Tesla Is Navigating Free FSD Trials, Gigafactory Challenges, and Governance Hurdles: Analyst

Meet Kevin Pricing Power ETF PP | 26.01 | +2.26% |

Tesla Motors, Inc. TSLA | 421.06 | -3.46% |

Vanguard World Fds Vanguard Consumer Discretionary ETF VCR | 383.28 | +0.68% |

RBC Capital Markets analyst Tom Narayan maintained an Outperform rating on Tesla Inc (NASDAQ:TSLA) with a price target of $298.

The fourth quarter of fiscal 2023 saw a demand-pull forward from the IRA expiry of particular Model 3s, and that likely negatively impacted the first quarter of 2024, as per the analyst.

The analyst flagged the Red Sea disruption in January and the arson attack in February, hampering the Berlin gigafactory operations.

Narayan expects the company’s decision to give one month of free trials of FSD in the U.S. will help drive higher volumes in the second quarter.

Higher FSD attach rates are also central to his investment thesis on the stock.

Narayan projects Tesla deliveries of 446,000 in the first quarter of 2024, down 10.7% vs. his prior estimate of 500k and 3.3% below consensus, based on registration data and app downloads. He expects Tesla to report deliveries during the first week of April.

Narayan projects first-quarter revenue and adj EPS of $25.71 billion and $0.80.

HSBC analyst Michael Tyndall retained a Reduced rating and price target of $143.

The analyst reduced his forecasts due to deeper-than-expected Tesla price cuts, doubting the market’s desire for continued devaluation despite cost improvements.

He said that Tesla’s rapid depreciation and decisions by professional buyers like Sixt and Hertz to cut their fleets highlight concerns over using price cuts for durable consumer goods.

Per the analyst, pre-revenue opportunities for Tesla, such as Dojo, appear more distant amid challenges in gaining regulatory and social approval for autonomous vehicles.

A Delaware court voided CEO Elon Musk’s share option package, leading him to propose relocating Tesla’s incorporation to Texas for a new pay agreement, raising governance and future leadership concerns, Tyndall added.

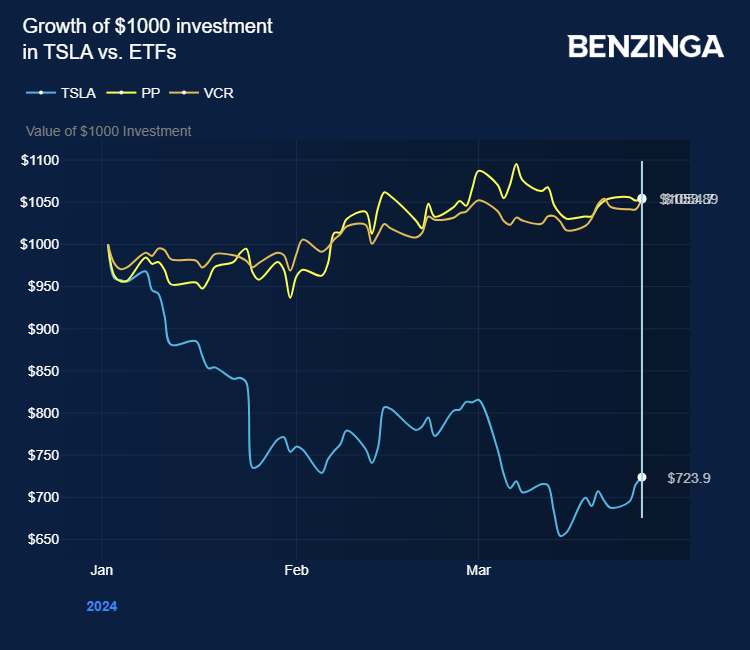

The stock price has plunged over 28% year-to-date. Investors can gain exposure to the Tesla stock via Tidal ETF Trust II The Meet Kevin Pricing Power ETF (NYSE:PP), and Vanguard Consumer Discretion ETF (NYSE:VCR).

Price Action: TSLA shares traded lower by 1.56% at $177.03 on the last check Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Tesla CEO Elon Musk. Photo via Shutterstock