Please use a PC Browser to access Register-Tadawul

Spotlight on UnitedHealth Group: Analyzing the Surge in Options Activity

UnitedHealth Group Incorporated UNH | 420.00 422.00 | +0.32% +0.48% Pre |

Financial giants have made a conspicuous bearish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 16 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 56% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $849,612, and 9 were calls, valued at $354,957.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $460.0 to $620.0 for UnitedHealth Group over the recent three months.

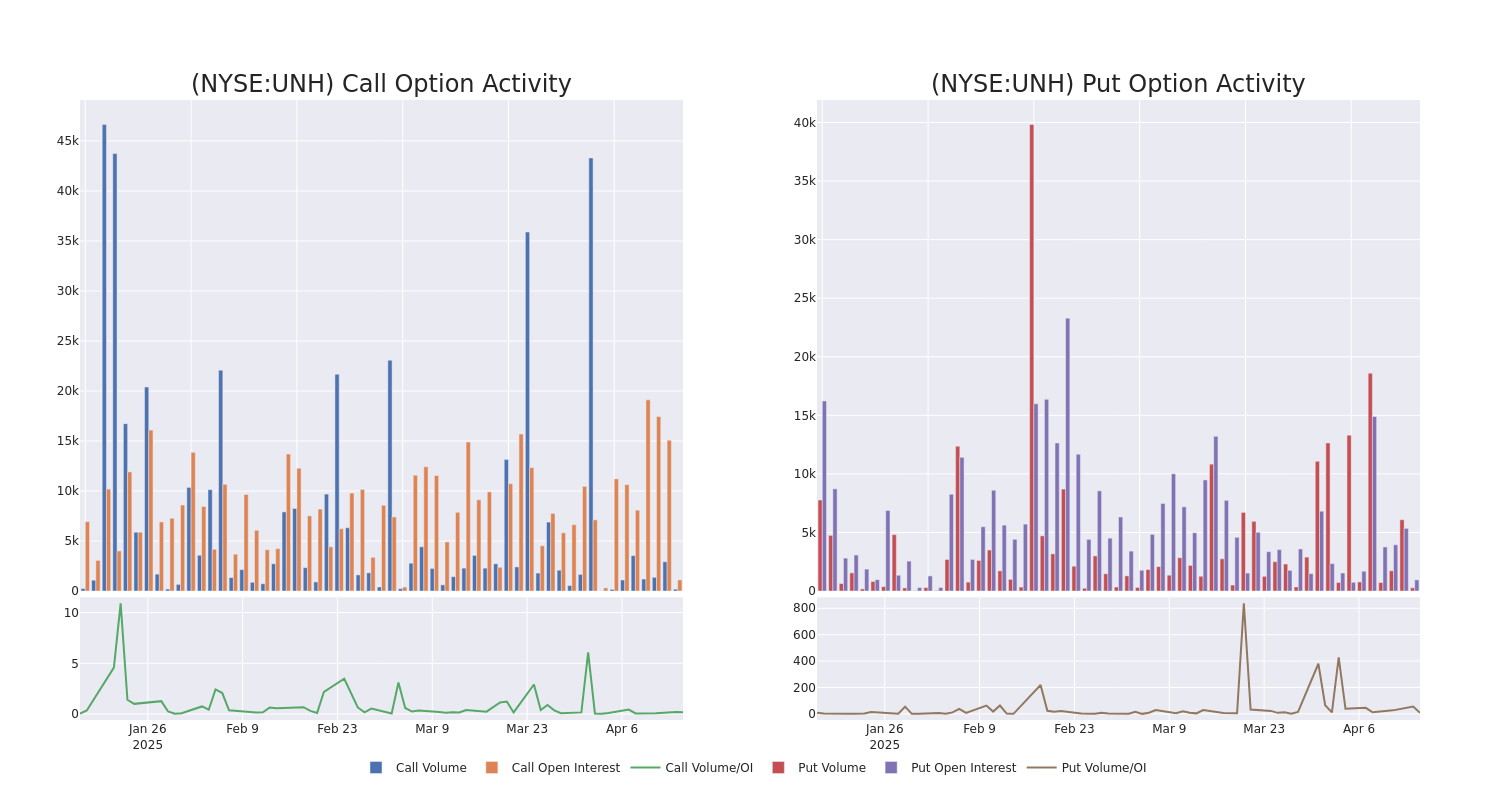

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for UnitedHealth Group options trades today is 147.79 with a total volume of 450.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for UnitedHealth Group's big money trades within a strike price range of $460.0 to $620.0 over the last 30 days.

UnitedHealth Group Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | PUT | SWEEP | BEARISH | 05/16/25 | $42.85 | $38.5 | $40.0 | $620.00 | $408.0K | 16 | 102 |

| UNH | PUT | SWEEP | BEARISH | 06/20/25 | $10.25 | $9.2 | $9.62 | $530.00 | $281.0K | 501 | 5 |

| UNH | CALL | SWEEP | NEUTRAL | 04/17/25 | $127.85 | $120.4 | $124.18 | $460.00 | $62.0K | 134 | 5 |

| UNH | PUT | SWEEP | BULLISH | 04/17/25 | $11.05 | $10.85 | $10.85 | $582.50 | $54.1K | 94 | 96 |

| UNH | CALL | TRADE | BULLISH | 12/19/25 | $50.4 | $48.8 | $49.8 | $600.00 | $49.8K | 254 | 10 |

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers and provides medical benefits to about 51 million members globally, including 1 million outside the US as of December 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in medical insurance. Along with its insurance assets, UnitedHealth's Optum franchises help create a healthcare services colossus that spans everything from pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of UnitedHealth Group

- Trading volume stands at 1,034,481, with UNH's price down by -0.36%, positioned at $584.92.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 2 days.

Professional Analyst Ratings for UnitedHealth Group

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $655.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Truist Securities has decided to maintain their Buy rating on UnitedHealth Group, which currently sits at a price target of $660. * Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for UnitedHealth Group, targeting a price of $650.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for UnitedHealth Group, Benzinga Pro gives you real-time options trades alerts.