Smart Money Is Betting Big In CVNA Options

Carvana Co. Class A CVNA | 223.68 | -0.09% |

Deep-pocketed investors have adopted a bullish approach towards Carvana (NYSE:CVNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Carvana. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 40% bearish. Among these notable options, 5 are puts, totaling $295,000, and 5 are calls, amounting to $205,854.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $305.0 for Carvana, spanning the last three months.

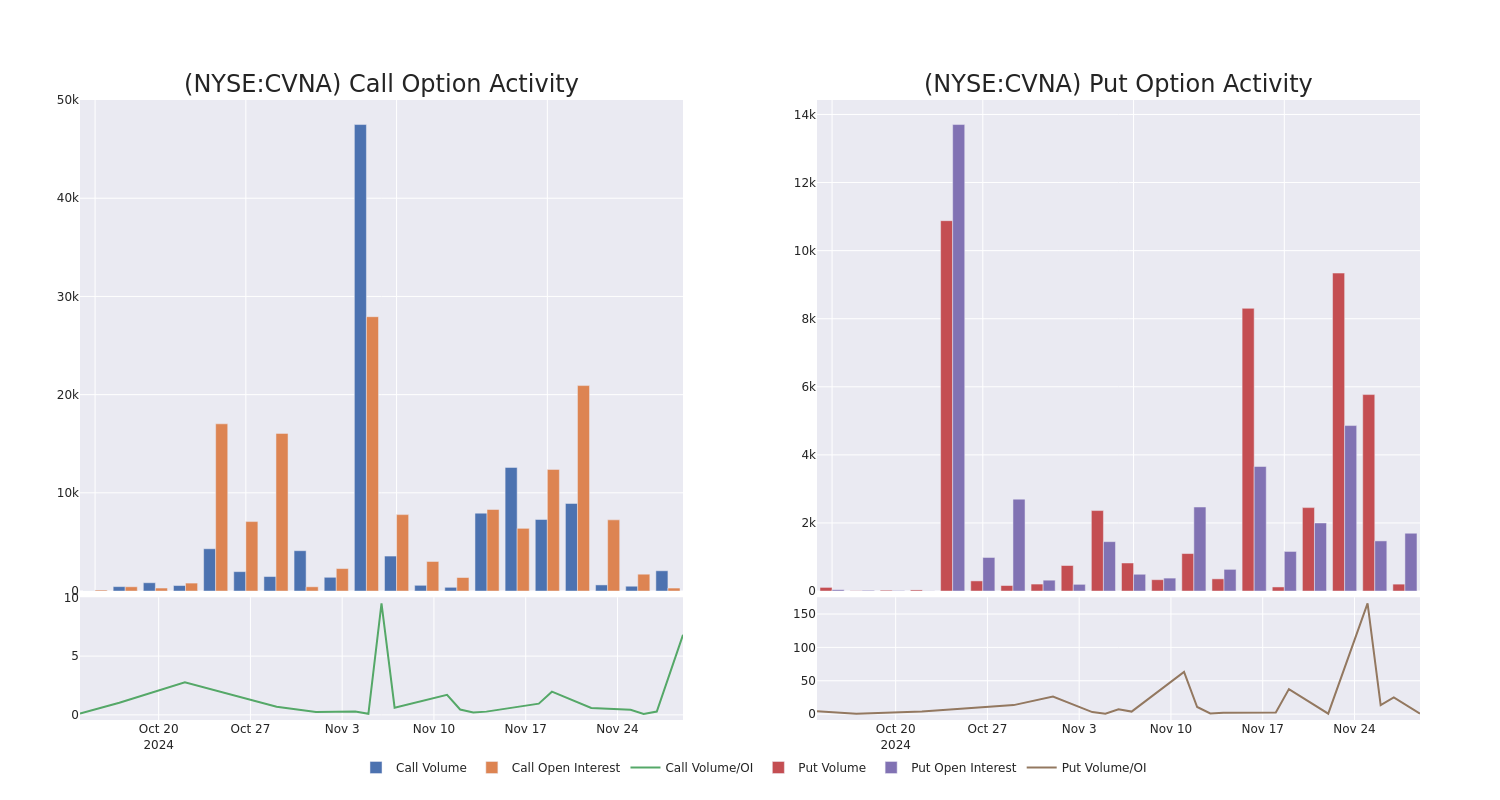

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Carvana's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Carvana's substantial trades, within a strike price spectrum from $240.0 to $305.0 over the preceding 30 days.

Carvana Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | SWEEP | BEARISH | 03/21/25 | $43.45 | $42.2 | $43.45 | $280.00 | $91.2K | 146 | 21 |

| CVNA | PUT | SWEEP | BEARISH | 03/21/25 | $43.15 | $42.35 | $43.15 | $280.00 | $81.9K | 146 | 40 |

| CVNA | PUT | SWEEP | BULLISH | 12/06/24 | $5.85 | $5.0 | $5.0 | $260.00 | $50.5K | 386 | 108 |

| CVNA | CALL | TRADE | BULLISH | 06/20/25 | $35.9 | $32.9 | $35.2 | $300.00 | $49.2K | 83 | 14 |

| CVNA | CALL | SWEEP | BULLISH | 12/06/24 | $0.49 | $0.31 | $0.49 | $290.00 | $48.5K | 115 | 1.0K |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

In light of the recent options history for Carvana, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Carvana's Current Market Status

- Currently trading with a volume of 514,090, the CVNA's price is up by 2.31%, now at $260.86.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

What Analysts Are Saying About Carvana

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $269.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from JMP Securities persists with their Market Outperform rating on Carvana, maintaining a target price of $320. * An analyst from Morgan Stanley upgraded its action to Equal-Weight with a price target of $260. * An analyst from JP Morgan has decided to maintain their Overweight rating on Carvana, which currently sits at a price target of $300. * An analyst from Baird has decided to maintain their Neutral rating on Carvana, which currently sits at a price target of $240. * An analyst from Piper Sandler persists with their Neutral rating on Carvana, maintaining a target price of $225.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.