November 2024's Top Picks: Penny Stocks On US Exchanges

Prelude PRLD | 1.19 1.19 | -4.03% 0.00% Pre |

As November 2024 comes to a close, the U.S. stock market has been making headlines with the S&P 500 and Dow Jones Industrial Average reaching record highs and posting their largest monthly gains of the year. Amidst this robust market performance, investors are increasingly exploring diverse opportunities, including those offered by penny stocks. While often considered a throwback to earlier trading days, penny stocks represent smaller or newer companies that can offer significant potential when backed by strong financials. In this article, we will explore three such penny stocks on U.S. exchanges that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.802475 | $5.83M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.67M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.72 | $139.43M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.22 | $8.1M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.90 | $805.62M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $52.14M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.952 | $85.62M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $410.03M | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Adagene (NasdaqGM:ADAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Adagene Inc. is a clinical-stage biotechnology company focused on the research, development, and production of monoclonal antibody drugs for cancer treatment, with a market cap of $102.27 million.

Operations: Adagene Inc. has not reported any revenue segments.

Market Cap: $102.27M

Adagene Inc., with a market cap of US$102.27 million, is pre-revenue, generating less than US$1 million. The company has a robust cash runway exceeding three years and short-term assets of US$98.8 million surpassing its liabilities, suggesting financial stability despite rising debt levels over five years. Recent data from the SITC 2024 conference highlighted promising therapeutic potential for ADG126 in combination with pembrolizumab for MSS colorectal cancer treatment, showing enhanced efficacy and safety profiles compared to existing therapies. However, Adagene remains unprofitable with earnings projected to decline annually by 10.5% over the next three years.

Prelude Therapeutics (NasdaqGS:PRLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prelude Therapeutics Incorporated is a clinical-stage biopharmaceutical company dedicated to discovering and developing novel precision cancer medicines for underserved patients, with a market cap of $57.79 million.

Operations: Prelude Therapeutics Incorporated currently does not report any revenue segments.

Market Cap: $57.79M

Prelude Therapeutics, with a market cap of US$57.79 million, is pre-revenue, reporting sales of US$3 million and a net loss of US$32.27 million for Q3 2024. The company is debt-free and has short-term assets of US$156.4 million exceeding its liabilities, offering some financial stability despite high volatility in share price. Prelude's ongoing Phase 1 trial for PRT3789 shows potential in treating SMARCA4-mutated cancers; however, profitability remains elusive with earnings forecasted to decline by 7.1% annually over the next three years. The management and board are experienced but face challenges in achieving revenue growth targets.

Xunlei (NasdaqGS:XNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xunlei Limited, with a market cap of $123.61 million, operates an internet platform for digital media content in the People's Republic of China.

Operations: The company's revenue is primarily generated from the operation of its online media platform, amounting to $359.61 million.

