Please use a PC Browser to access Register-Tadawul

Stocks to Watch | 13 Firms Nvidia Has Recently Invested In and Collaborated With

NVIDIA Corporation NVDA | 0.00 | |

Applied Digital APLD | 0.00 | |

Dell Technologies Inc. DELL | 0.00 | |

Goldman Sachs Group, Inc. GS | 0.00 | |

JPMorgan Chase & Co. JPM | 0.00 |

NVIDIA Corporation(NVDA.US) has undoubtedly cemented its position as a standout performer in the U.S. stock market. Beyond its internal successes, the companies and sectors Nvidia invests in or collaborates with often become hot spots for market excitement. The sentiment in the market suggests that Nvidia's investment strategies often point towards the direction of industry trends, highlight critical areas of AI technology application, and hint at potential technical breakthroughs.

Here is a compiled list of companies that Nvidia has invested in and recently announced collaborations with, which might be insightful for investors.

Overall, Nvidia's investment portfolio demonstrates a diversified approach, covering various sectors such as AI infrastructure, voice interaction, healthcare, robotics, and autonomous driving.

Specifically, the investments are as follows:

1. AI Data Centers - Applied Digital

Applied Digital(APLD.US), a designer, builder, and operator of next-generation digital infrastructure, operates in AI cloud services, high-performance data center hosting, and encrypted data hosting.

Last September, the AI cloud company secured $160 million in funding from investors including Nvidia, boosting its standing in the AI and HPC infrastructure market. According to the latest 13F data, Nvidia holds approximately 7.716 million shares, accounting for around a 14.70% stake. Since announcing Nvidia's investment on September 5, the company’s stock has surged by 190%.

Applied Digital focuses on data center and HPC infrastructure, GPU cloud solutions, and innovative technologies like AI and machine learning. The company has forged partnerships with major firms such as Dell Technologies Inc.(DELL.US), NVIDIA Corporation(NVDA.US), Goldman Sachs Group, Inc.(GS.US), and JPMorgan Chase & Co.(JPM.US), potentially driving net sales growth and attracting new investors.

2. AI Drug Discovery Leader - Recursion Pharmaceuticals

RECURSION PHARMACEUTICALS, INC.(RXRX.US), a technology-driven biopharmaceutical company, leverages AI and machine learning to identify new treatment targets for unmet clinical needs, accelerating drug discovery and reducing development costs. Nvidia holds around 7.7064 million shares, representing about an 11.73% stake, according to the latest 13F data. Since the company announced Nvidia’s investment on July 12, 2023, its stock price nearly doubled at its peak.

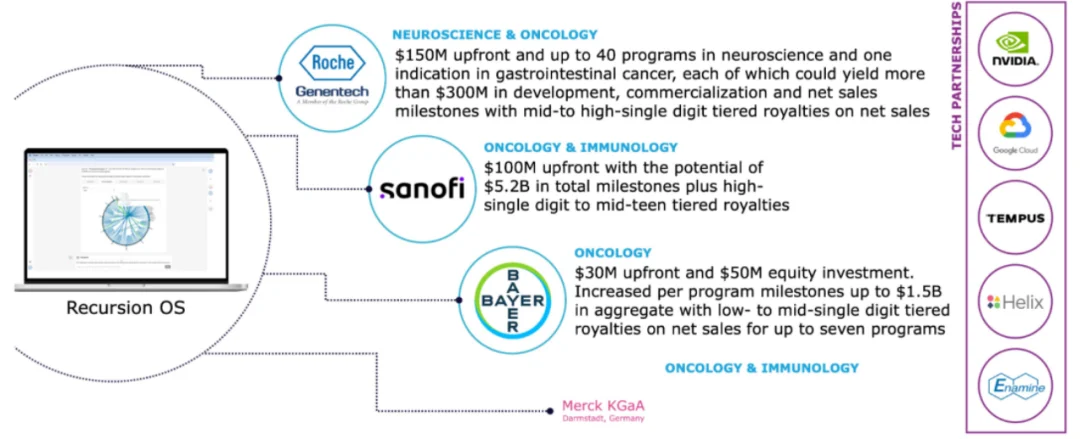

Recursion has robust partnerships with leading tech and pharmaceutical companies such as Roche (via Genentech), Nvidia, Bristol-Myers Squibb, Bayer, Sanofi, Merck, Google Cloud, Tempus AI, Helix, and Enamine.

Recursion reported receiving $450 million in collaboration plans by November 20, with potential milestones reaching $20 billion, excluding royalties.

3. Last-Mile Robotics - Serve Robotics

Serve Robotics Inc.(SERV.US), spun off from Uber in 2021, focuses on providing last-mile delivery robots for Uber's food delivery platform. Uber remains its largest shareholder and customer. The company constitutes about 7% of Nvidia’s investment portfolio, according to the latest 13F file. Since July 19, the stock price has increased by 608% since Nvidia's investment disclosure.

Serve Robotics’ sidewalk delivery robots possess "L4" autonomy, originally set as a standard for self-driving cars by the Society of Automotive Engineers (SAE). Achieving L4 means vehicles can operate fully autonomously under specific conditions or regions without human intervention. Through collaboration with Serve Robotics, Uber Technologies,Inc.(UBER.US) and NVIDIA Corporation(NVDA.US) are exploring the feasibility of large-scale commercial automated delivery robots. Interestingly, these delivery robots are also popular with advertisers.

