Please use a PC Browser to access Register-Tadawul

Trading Wisdom | Top 10 Great Investors of All Time

PowerShares QQQ Trust,Series 1 QQQ | 521.51 519.40 | +0.44% -0.40% Post |

Apple Inc. AAPL | 211.26 210.12 | -0.09% -0.54% Post |

Navigating the investment world is no easy feat, yet some investors have not only mastered it but also revolutionized it. These ten influential figures have left an indelible mark on the financial landscape, thanks to their unique strategies and remarkable foresight. Here are the top ten most influential investors of all time, whose legacies extend well beyond their financial gains.

1. Warren Buffett — The Oracle of Omaha

Few names resonate in the investment world like Warren Buffett. Known as the "Oracle of Omaha," Buffett champions the art of value investing. He meticulously picks companies that he believes are undervalued but have strong long-term growth prospects.

Noteworthy Investment: Coca-Cola

In 1988, Buffett made a significant investment in Coca-Cola through his conglomerate, Berkshire Hathaway. Recognizing the iconic brand’s potential, this move has since turned into one of the most rewarding investments of his career.

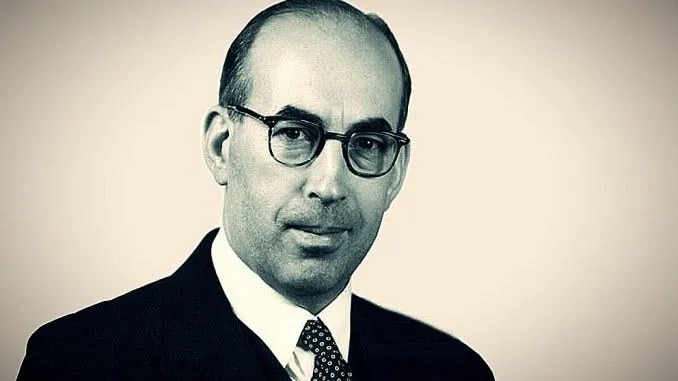

2. Benjamin Graham — The Father of Value Investing

Benjamin Graham's investment philosophies laid the groundwork for the field of value investing. His approach emphasizes the idea of buying stocks below their intrinsic value to minimize risk and maximize profit.

Noteworthy Investment: Geico

In a move that spoke volumes about his foresight, Graham invested in Geico during its early, challenging days. The investment turned out to be a multi-decade success story.

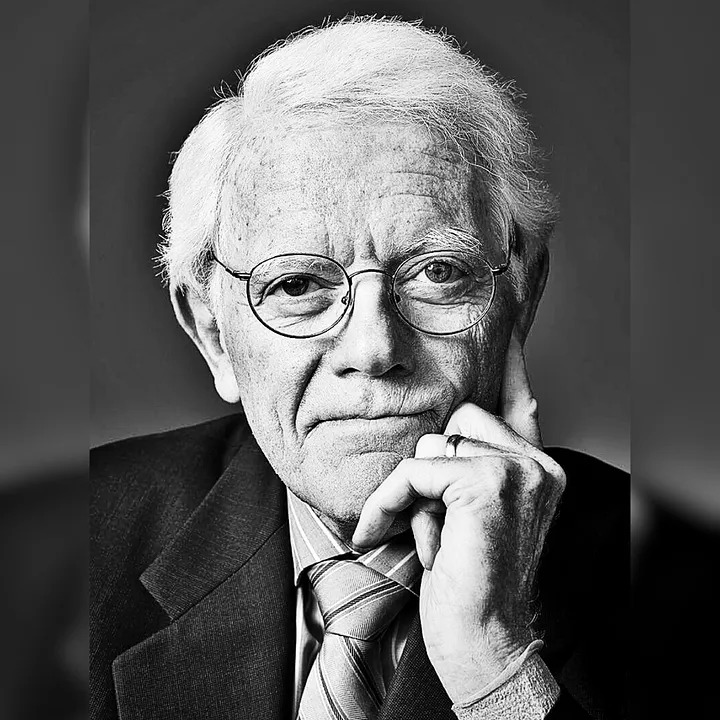

3. Peter Lynch — The Growth Guru

Peter Lynch managed Fidelity’s Magellan Fund with an astonishing annualized return of 29% over 13 years. His investment mantra, “Invest in what you know,” led him to extraordinary growth opportunities.

Noteworthy Investment: The Limited

Lynch spotted The Limited's potential during casual shopping trips and transformed this insight into substantial gains by thoroughly researching and investing in the company.

4. George Soros — The Alchemist of Finance

George Soros is synonymous with big, bold bets in the financial markets. His macroeconomic analysis and readiness to act on his convictions have earned him substantial profits and a legendary status.

Noteworthy Investment: Shorting the Pound

In 1992, Soros famously shorted the British pound, challenging the UK’s ability to maintain its currency's exchange rate. His bold move earned him $1 billion in a single day and a place in financial history.

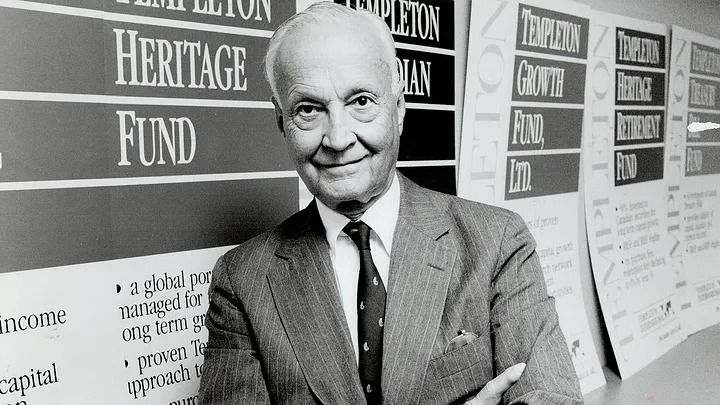

5. John Templeton — The Global Visionary

John Templeton was a pioneer in global investing, scouring the earth for undervalued opportunities. His focus on international markets allowed him to leverage economic growth stories from across the globe.

