Semtech Corporation's (NASDAQ:SMTC) Shares Climb 28% But Its Business Is Yet to Catch Up

Semtech Corporation SMTC | 65.67 65.67 | +1.83% 0.00% Post |

Despite an already strong run, Semtech Corporation (NASDAQ:SMTC) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 262% following the latest surge, making investors sit up and take notice.

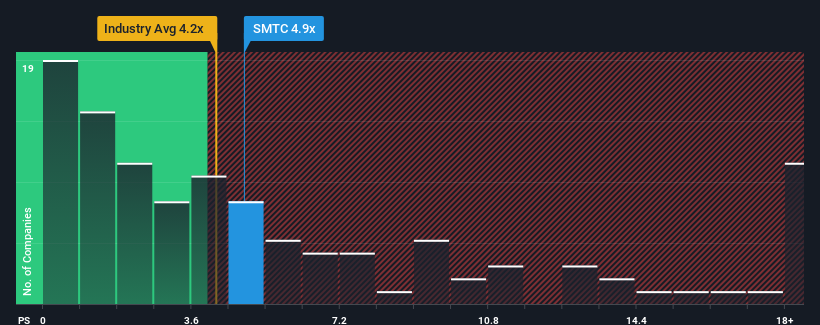

In spite of the firm bounce in price, it's still not a stretch to say that Semtech's price-to-sales (or "P/S") ratio of 4.9x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in the United States, where the median P/S ratio is around 4.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Semtech Has Been Performing

Semtech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Semtech's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Semtech?

In order to justify its P/S ratio, Semtech would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 21% over the next year. That's shaping up to be materially lower than the 40% growth forecast for the broader industry.

In light of this, it's curious that Semtech's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Semtech's P/S Mean For Investors?

Semtech's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Semtech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

If you're unsure about the strength of Semtech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.