Please use a PC Browser to access Register-Tadawul

Texas Instruments (NasdaqGS:TXN) Drops 14% In A Week As Geopolitical Tensions Weigh On Markets

Texas Instruments Incorporated TXN | 172.27 172.27 | +4.00% 0.00% Post |

Texas Instruments (NasdaqGS:TXN) recently launched new power-management chips and expanded its microcontroller portfolio, signaling a strong thrust into high-performance computing and personal electronics markets. Despite these advancements, the company's share price declined by 14% over the past week. This downturn aligns with a broader market decline, as geopolitical tensions, particularly U.S.-China trade tariffs, drove significant sell-offs across major indices. The Nasdaq witnessed a 10% drop, entering bear market territory. Overall, Texas Instruments' share performance appears to be overwhelmingly influenced by the wider market sentiment and trade anxieties rather than its product announcements.

Over the past five years, Texas Instruments has delivered a total return of 61.59%, showcasing the company's efforts to enhance value through strategic initiatives. A pivotal influence on this performance has been the expansion of its manufacturing capabilities, backed by $1.6 billion from the CHIPS Act. This move optimizes production efficiency to meet rising demand in critical sectors such as industrial and automotive. Additionally, a robust dividend growth strategy, with 21 consecutive years of increases, underscores strong cash flow management and commitment to shareholder value.

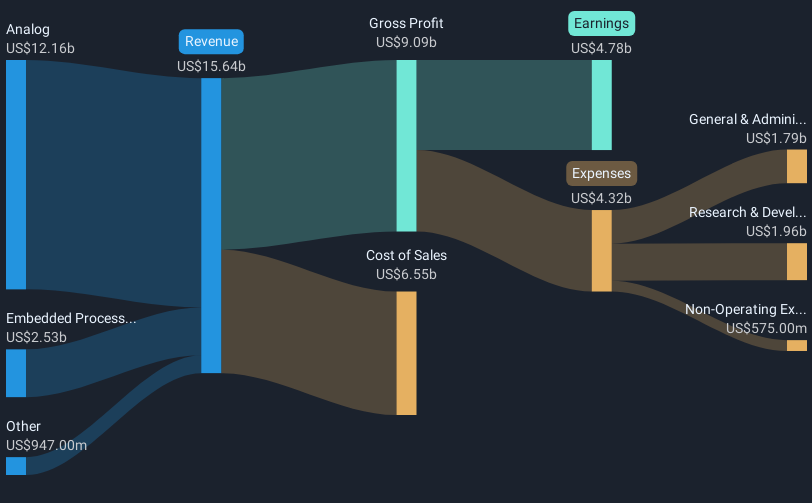

In recent times, Texas Instruments has faced considerable market headwinds, including a 26.3% decline in earnings over the last year, driven by reduced sales and profitability challenges. Despite these setbacks, the company has shown resilience by successfully completing a $6.75 billion buyback program, enhancing shareholder returns. Recent product launches, especially in the automotive and data center markets, highlight Texas Instruments' continuous innovation, although broader market dynamics have constrained short-term results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.