Stocks to Watch | 7x, 4x, 3x Big Gainers! AI Software Stocks Hit Peak—Where’s the Next Opportunity?

NVIDIA Corporation NVDA | 134.70 | +3.08% |

Amazon.com, Inc. AMZN | 224.92 | +0.73% |

Alphabet Inc. Class C GOOG | 192.96 | +1.72% |

Microsoft Corporation MSFT | 436.60 | -0.10% |

Meta Platforms META | 585.25 | -1.73% |

The year 2024 stands out in the AI investment boom, with companies like NVIDIA Corporation(NVDA.US) dominating the AI GPU market and consistently exceeding earnings expectations. Tech giants, including Amazon.com, Inc.(AMZN.US), Alphabet Inc. Class C(GOOG.US), Microsoft Corporation(MSFT.US), and Meta Platforms(META.US), are ramping up data center investments.

Investor enthusiasm for AI has peaked as improvements in model performance and applications drive a shift in focus from semiconductor firms to software companies.

The application demand for AI is robust, leading to an explosive performance of software stocks and a collective surge in stock prices.

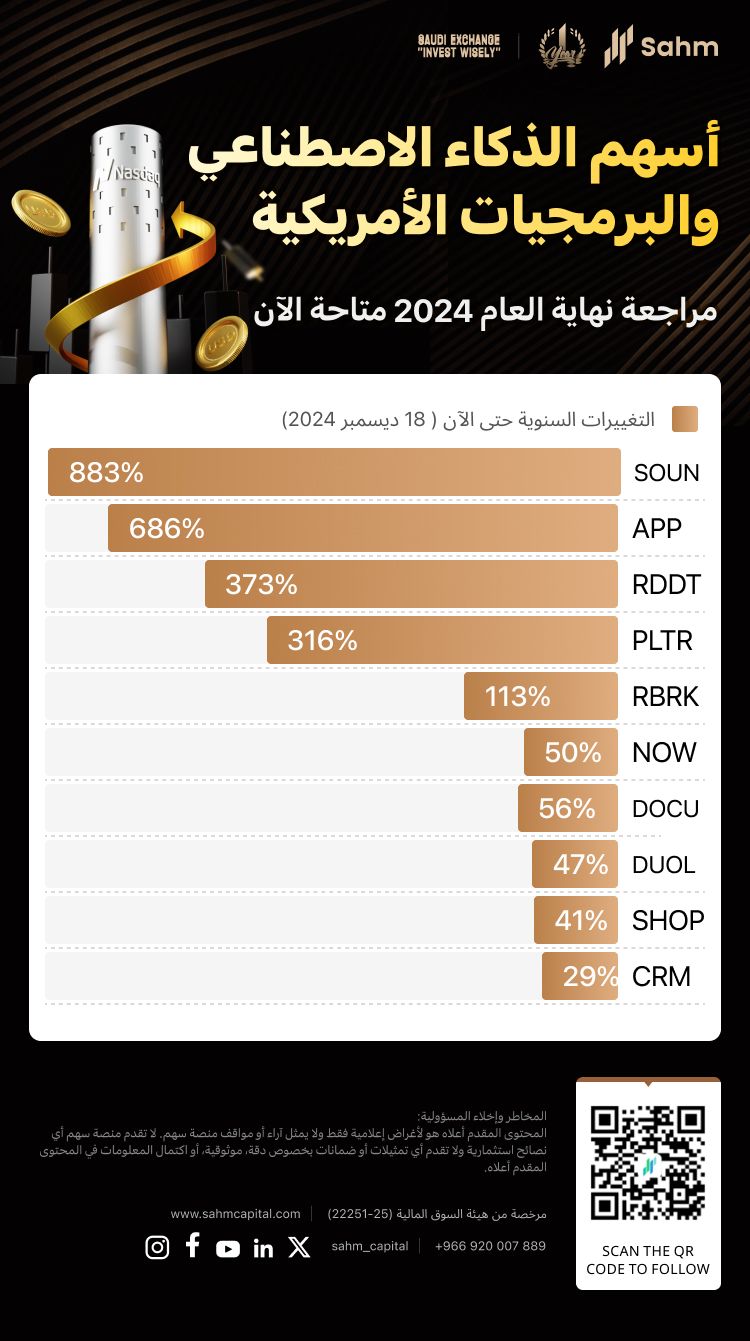

Since the beginning of the year, many software companies have shown strong momentum in their product offerings, thanks to AI revenue data and notable performance forecasts. Among them, application software companies that view AI as a new growth engine, such as AppLovin Corporation(APP.US), SoundHound AI(SOUN.US), Reddit(RDDT.US), Palantir Technologies(PLTR.US), have seen respective increases in their stock prices this year.

Strong AI Demand Boosts Software Stocks

Vertical software companies, particularly Palantir Technologies(PLTR.US), have exhibited robust revenue growth, with its Foundry platform boosting third-quarter earnings from 16.8% to 30%. This reflects how applications benefit from AI technology, with increased demand leading to solid performance gains.

