Take Care Before Jumping Onto Evolent Health, Inc. (NYSE:EVH) Even Though It's 49% Cheaper

Evolent Health Inc Class A EVH | 11.16 | -0.98% |

Evolent Health, Inc. (NYSE:EVH) shareholders that were waiting for something to happen have been dealt a blow with a 49% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

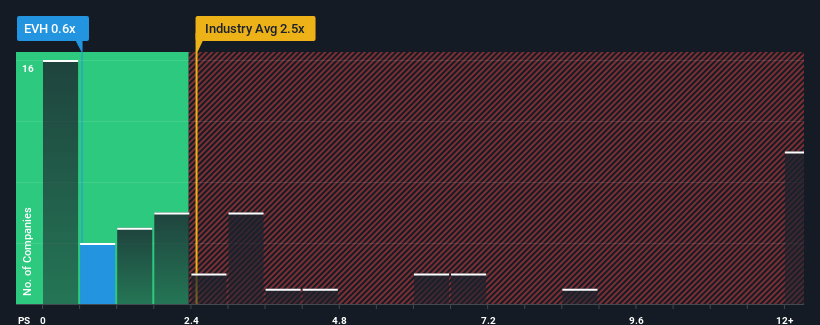

Following the heavy fall in price, Evolent Health may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Evolent Health's Recent Performance Look Like?

Recent times have been advantageous for Evolent Health as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Evolent Health will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Evolent Health?

Evolent Health's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. The latest three year period has also seen an excellent 172% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 11% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Evolent Health's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The southerly movements of Evolent Health's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Evolent Health's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If you're unsure about the strength of Evolent Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.