Please use a PC Browser to access Register-Tadawul

Protagonist Therapeutics, Inc.'s (NASDAQ:PTGX) Shares Climb 44% But Its Business Is Yet to Catch Up

Protagonist Therapeutics, Inc. PTGX | 0.00 |

Protagonist Therapeutics, Inc. (NASDAQ:PTGX) shares have had a really impressive month, gaining 44% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

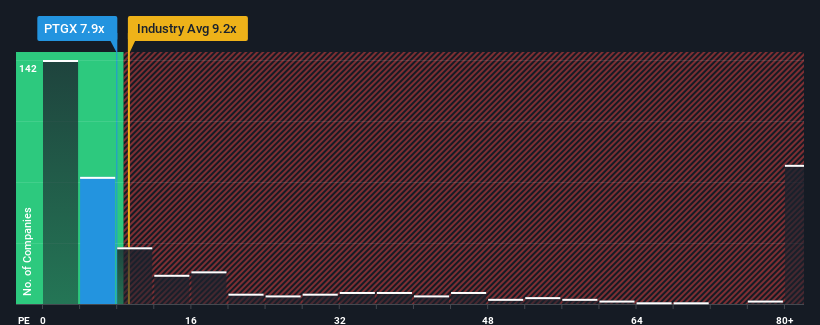

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Protagonist Therapeutics' P/S ratio of 7.9x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 9.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Protagonist Therapeutics Has Been Performing

With revenue growth that's inferior to most other companies of late, Protagonist Therapeutics has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Protagonist Therapeutics.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Protagonist Therapeutics would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 33% per annum during the coming three years according to the ten analysts following the company. That's not great when the rest of the industry is expected to grow by 128% each year.

With this in consideration, we think it doesn't make sense that Protagonist Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Protagonist Therapeutics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Protagonist Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.