past year, suggesting belief in future growth prospects amidst evolving industry dynamics.

Custom Truck One Source (NYSE:CTOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Custom Truck One Source operates as a provider of specialty equipment and services, focusing on truck and equipment sales, aftermarket parts and services, and equipment rental solutions, with a market capitalization of $1.76 billion.

Operations: TES contributes significantly to revenue, followed by ERS and APS. The gross profit margin has seen fluctuations, reaching 24.91% recently. Operating expenses and non-operating expenses are notable cost components impacting net income.

PE: -69.4x

Custom Truck One Source, a smaller player in the U.S. market, shows potential for growth with an earnings forecast of 92.85% annually despite recent financial challenges. For the nine months ending September 2024, revenue reached US$1.28 billion but net losses amounted to US$56.23 million, highlighting operational hurdles. Insider confidence is evident as insiders have increased their holdings recently, signaling belief in future prospects. The company also repurchased shares worth US$16.87 million between April and June 2024, reflecting strategic financial management amidst external borrowing risks.

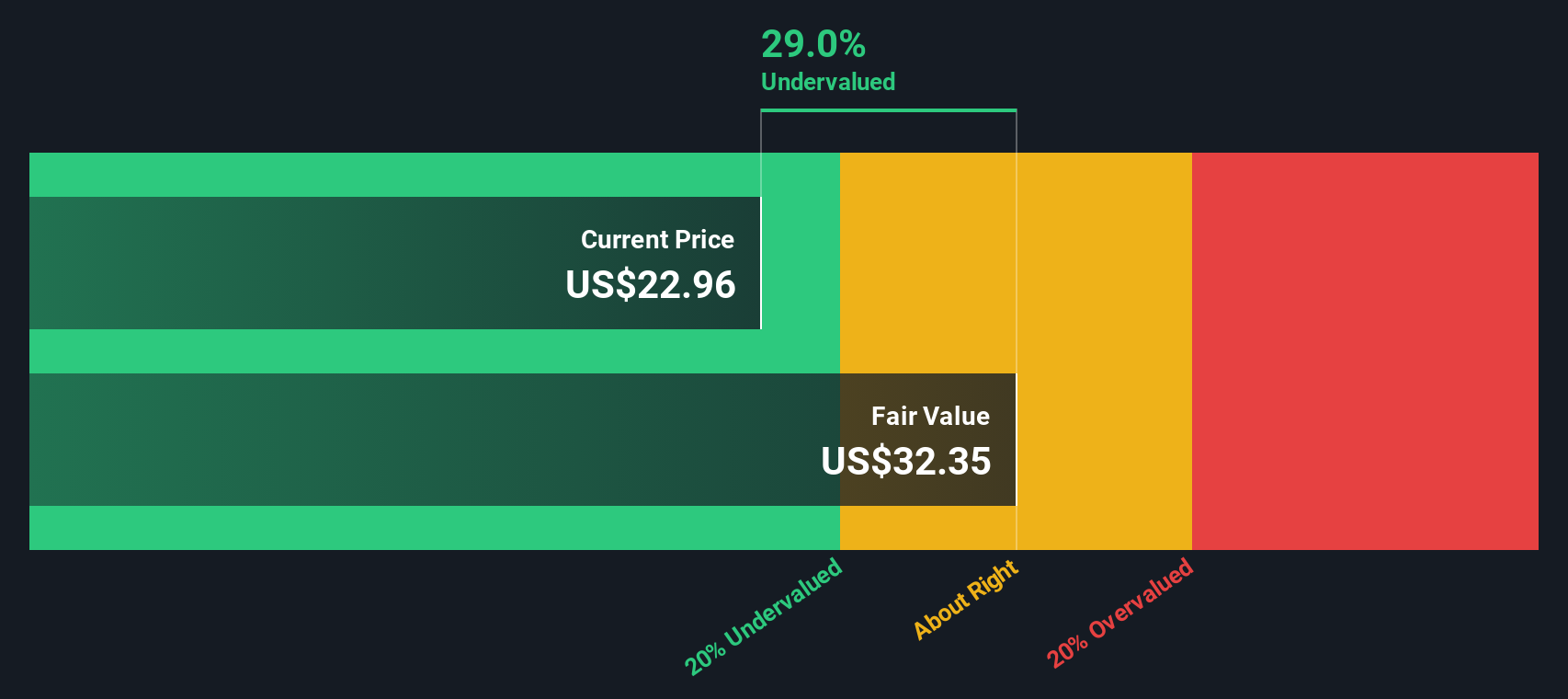

PROS Holdings (NYSE:PRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: PROS Holdings is a company that provides AI-powered solutions to optimize pricing, selling, and revenue management for businesses across various industries, with a market cap of approximately $1.51 billion.

Operations: PROS Holdings generates revenue primarily through its gross profit, which has shown a gradual increase from $101.70 million in 2013 to $208.20 million by September 2024. The company's cost of goods sold (COGS) and operating expenses have also risen over the years, impacting net income margins negatively, with figures such as -0.0889% noted in recent periods. Notably, the gross profit margin has experienced an upward trend reaching 64.48% by September 2024, indicating improved efficiency in managing production costs relative to sales revenue over time.

PE: -34.4x

PROS Holdings, a smaller U.S. company, recently reported third-quarter revenue of US$82.7 million, up from US$77.25 million the previous year, with a net income of US$0.235 million compared to a significant loss previously. Despite being unprofitable and reliant on external borrowing for funding, PROS is enhancing its platform with innovations like Smart Rebate Management to streamline sales processes and boost profitability. The company's leadership transition is underway as CEO Andres Reiner plans retirement while remaining involved during the succession phase.

Where To Now?

- Access the full spectrum of 48 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.