Please use a PC Browser to access Register-Tadawul

Revenues Tell The Story For Sify Technologies Limited (NASDAQ:SIFY) As Its Stock Soars 41%

Sify Technologies Limited Sponsored ADR SIFY | 4.38 4.38 | +0.23% 0.00% Pre |

Sify Technologies Limited (NASDAQ:SIFY) shareholders would be excited to see that the share price has had a great month, posting a 41% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

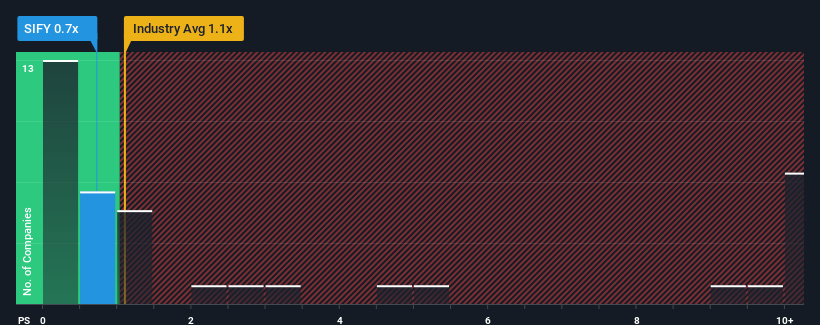

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Sify Technologies' P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Telecom industry in the United States is also close to 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sify Technologies

What Does Sify Technologies' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Sify Technologies has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Sify Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Sify Technologies would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 46% during the coming year according to the lone analyst following the company. That's shaping up to be similar to the 48% growth forecast for the broader industry.

With this information, we can see why Sify Technologies is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Sify Technologies' P/S

Its shares have lifted substantially and now Sify Technologies' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Sify Technologies maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Sify Technologies (1 is potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.