In media and entertainment, AI personalization has enhanced user engagement and ad revenues for firms like Netflix, Inc.(NFLX.US), Alphabet Inc. Class C(GOOG.US), and Meta Platforms(META.US). Cost efficiencies in production have also been achieved through AI, reducing expenses in animation, visual effects, and production times. Notably, large media companies have seen a faster revenue rise in Q3, with Reddit jumping from 20% to 68% and AppLovin from 21% to 39%.

| Stock Name | Business Highlights | Financial Highlights | Year-to-Date Gain |

|---|---|---|---|

| SoundHound AI(SOUN.US) | AI + Cutting-edge Voice: Launches in-car AI voice assistant supported by NVIDIA's technology. Recently deployed AI-driven ordering services at Torchy’s Tacos, a Mexican restaurant chain. | Q3 revenue grew 89% YoY; 2025 revenue projected between $155M and $175M. Management emphasizes the critical role and potential of voice in generative AI applications. | +883% |

| AppLovin Corporation(APP.US) | AI + Advertising: Utilizes AI algorithms to significantly enhance ad efficiency for advertisers and app developers. Boasts 1.4 billion daily active users and deep integration with MAX mediation. | Q3 revenue approximately $1.198 billion, up 39% YoY; net profit surged 300% YoY to $434 million. | +686% |

| Reddit(RDDT.US) | AI + Social: Introduced AI-powered search tool "Reddit Answers." Partnered with Google to license content and data for training large AI models and optimizing Google Search. | Q3 revenue reached $348.4 million, up 67.9% YoY, turning profitable. | +373% |

| Palantir Technologies(PLTR.US) | AI + Data Analytics: Rapid adoption of its AI platform (AIP) allows enterprises to integrate large language models and generative AI into operations. | Q3 revenue grew 30% YoY to $726 million; AIP significantly boosted growth, particularly in the U.S. commercial market. | +316% |

| Rubrik Inc.(RBRK.US) | AI + Data Security: Combines data recovery with AI and integrates with multi-cloud service providers; offers DSPM and recovery capabilities. | Q3 revenue grew 43% YoY; 2,085 customers with subscriptions over $100,000, up 32% YoY. | +113% |

| ServiceNow, Inc.(NOW.US) | AI + Cloud Services: Incorporates generative AI into products and develops native "AI Agents" with NVIDIA. | Generative AI drove Q3 subscription revenue growth by 23% YoY to $2.715 billion. | +50% |

| DOCUSIGN INC(DOCU.US) | AI + Cloud E-signature: Automates data workflows and enhances contract management through AI features; launched the new DocuSign Transactions platform. | Multiple quarters of EPS exceeding expectations; strong product innovation, customer growth, and financial performance. Free cash flow more than doubled YoY in the latest quarter. | +56% |

| Duolingo, Inc.(DUOL.US) | AI + Education: Collaborates with OpenAI to offer Duolingo Max subscription and develops the Birdbrain model to optimize teaching alongside OpenAI models. | Q3 revenue grew 40% YoY, with significant increases in monthly active users, daily active users, and total paid subscribers. | +47% |

| Shopify, Inc. Class A(SHOP.US) | AI + E-commerce: Provides tools for businesses from website creation to product shipping; launched AI assistant Sidekick. | Sixth consecutive quarter of revenue growth exceeding 25%; Q3 GMV reached $69.7 billion, up 24% YoY. | +41% |

| Salesforce.com, inc.(CRM.US) | AI + CRM: Introduced platforms like Agentforce to create autonomous AI agents; signed numerous enterprise-level deals related to Agentforce. | Latest quarter revenue grew 8.3% YoY to $9.44 billion, with AI applications contributing to growth. | +29% |

Date of data: 19 December 2024

Next AI Investment Opportunities by 2025

AI is advancing in two key areas:

- Generative AI Applications (e.g., ChatGPT, Sora, Claude).

- AI Agents (e.g., Salesforce's Agentforce, Microsoft's Dynamics 365 AI Agent).

These trends signal a transformative shift, with enterprise adoption expected to accelerate through 2025.

Key Growth Areas

Analysts highlight B2B sectors as leading AI development, particularly in:

- AI Advertising: Applovin's Axon 2.0 system has driven over 35% revenue growth for four consecutive quarters, with significant potential in e-commerce.

- AI Assistants: Tools like Salesforce’s Agentforce improve enterprise efficiency, while companies like SAP and Workday benefit in finance, HR, and supply chain management.

- AI Data Analytics: Companies like Palantir and Snowflake show strong growth as AI enhances data visualization and management.

B2B vs. B2C Potential

- Short-term: B2B solutions deliver faster ROI and adoption.

- Long-term: B2C offers greater scalability in areas like video, gaming, and search.

Wall Street’s View

AI Agent technologies are seen as game-changers, driving innovation and productivity across industries. Bank of America outlines three growth phases:

- Chipmakers and Cloud Services: Expanding beyond NVIDIA to broader semiconductor and telecom sectors.

- AI Software Developers: Companies creating applications and data center components.

- Industry Integrators: Media, retail, and biopharma adopting AI solutions.

Key Takeaways

As AI adoption expands across B2B and B2C sectors, BofA foresees market attention shifting to second-tier beneficiaries of AI growth, particularly software companies focusing on generative AI and AI Agents. These developments are expected to reshape industries and drive substantial market opportunities by 2025.