Market Cap: $123.61M

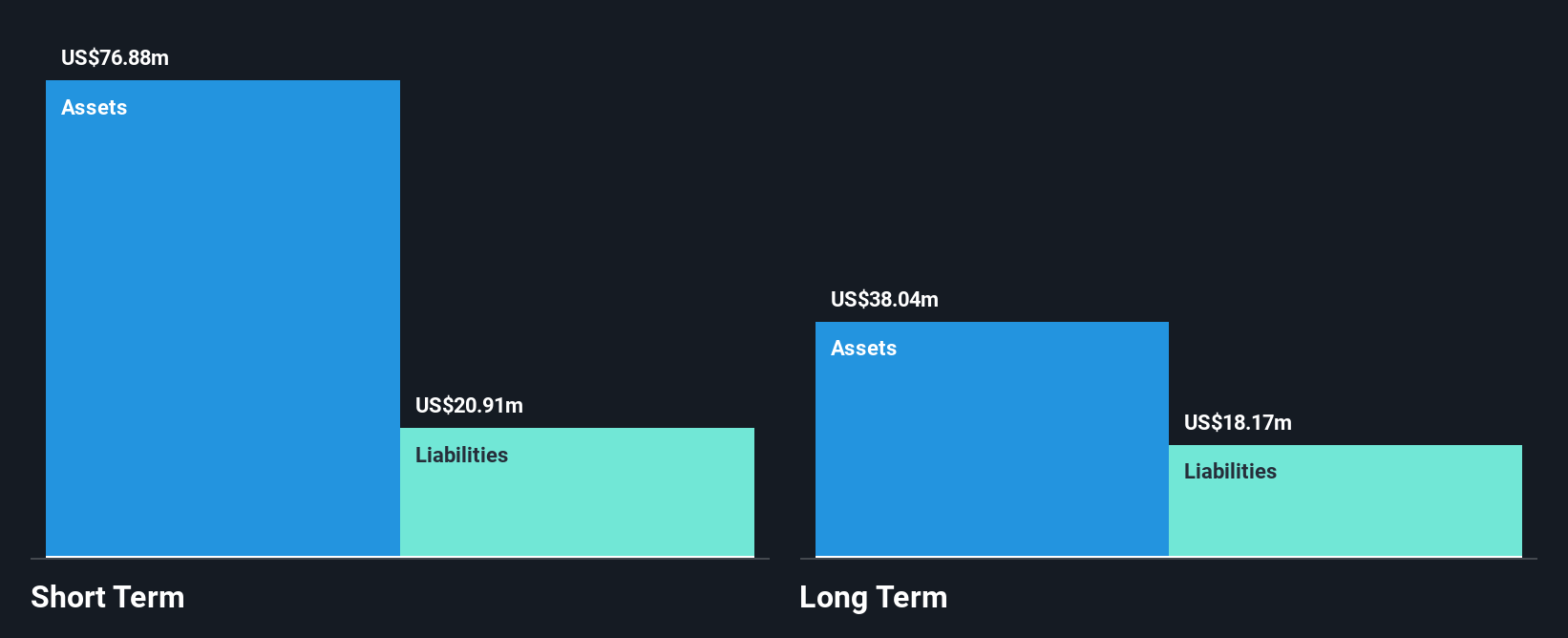

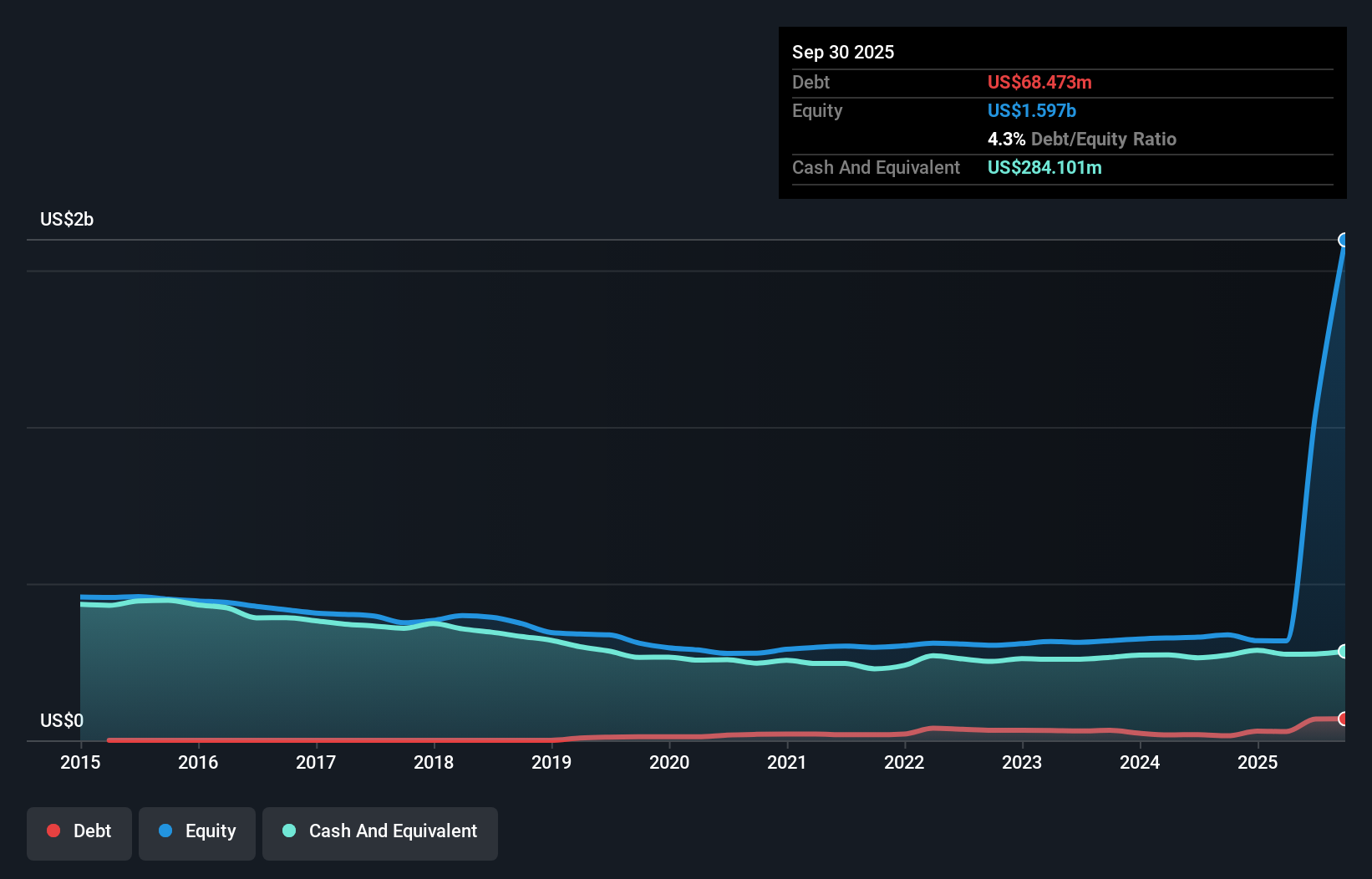

Xunlei Limited, with a market cap of US$123.61 million, operates an internet platform in China and reported Q3 2024 revenue of US$79.84 million, showing a slight decline from the previous year. The company maintains strong liquidity, with short-term assets of US$348.4 million exceeding both its short-term and long-term liabilities significantly. Xunlei's debt is well-covered by operating cash flow, indicating sound financial management despite low return on equity at 4.2%. Recent board changes include the appointment of He Huang as an independent director following Ya Li's resignation, potentially impacting corporate governance dynamics moving forward.

Turning Ideas Into Actions

- Get an in-depth perspective on all 712 US Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.