Noteworthy Investment: Post-War Japan

Templeton’s shrewd investments in Japan after World War II capitalized on the country's rapid post-war industrialization, yielding impressive returns.

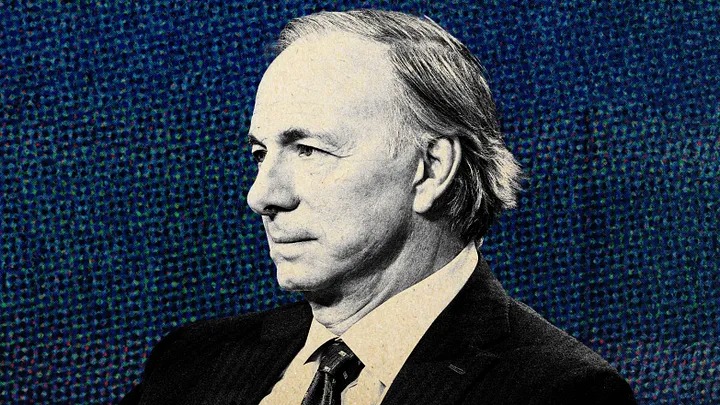

6. Ray Dalio — The Diversification Maestro

Ray Dalio’s Bridgewater Associates has grown into the world’s largest hedge fund. His All-Weather portfolio, designed to perform well under any economic condition, exemplifies his deep understanding of diversification.

Noteworthy Investment: The All-Weather Portfolio

Dalio's strategic diversification into multiple asset classes has allowed his fund to weather financial storms, underscoring his mastery of risk management.

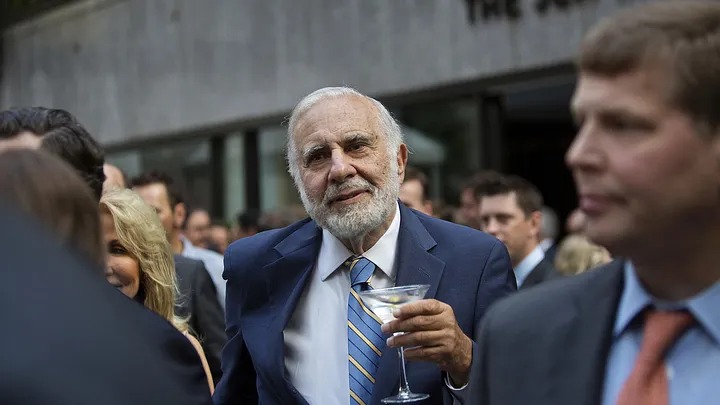

7. Carl Icahn — The Activist Investor

Carl Icahn is the epitome of an activist investor, taking substantial stakes in companies to influence management and unlock shareholder value.

Noteworthy Investment: Apple Inc.

Icahn's substantial investment in Apple Inc., coupled with his advocacy for stock buybacks, significantly increased shareholder returns and exemplified his impact as an activist investor.

8. Philip Fisher — The Long-Term Growth Investor

Philip Fisher’s keen eye for quality growth companies and his long-term investment horizon have made him an enduring figure in the investment world.

Noteworthy Investment: Motorola

By investing early in Motorola, Fisher identified and benefited from the company's historical growth trajectory in the telecommunications industry.

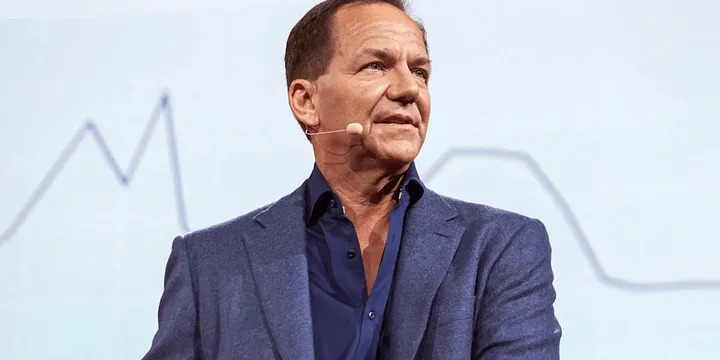

9. Paul Tudor Jones — The Visionary Trader

Paul Tudor Jones is celebrated for his trading acumen, particularly his ability to anticipate and bet against market trends.

Noteworthy Investment: 1987 Market Crash

Jones's foresight during the 1987 market crash, where he shorted stocks just before the collapse, protected his investments and earned him significant profits.

10. David Swensen — The Endowment Strategist

David Swensen transformed Yale University's endowment fund with his innovative “Endowment Model,” focusing on diversification and alternative investments.

Noteworthy Investment: Yale Endowment Fund

By diversifying Yale’s investments into private equity, hedge funds, and real estate, Swensen managed to achieve an annualized return of over 20%, setting a new standard for institutional investors.

These ten investors have not only amassed fortunes but also enriched the investment world with their unique strategies and insights. Their stories and successes offer invaluable lessons for anyone seeking to navigate the complex world of finance.