Please use a PC Browser to access Register-Tadawul

Trading Wisdom | It's Difficult to Predict Market Bottoms and Tops, Here Are Key Tips to Spot Potential Turning Points

S&P 500 index SPX | 0.00 | |

Tadawul All Shares Index TASI.SA | 0.00 |

Accurately predicting the market's highs and lows is not an easy task, even for the most experienced traders and investors. Most of the time, predicting whether the market will rise or fall is essentially a coin toss.

Despite certain situations that may lead us to have a preference, these are not sufficient for making predictions.

Instead, the thinking should be: How can I identify potential turning points in the market? These are points that are likely to precede volatility or momentum increases compared to any random market data.

For many independent traders, they're making small, conservative trades with a slightly positive expectation until the conditions are clearly in their favour, which is when they increase their stake significantly.

Most often, these optimal conditions occur near turning points or at market highs and lows.

1. Identifying Market Tops and Bottoms

Breaking the Trend

Not all market highs and lows occur within a trend. However, it is generally more challenging to find consistently profitable opportunities in a trendless, fluctuating market.

Prices are mostly random, and it's difficult to define current market behavior.

If we assume we are only looking for the possibility of a top or a bottom, the first step is to identify the current trend's turning points.

Every trader has their definition of a trend. Some use indicators, trend lines, growth rates, etc. The basic way to differentiate between a trend and a non-trend is a series of higher highs and lower lows (or vice versa).

This is the fundamental pattern. Everything else depends on personal preference.

Below is a clear case of a trend break. A higher low has been broken, suggesting a potential change in the trend.

It indicates that the market has weakened and can no longer maintain the trend. This can help you identify important turning points.

Here's a real case with the S&P 500 index, in October 2020.

Most examples won't look like this (a significant downward trend once the trend is broken), but it shows the possible chain reaction when a strong trend is disrupted.

Creating a model to analyze each fluctuation in a trend, should you become more aggressive or reduce your position? Should you join the trend or start looking for counter-trend trades?

Linking the current position to its current trend is important. A few key questions to ask are:

- How many fluctuations have occurred in this trend?

- Compared to early in the trend, are recent increases larger or smaller?

- In this trend, has the fluctuation range expanded or contracted?

(Fluctuation refers to the range between high and low points within a trend movement.)

Trend Acceleration

A trend's acceleration is often its final round of movement, typically characterized by many extremes in volume and sentiment.

The most obvious and relevant example is the 2017 Bitcoin bull market. Notice how, towards the end of the uptrend, the fluctuation range significantly expanded, followed by a severe pullback, ending the trend.

The price not only broke the previous low but also failed to create new higher-highs in subsequent rises.

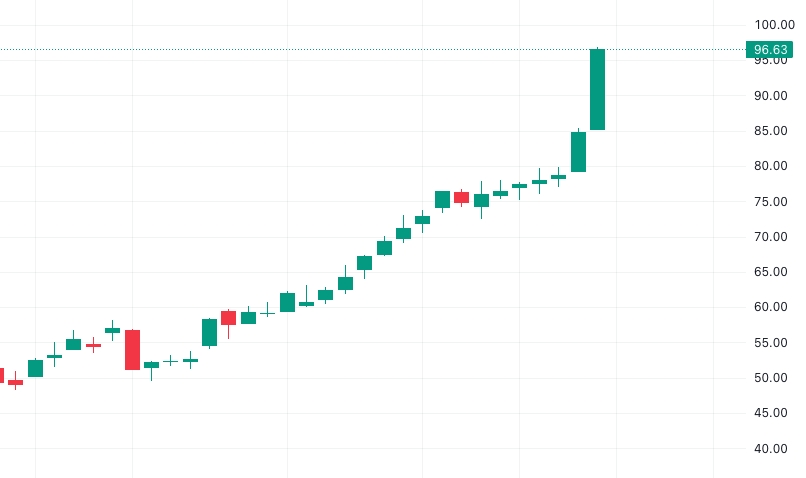

Here's another example where the outcome is still unknown. (NASDAQ:KOD)

For over a month, this stock has been in a stable and strong upward trend with no pullbacks.

