Super Micro Computer Shares Soar 32% As It Avoids Getting Booted Off Nasdaq, But Analysts Are Not Convinced: Here's What's Coming Next For SMCI

Super Micro Computer, Inc. SMCI | 41.81 41.60 | +3.98% -0.50% Post |

Shares of Super Micro Computer Inc (NASDAQ:SMCI) closed 31.24% higher in trade on Tuesday at $28.27 apiece. This happened after it announced the appointment of BDO USA as its Independent Auditor and also filed a compliance plan with Nasdaq, according to its press release.

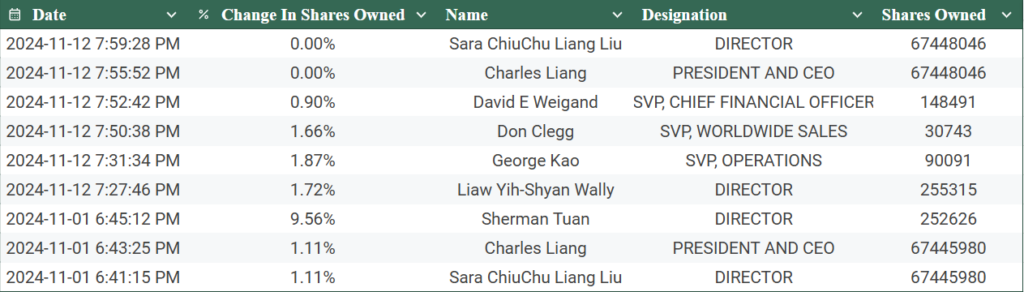

The aforementioned update has prevented the company shares from being delisted from Nasdaq, however, company insiders loaded up on the shares of SMCI before this update. Furthermore, despite the rise in shares, analysts tracking the company have mostly downgraded the stock.

What Happened: Super Micro Computer shares have waded through a flurry in 2024 since it has been riddled with several troubles. It missed filing the Form 10-K with the SEC, the annual financial report for the company’s year ending June 30.

It was followed by the release of the short-seller Hindenburg’s report on Aug. 27 stating that the company was involved in accounting manipulation along with the allegations of self-dealing and evading sanctions.

Ernst & Young resigned as the auditor of the company on Oct. 30 and it delayed filing the Form 10-Q with the SEC for the first quarter of fiscal 2025, ending Sept. 30.

Also read: Why Super Micro’s Future May Hinge On Nvidia Earnings, Nasdaq Deadline

Why It Matters: The stock was nearly 64% up at $28.27 per share from its 52-week low of $17.25 apiece. But still down 77% from its 52-week high at $122.90 apiece. On a year-to-date basis, the stock was down by nearly 1%.

The relative strength index at 45.26 implies that the stock is not overbought or oversold. The recent trade by company insiders, as per Benzinga Pro shows that they bought the stocks before announcing the appointment of the new Independent Auditor between Nov. 1 to Nov. 12.

Analyst Snapshot

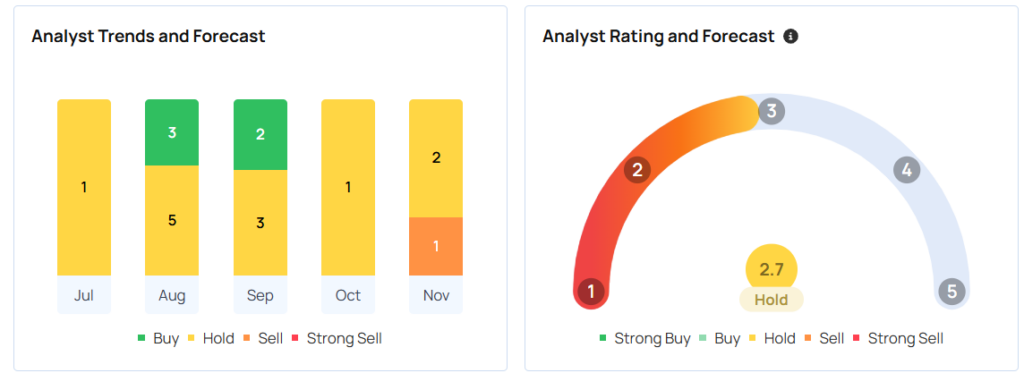

Many brokerages have lowered their ratings and target prices on SMCI. According to MarketBeat, Bank of America downgraded it to a ‘neutral’ rating and decreased their target price to $70.00 per share and Rosenblatt Securities reissued a ‘buy’ rating and set a $130.00 target price, in August.

Barclays lowered their price to $42.00 apiece and set an ‘equal weight’ rating in October. JPMorgan Chase & Co. lowered a “neutral” rating to an “underweight” and set a price target of $23.00 per share in November.

According to Benzinga Pro, based on an average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there’s an implied -2.65% downside for Super Micro Computer Inc. from these most recent analyst ratings. The consensus rating forecast on Benzinga, suggests a score of 2.7 out of 5 points, which implies holding the stock.

Read next: Palantir Board Member In A Deleted X Post Said Nasdaq Move Will ‘Force Billions In ETF Buying And Deliver Tendies’: Here’s What This Meme-Stock Term Means

Image via Shutterstock