Palantir's YTD Returns Surge 298%: Here's How ETFs With Exposure To Alex Karp's Company Have Performed

Palantir Technologies PLTR | 82.38 82.80 | +2.09% +0.51% Pre |

ETF Opportunities Trust REX AI Equity Premium Income ETF AIPI | 50.47 50.46 | +1.32% -0.02% Pre |

ARK Innovation ETF ARKK | 60.96 60.60 | +2.90% -0.59% Pre |

GLOBAL X DEFENSE TECH ETF SHLD | 38.12 38.30 | +0.61% +0.47% Pre |

Palantir Technologies Inc. (NASDAQ:PLTR) has experienced a remarkable rise, achieving a 298.37% year-to-date return as of Thursday morning. This surge has sparked interest in ETFs with significant exposure to Palantir.

According to Benzinga Pro, the Global X Defense Tech ETF (NYSE:SHLD) holds 7.82% of its portfolio in Palantir stock, amounting to $51.85 million across 1.24 million shares. SHLD, which combines Palantir’s defense and intelligence sector presence with other aerospace and defense players, has seen a 40.86% YTD return.

Meanwhile, ARK Innovation ETF (NYSE:ARKK) has allocated nearly 5% of its portfolio to Palantir, with over $273 million invested in 6.53 million shares. Known for backing high-growth companies, ARKK boasts over $6 billion in assets under management and has achieved a 13.17% YTD return.

See Also: MicroStrategy Shares Rise In Monday Pre-Market As Michael Saylor Reveals MSTR Generating $500M Daily Amid Bitcoin’s Surge (UPDATED)

On the other hand, the REX AI Equity Premium Income ETF (NASDAQ:AIPI) holds 9.46% exposure to Palantir, translating to a $9.24 million position. However, its YTD returns have declined by 0.61%. AIPI’s strategy involves selling out-of-the-money covered call options, which can generate income but may limit capital appreciation.

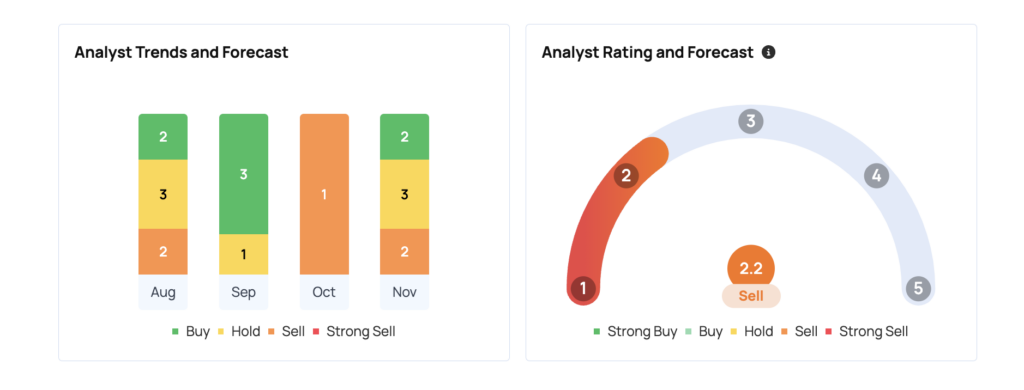

At the time of writing, Palantir’s stock was up by 0.23%. The three most recent analyst ratings for Palantir. were issued by BofA Securities, Wedbush, and Goldman Sachs on Nov. 25 and Nov, 7, with an average price target of $63.67 from these firms.

Read Next:

- Crypto’s Next Mega-Rocket? Analyst Forecasts Insane 2725%-6600% Surge For This Coin

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Flickr