Please use a PC Browser to access Register-Tadawul

Stocks to Watch | Nvidia’s Stock Rebound: How to Use Options Strategies Effortlessly?

NVIDIA Corporation NVDA | 0.00 | |

Direxion Shares ETF Trust Direxion Daily NVDA Bear 1X Shares NVDD | 0.00 | |

GraniteShares 2x Long NVDA Daily ETF NVDL | 0.00 | |

Apple Inc. AAPL | 0.00 | |

Advanced Micro Devices, Inc. AMD | 0.00 |

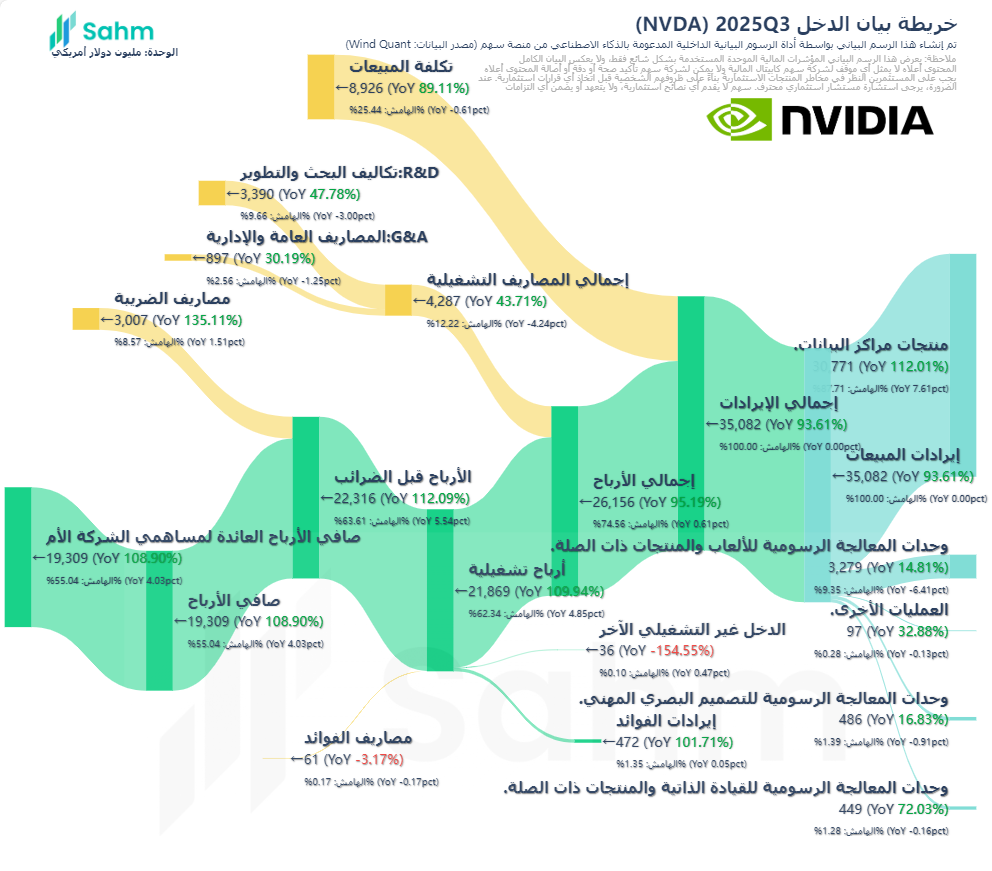

NVIDIA Corporation(NVDA.US) has solidified its position as the undisputed leader in the evolving AI landscape. In its latest earnings report, the tech giant posted a remarkable Q3 revenue of $35.82 billion, marking a year-over-year increase of 94%, while net income surged by 109% to $19.3 billion. All key business segments performed beyond expectations. Notably, NVIDIA's current valuation appears attractive compared to its industry peers.

From a technical perspective, following the earnings report, NVIDIA's stock experienced a pullback to around $131 but began a gradual rebound starting last Wednesday. This presents a re-entry opportunity for bullish investors, especially given its robust fundamentals and potential for significant earnings.