4. AI Voice Company - SoundHound AI

SoundHound AI(SOUN.US), starting with AI voice assistants, differentiates itself from traditional AI speech comprehension by directly understanding voice meanings, and enhancing speed and accuracy. SoundHound AI leads in conversational intelligence, offering voice AI solutions for sectors like automotive, TVs, and IoT. The company hit a revenue record in Q3 and foresees doubling earnings by 2025 to $155 million-$175 million, from an expected $84 million in 2024.

Nvidia holds 1.7308 million shares, around 1.86% of its portfolio. Nvidia first invested in SoundHound AI in 2017 during a $75 million round to aid international growth. Since Nvidia’s holdings were revealed in February last year, SoundHound AI's stock has increased over sevenfold.

5. Medical Imaging Company Nano X Imaging

Nano-X Imaging Ltd.(NNOX.US), an Israeli medical imaging technology company, developed the first commercial-grade multi-source digital imaging system, Nanox.ARC, for realistic medical imaging applications, aims to democratize CT scans. The company's Nanox.AI platform uses AI to identify early signs of asymptomatic chronic diseases for early diagnosis and preventive management.

Nvidia holds a modest 59,362 shares in Nanox, valued at approximately $360,000, making up about 0.08% of its portfolio.

6. AI Infrastructure Company - Nebius

Nebius Group N.V. Ordinary Shares - Class A(NBIS.US), a cloud computing and AI infrastructure service provider, announced a $700 million funding round on December 2, 2024. Investors included Accel, Nvidia, and Orbis Investments. The funds will help build large-scale GPU clusters, expand cloud platforms, and provide more tools and services for global AI development.

Nebius Group was previously "Yandex NV," with its major subsidiary Yandex, known as the "Russian Google." Yandex’s business spans search, advertising, e-commerce, ride-hailing, cloud computing, data labeling, and autonomous driving. In July last year, Yandex sold its Russian business for $5.4 billion to a consortium amid the Russia-Ukraine conflict.

7. Chip Giant - Arm Holdings

Nvidia’s largest investment is in the UK-based chip design company Arm Holdings Ltd.(ARM.US), owning 1.96 million shares, which is 65% of Nvidia’s total holdings. Previously, Nvidia attempted to acquire Arm for $40 billion from SoftBank. However, the deal faced opposition from U.S. and UK regulators and failed in February 2022, prompting SoftBank to push for Arm's public listing.

Nvidia's recent collaborations:

1. Automotive AI Technology Company - Cerence

On January 3rd Eastern Time, CERENCE INC(CRNC.US), a US-based automotive AI voice technology company, announced a deeper collaboration with Nvidia to enhance the performance of its in-car language models. The company's stock surged over 154% in two days.

In the automotive AI market, Cerence's main competitors include SoundHound AI(SOUN.US) and Nuance. These companies also provide voice assistants and intelligent interaction technologies.

Analysts suggest that with Nvidia's technological support, Cerence is likely to reduce R&D costs and accelerate the pace of launching new products and features. For a company with a market value of only $334 million, an alliance with an industry giant like Nvidia undoubtedly adds significant credibility and technical strength. Furthermore, Nvidia's AI infrastructure is industry-leading, allowing Cerence to leverage these resources directly to develop more powerful language models and in-car systems.

2. Perception Radar Related Stock - Arbe Robotics

Arbe Robotics Ltd Ordinary Shares(ARBE.US) announced a collaboration with Nvidia to enhance its free space mapping and AI-based capabilities and will showcase its "revolutionary ultra-high-resolution radar" at this week's Consumer Electronics Show (CES). The company's stock soared over 52% on Monday.

Arbe Robotics is a leading provider of 4D imaging radar solutions, with radar technology that is 100 times more detailed than other radars on the market, serving as a critical sensor for L2+ and higher-level autonomous driving.

The company highlights that the core of its technological innovation lies in AI-based processing capabilities. Arbe claims that their radar technology is "100 times more detailed than any other radar on the market." Arbe's high-resolution radar is integrated with Nvidia's in-car computing platform DRIVE AGX, creating hands-off driving and real-time safety features.

3. Autonomous Driving Technology Leader - Aurora Innovation

Yesterday, Nvidia announced a partnership with Aurora Innovation, Inc. - Class A Common Stock(AUR.US) and Continental to deploy autonomous trucks on a large scale. Nvidia's Drive Thor and DriveOS will be integrated into the autonomous system Aurora Driver, with Continental planning to mass-produce this system by 2027.

According to public information, Aurora Innovation is a leading company in the autonomous driving technology field. Its co-founders include Chris Urmson, former CTO of Google's self-driving team (later renamed Waymo), Sterling Anderson, former head of Tesla's Autopilot, and Drew Bagnell, former head of Uber’s autonomous driving and perception team, focusing on developing technology for passenger cars and trucks.

4. Automotive Giant - Toyota Motor

Yesterday, NVIDIA Corporation(NVDA.US) announced that it will collaborate with Toyota Motor Corp. Sponsored ADR(TM.US) to develop the next generation of self-driving cars. Toyota's next-gen vehicles will be equipped with Nvidia's on-board supercomputer system Drive AGX Orin and the autonomous driving platform operating system DriveOS.

5. Chip Giant - Micron Technology

Yesterday, Nvidia released the new GeForce RTX 50 series Blackwell architecture GPU, with Micron Technology, Inc.(MU.US) providing the memory for the new GPU. The company's stock rose over 2% yesterday despite market trends.

6. Inetvisionz Com Inc Com

Inetvisionz Com Inc Com(INVZ.US) announced a collaboration with Nvidia, showcasing cutting-edge perception software using the Nvidia Drive AGX Orin at CES 2025, and introduced new software-driven features. The company's stock rose over 10% yesterday.