Please use a PC Browser to access Register-Tadawul

There's Reason For Concern Over Comstock Resources, Inc.'s (NYSE:CRK) Massive 32% Price Jump

Comstock Resources, Inc. CRK | 0.00 |

Comstock Resources, Inc. (NYSE:CRK) shares have continued their recent momentum with a 32% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 42%.

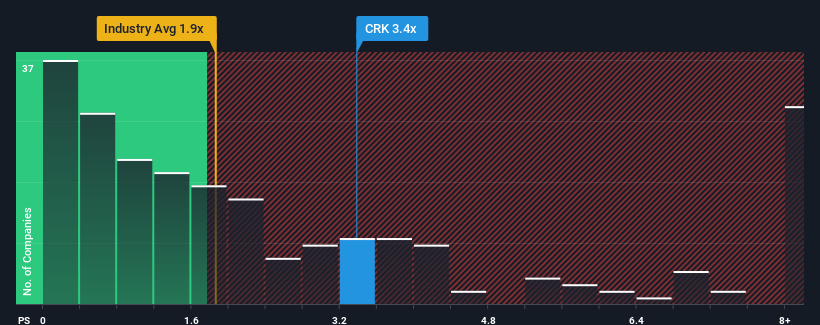

Following the firm bounce in price, you could be forgiven for thinking Comstock Resources is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in the United States' Oil and Gas industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Comstock Resources Has Been Performing

With revenue that's retreating more than the industry's average of late, Comstock Resources has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Comstock Resources will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Comstock Resources would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the nine analysts following the company. That's shaping up to be materially lower than the 91% growth forecast for the broader industry.

With this information, we find it concerning that Comstock Resources is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Comstock Resources' P/S Mean For Investors?

Comstock Resources shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Comstock Resources, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.