The Market Doesn't Like What It Sees From Beam Global's (NASDAQ:BEEM) Revenues Yet As Shares Tumble 26%

BEAM GLOBAL BEEM | 3.14 | +10.92% |

Beam Global (NASDAQ:BEEM) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

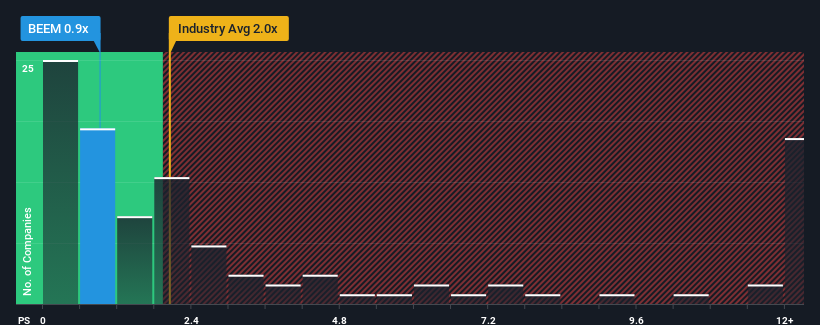

After such a large drop in price, Beam Global may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 2x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Beam Global Performed Recently?

Recent revenue growth for Beam Global has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beam Global.How Is Beam Global's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beam Global's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 18% per year over the next three years. That's shaping up to be materially lower than the 27% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Beam Global's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Beam Global's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Beam Global's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Beam Global, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Beam Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.