These Analysts Boost Their Forecasts On VF Corp Following Better-Than-Expected Results

V.F. Corporation VFC | 21.05 21.05 | +1.64% 0.00% Post |

V.F. Corporation (NYSE:VFC) reported better-than-expected second-quarter financial results on Monday.

VF Corp, the parent company of Vans and The North Face, reported second-quarter revenue of $2.8 billion, beating the consensus estimate of $2.7 billion, according to Benzinga Pro. The company reported second-quarter earnings of 60 cents per share, beating analyst estimates of 37 cents per share.

"Our results in the quarter met our expectations and reflect a sequential and broad-based improvement in year-on-year trends. At the same time, we made further progress on our four Reinvent priorities and we are on track to reach our previously announced $300 million savings target by the end of FY25," said Bracken Darrell, president and CEO of VF Corp.

VF Corp expects third-quarter revenue to be in the range of $2.7 billion to $2.75 billion versus estimates of $2.96 billion, according to Benzinga Pro. The company anticipates third-quarter adjusted operating income of $170 million to $200 million.

VF Corp shares gained 1.8% to close at $17.03 on Monday.

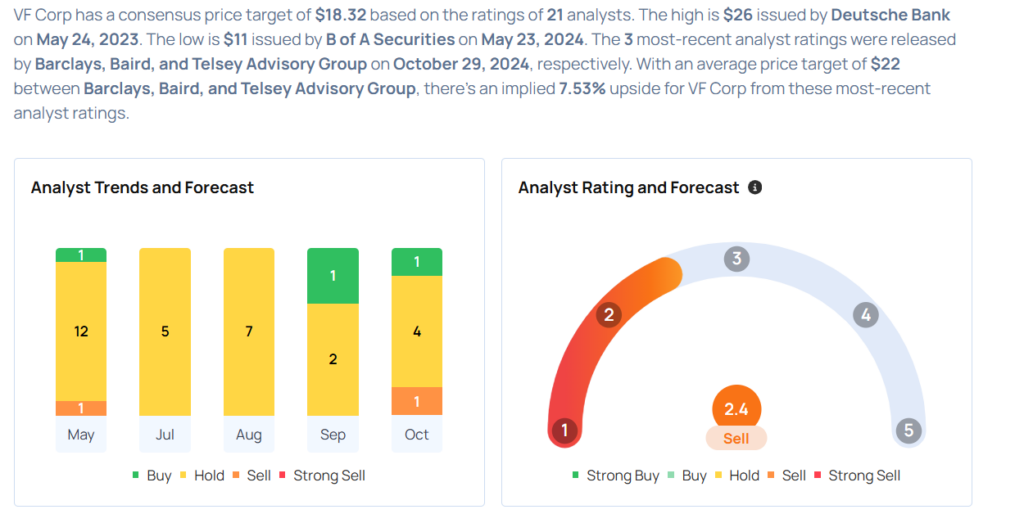

These analysts made changes to their price targets on VF Corp following earnings announcement.

- Telsey Advisory Group analyst Dana Telsey maintained VF with a Market Perform and raised the price target from $19 to $21.

- Baird analyst Jonathan Komp maintained VF with a Neutral and raised the price target from $17 to $20.

- Barclays analyst Adrienne Yih maintained the stock with an Overweight and increased the price target from $22 to $25.

Considering buying VFC stock? Here’s what analysts think:

Read More:

- Dow Surges Over 250 Points Ahead Of Alphabet, Pfizer Earnings: Investor Sentiment Improves, Fear Index Remains In ‘Greed’ Zone