Please use a PC Browser to access Register-Tadawul

Take Care Before Jumping Onto Corsair Gaming, Inc. (NASDAQ:CRSR) Even Though It's 33% Cheaper

Corsair Gaming CRSR | 0.00 |

Corsair Gaming, Inc. (NASDAQ:CRSR) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

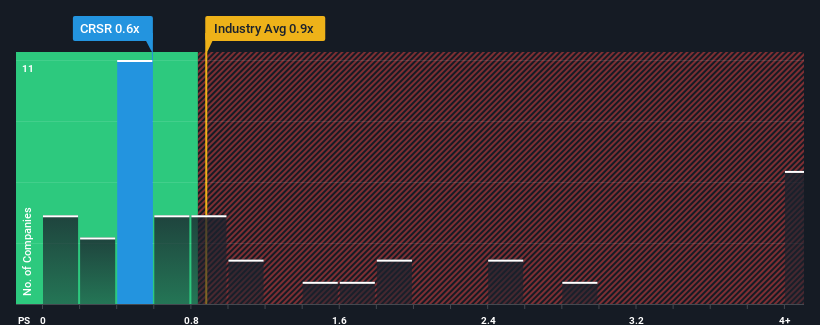

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Corsair Gaming's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Tech industry in the United States is also close to 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Corsair Gaming's P/S Mean For Shareholders?

Corsair Gaming hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Corsair Gaming's future stacks up against the industry? In that case, our free report is a great place to start .How Is Corsair Gaming's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Corsair Gaming's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.8%. The last three years don't look nice either as the company has shrunk revenue by 31% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.2% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Corsair Gaming's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Corsair Gaming's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Corsair Gaming looks to be in line with the rest of the Tech industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Corsair Gaming currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.