The stock has recently shown a parabolic trajectory.

What should we consider?

First, given that there has been no similar pullback (just like in the previous chart) yet, its strength may continue.

Furthermore, the last two bullish candles are strong and lack upper shadows, indicating minimal noticeable pullbacks.

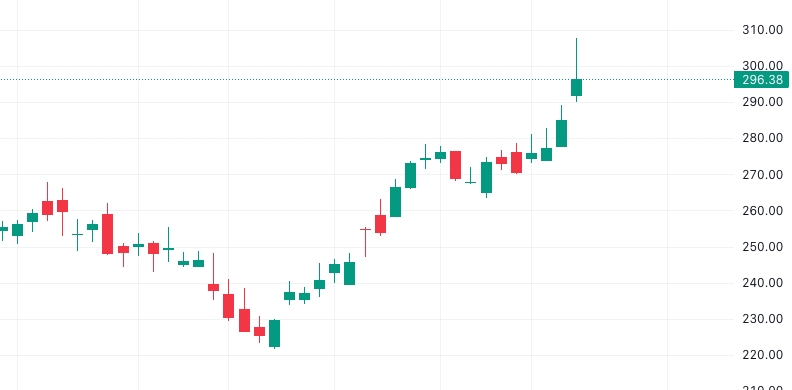

Here's another scenario where the future trend is unknown.

This stock is in a short-term upward trend and has recently broken through a resistance level.

The breakthrough candle is an "inverted hammer" candlestick pattern, indicating a pullback after reaching significant high point during the session.

Given the general failure of most breakthroughs and the weakness after the breakthrough, a failed breakout trade might occur here.

However, as long as there is no similar adjustment to follow afterward, traders should still assume the trend is not broken until further confirmation.

It's important to check previous fluctuations to see if there are significant resistance levels at current prices; otherwise, a major downward trend is unlikely.

2. Appropriate Forecasting

For most traders, consistently successful predictions of market tops and bottoms are difficult to maintain. The best approach is often to start with light positions, wait for clear signals, and then increase exposure.

This article is not about useless predictions.

Nor is it about trying to trade solely at the bottom or top; it’s more about recognizing market conditions and dynamics that could indicate the beginning of significant shifts, creating highly favorable trading setups.

These conditions often occur at extreme price tops and bottoms. In such extreme situations, the risk of prediction is clearly too high, and we must wait for further market validation.

3. Technical Analysis Methods for Identifying Potential Bottoms or Tops

In trading practice, to spot potential market bottoms and tops, many investors use a combination of technical analysis tools such as support and resistance levels, trend lines, volatility indicators, price patterns, and trading volume. They closely monitor changes in price movements to more accurately predict potential market directions.

- Support and Resistance Levels: Support and resistance levels are crucial reference points in the market. A support level is a point where the price stops falling and begins to rebound after reaching a certain level, while a resistance level is where the price stops rising and starts to decline after reaching a certain height. By observing how prices have reacted at these levels in the past, traders can identify potential bottoms and tops.

- Trend Lines: Trend lines are lines drawn to connect the highs or lows in price movements. In an uptrend, you can draw an ascending trend line that connects the rising lows, and in a downtrend, a descending trend line that connects the falling highs. When prices approach these trend lines, signs of a reversal may appear, possibly indicating the formation of a market bottom or top.

- Volatility Indicators: Volatility indicators like the Relative Strength Index (RSI) and the Stochastic Oscillator can help determine whether the market is in an overbought or oversold state. When these indicators reach extreme levels, it could mean that the market is about to reverse, potentially signaling a market bottom or top.

- Price Patterns: Price patterns are specific chart patterns that often indicate the likelihood of a price reversal. For example, head and shoulders bottoms and head and shoulders tops are two common price patterns that suggest potential bottoms and tops, respectively. By learning and identifying these patterns on charts, you can discover potential market bottoms and tops.

- Trading Volume: Trading volume can provide insights into the level of market participant activity. Observing changes in trading volume near potential bottoms or tops can help confirm whether there is sufficient market support for a price reversal.