Please use a PC Browser to access Register-Tadawul

Samsara (NYSE:IOT) Falls 14% Over The Week Despite Launch Of New Electronic Brake System

Samsara, Inc. IOT | 0.00 |

Samsara (NYSE:IOT) recently launched its Electronic Brake Performance Monitoring System (EBPMS), receiving positive feedback from clients like Fox Brothers for enhancing compliance and operational efficiency. Despite these product advancements, the company's stock price fell 14% last week. This decline aligns with the broader market downturn triggered by significant global tariff developments, which saw major indices like the Dow and Nasdaq experience their worst weeks since early 2020. The overall market was down 9%, overshadowing even promising events for Samsara, as investors reacted to fears of escalating trade tensions affecting economic growth.

Over the past three years, Samsara has achieved a total shareholder return of 148.96%, illustrating strong long-term performance. While its stock price has experienced recent fluctuations, the company's growth in annual recurring revenue and successful acquisition of large enterprise customers have been crucial. In particular, the innovative launch of solutions like the AI agent platform has expanded their product offerings, fostering operational efficiencies and safety advancements across various sectors.

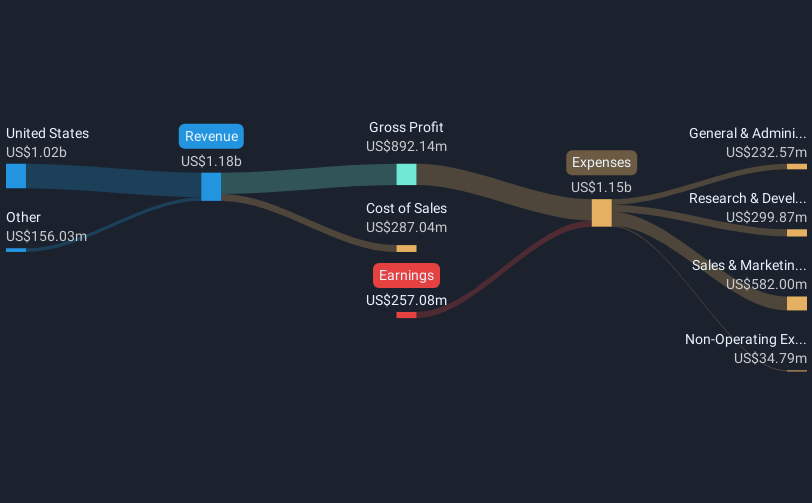

The company's strategic focus on international expansion, exemplified by the opening of a new office in Mexico City, has broadened its market reach. Despite facing challenges such as a lawsuit from Motive Technologies Inc. alleging patent infringement, Samsara has maintained revenue growth momentum. Additionally, their recent earnings announcement reflected a substantial reduction in net losses to US$154.91 million, down from US$286.73 million, underscoring improved financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.