Okta (NASDAQ:OKTA) Has Debt But No Earnings; Should You Worry?

Okta, Inc. Class A OKTA | 83.19 82.50 | -0.49% -0.83% Pre |

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Okta, Inc. (NASDAQ:OKTA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Okta's Debt?

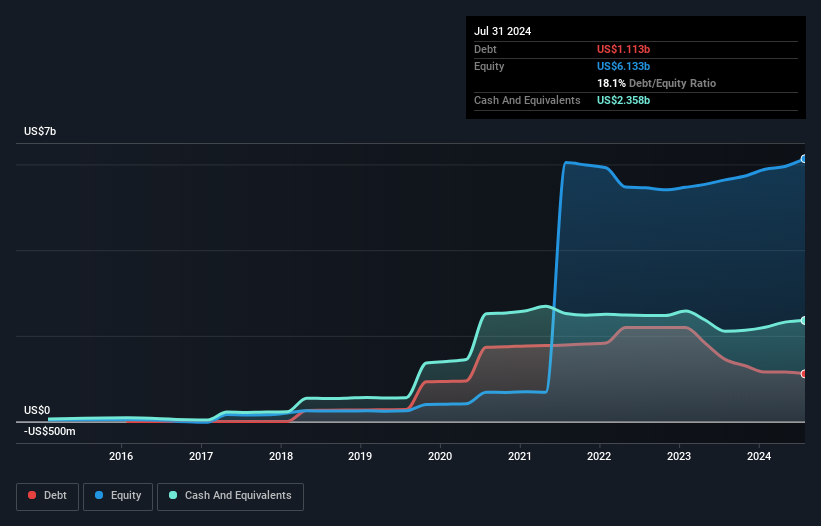

As you can see below, Okta had US$1.11b of debt at July 2024, down from US$1.45b a year prior. However, its balance sheet shows it holds US$2.36b in cash, so it actually has US$1.25b net cash.

A Look At Okta's Liabilities

Zooming in on the latest balance sheet data, we can see that Okta had liabilities of US$1.66b due within 12 months and liabilities of US$1.27b due beyond that. Offsetting these obligations, it had cash of US$2.36b as well as receivables valued at US$400.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$176.0m.

This state of affairs indicates that Okta's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$12.2b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Okta boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Okta can strengthen its balance sheet over time.

In the last year Okta wasn't profitable at an EBIT level, but managed to grow its revenue by 19%, to US$2.5b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Okta?

Although Okta had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$607m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.