Please use a PC Browser to access Register-Tadawul

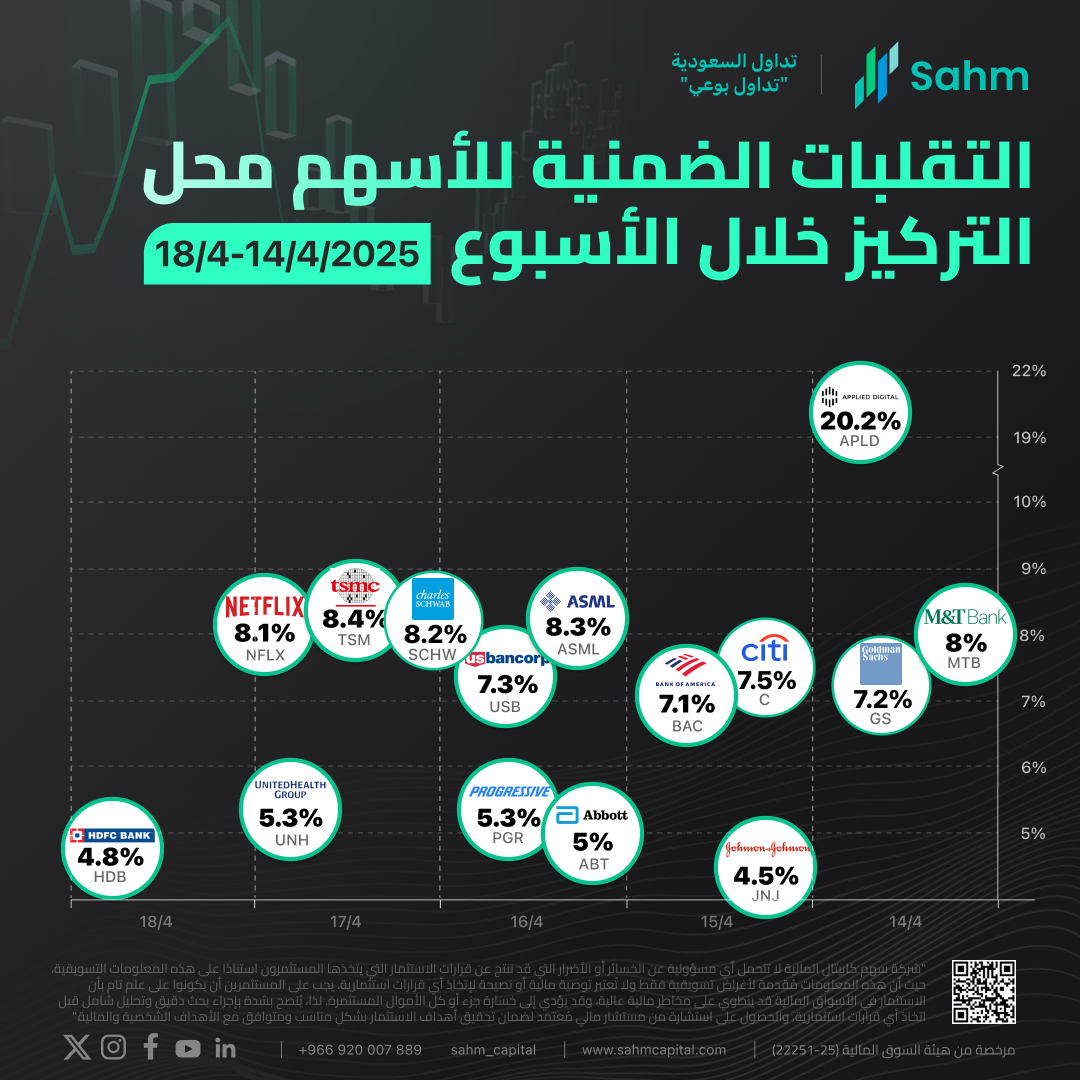

Stock Volatility Alert | APLD(20.2%), TSM(8.4%) And ASML(8.3%): Top Potential Volatility in Options to Watch This Week

Goldman Sachs Group, Inc. GS | 529.31 530.05 | +1.79% +0.14% Post |

Bank of America Corporation BAC | 38.75 38.75 | +1.12% 0.00% Post |

Citigroup Inc. C | 66.30 66.45 | +2.71% +0.23% Post |

Netflix, Inc. NFLX | 1049.59 1049.59 | +0.89% 0.00% Post |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 157.81 157.56 | +4.23% -0.16% Post |

This column is updated every Monday, featuring options volatility data for key earnings stocks in the upcoming week.

Option Volatility And Earnings Report For April 14- April 18

Against a backdrop of significant fluctuations in the US stock market, rising US bond yields, a weakening dollar, and Trump's tariff policies, investors this week will be looking for any clues about rate cuts in a barrage of speeches from Fed policy makers.

The upcoming week's US earnings season will present another challenge for investors. Major US banks, including Goldman Sachs Group, Inc.(GS.US) , Bank of America Corporation(BAC.US) , and Citigroup Inc.(C.US) , will release their earnings; tech stocks will also kick off their earnings season, with Netflix, Inc.(NFLX.US) 's report potentially setting the tone for growth stocks. Additionally, earnings from chip stocks like Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) and ASML Holding NV ADR(ASML.US) will be released.

Earnings reports often lead to heightened implied volatility in options due to market uncertainty, driving up demand and prices for options. However, implied volatility typically drops back to normal levels after the earnings announcement.

To estimate a stock's expected price range around earnings, traders can use the option chain by adding the prices of the at-the-money put and call options for the first expiry date after the earnings report. While this method provides a rough estimate, it is a useful tool for structuring trades.

Data as of 14/04/2025

| Day | Ticker | Potential Volatility |

|---|---|---|

| Monday | Goldman Sachs Group, Inc.(GS.US) | 7.2% |

| M&T Bank Corporation(MTB.US) | 8.0% | |

| Applied Digital(APLD.US) | 20.2% | |

| Tuesday | Johnson & Johnson(JNJ.US) | 4.5% |

| Bank of America Corporation(BAC.US) | 7.1% | |

| Citigroup Inc.(C.US) | 7.5% | |

| Wednesday | ASML Holding NV ADR(ASML.US) | 8.3% |

| Abbott Laboratories(ABT.US) | 5.0% | |

| Progressive Corporation(PGR.US) | 5.3% | |

| U.S. Bancorp(USB.US) | 7.3% | |

| Thursday | Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) | 8.4% |

| UnitedHealth Group Incorporated(UNH.US) | 5.3% | |

| Charles Schwab Corporation(SCHW.US) | 8.2% | |

| Netflix, Inc.(NFLX.US) | 8.1% | |

| Friday | HDFC Bank Limited Sponsored ADR(HDB.US) | 4.8% |

- Bearish traders can consider selling bear call spreads outside the expected range.

- Bullish traders may opt for selling bull put spreads outside the expected range or explore naked puts for higher risk tolerance.

- Neutral traders can utilize iron condors, ensuring the short strikes remain outside the expected range.

When trading options during earnings, it is crucial to use risk-defined strategies and maintain small position sizes. This ensures that even if a trade suffers a full loss due to an unexpected stock move, the impact on the overall portfolio remains limited to 1-3%.

Details on Options Strategies, Follow Here:

Disclaimer: This column is solely for information organization and sharing. All materials and data are sourced from publicly available markets and should not be used as a basis for investment decisions.