Please use a PC Browser to access Register-Tadawul

Stocks to Watch | AI Cooling Tech Heats Up - Vertiv, the Sector Leader, Surges up to 8X Since 2022, Other Players Also See Robust Gains

VERTIV HOLDINGS LLC VRT | 94.06 | -1.75% |

NVIDIA Corporation NVDA | 116.65 | -0.61% |

Dell Technologies Inc. DELL | 95.91 | -0.32% |

Micron Technology, Inc. MU | 85.86 | +0.83% |

The rapid proliferation of artificial intelligence (AI) is driving increased energy consumption in data centers, leading to a surge in heat generation and presenting opportunities for companies specializing in server cooling solutions. We have compiled key points for investors to consider and discuss.

Key Insights:

- Energy Surge: According to the International Energy Agency, U.S. data centers' electricity consumption is projected to increase by approximately 30% from 2022 to 2026, reaching 260 terawatt-hours—about 6% of the total U.S. electricity demand, equivalent to the yearly usage of 24 million households.

- Market Leaders: Ohio-based VERTIV HOLDINGS LLC(VRT.US), which manufactures power and cooling equipment for data centers, has seen its stock price soar nearly 700% since the end of 2022. The company reported a 60% year-over-year increase in orders last quarter and a record backlog of $6.3 billion as of March.

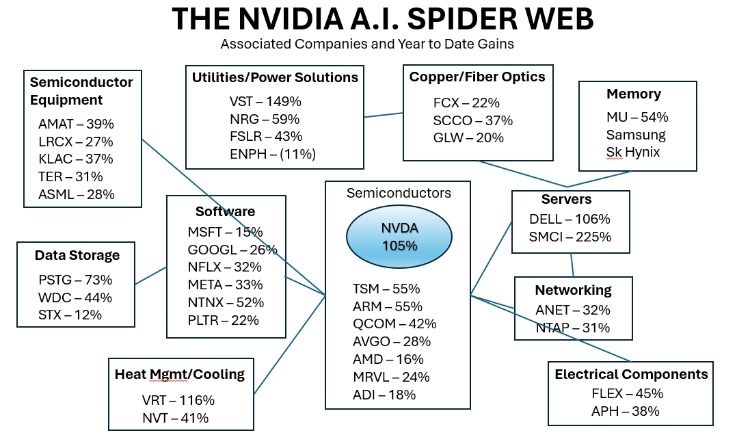

In fact, as illustrated in the chart below, even when compared alongside other U.S. AI-focused stocks centered around NVIDIA Corporation(NVDA.US), Vertiv's year-to-date gains secure its place firmly among the top three performers. The "thermal management/cooling" theme appears to hold its ground just as robustly against a host of other AI-related stocks.

- Cooling Market Expansion: Goldman Sachs forecasts that the server cooling market will grow from $4.1 billion in 2023 to $10.6 billion by 2026, with liquid cooling becoming increasingly popular. By 2026, it is expected that liquid cooling will penetrate 57% of AI servers, up from 23% this year.

- Global Trend: Asian manufacturers are also benefiting, with firms such as AVC and Auras Technology seeing stock gains of 600% and 510%, respectively, since late 2022. Faced with surging demand, these companies are expanding their production capacities.

- Valuation Caution: Despite the robust growth, some industry experts caution that the high stock prices of cooling system suppliers might already reflect future growth potential, advising investors to remain cautious regarding this emerging sector.

With AI continuing to heat up, the race is on to develop efficient cooling solutions, presenting significant opportunities and challenges for the industry.