Overall, NVIDIA's stock continues to perform within an ascending channel, outpacing the S&P 500. The recent pullback could serve as a support level for increasing bullish positions. With investor confidence on the rise, NVIDIA's stock is expected to recover and potentially surpass its previous highs in the coming weeks.

NVIDIA Eyes Continued Upside Momentum

- NVIDIA: Strong Demand and Positive Outlook

Demand for NVIDIA’s Blackwell GPUs has been described as "astonishing." Forrester Research analysts emphasize that modern AI is unthinkable without NVIDIA’s GPUs. The company's superior position is attributed to two main factors:

(1) NVIDIA’s GPUs are supported by the unrivaled CUDA software development tools ecosystem;

(2) NVIDIA's GPUs consistently outperform competitors' chips in AI training and inference tasks.

With the mass production of Blackwell GPUs, NVIDIA’s revenue hit an all-time high of $35.1 billion, representing a staggering 94% increase compared to the previous year. The data center business alone generated $30.8 billion, up by 112% year-over-year, reinforcing its role as a powerful growth driver. NVIDIA's current forward P/E ratio stands at 33, indicating a premium compared to peers.

Furthermore, CEO Jensen Huang has touted the Blackwell GPU architecture as possibly the most successful product in the company’s history, and perhaps even in the history of computing overall. With sales of Blackwell GPUs expected to propel revenues next year, NVIDIA is poised to deliver market-beating returns.

- Potential Impact of Trump’s Tax Reform on NVIDIA

A proposed federal corporate tax rate cut to 15% could have significant implications for NVIDIA. While lower corporate taxes do not always guarantee broad market prosperity, they can substantially enhance corporate profit margins. Excess capital can be returned to shareholders through stock buybacks and dividends.

Should the corporate tax rate decrease, NVIDIA might ramp up its share buyback program, thereby accelerating EPS growth by reducing the number of outstanding shares. This potential tax cut, therefore, could drive NVIDIA’s earnings growth beyond Wall Street estimates, boosting its stock price.

However, it's worth noting that the Trump administration might only pass the relevant legislation in Congress by 2025, with any changes effective the following year. Hence, NVIDIA would not benefit from these changes until 2026 at the earliest. That said, stock markets are forward-looking, suggesting that if investors anticipate tax reductions, it might be reflected in the stock price as early as next year.

Bullish Trading Strategy

To leverage Nvidia's strong fundamentals and technical support levels, consider buying a vertical call spread with strike prices of $136/$156 expiring on January 17, 2025.

Specifically, buy the Nvidia $136 call option NVDA 170125 C 136 and sell the Nvidia $156 call option NVDA 170125 C 156, both expiring on January 17, 2025.

Traders will incur an approximate cost of $781. This strategy allows potential profit if Nvidia's stock price exceeds $143.94 at expiration, with maximum profit realized if the stock price closes above $156. This approach provides a favorable way to participate in Nvidia's anticipated upside while limiting downside risk.

Position Details | |

|---|---|

| Buy Call Option 1 | NVDA 170125 C 136 |

| Sell Call Option 2 | NVDA 170125 C 156 |

| Underlying Stock | Nvidia |

| Strike Prices- Call Option 1 | $136 |

| Strike Prices- Call Option 2 | $156 |

| Contract Quantity | Equal amounts |

| Expiration Date | January 17, 2025 |

The potential profit and loss, as well as the breakeven point for this strategy, are as follows:

- Maximum Loss: $781

- Maximum Gain: $1,219

- Breakeven Point: $143.94

Risk Warning: Risk of technological breakthroughs falling short of expectations; risk associated with the macroeconomic environment; industry competition risk; regulatory and compliance risk; risk of production capacity falling short of expectations; risk of new product development falling short of expectations.

Finally, it is critical to note that while options are flexible and useful, options trading involves higher complexity and risk than trading the underlying stock. Caution is advised when entering the market.