Not Many Are Piling Into Mobile-health Network Solutions (NASDAQ:MNDR) Stock Yet As It Plummets 29%

Mobile-health Network Solutions MNDR | 0.26 0.26 | -4.57% 0.00% Pre |

Unfortunately for some shareholders, the Mobile-health Network Solutions (NASDAQ:MNDR) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

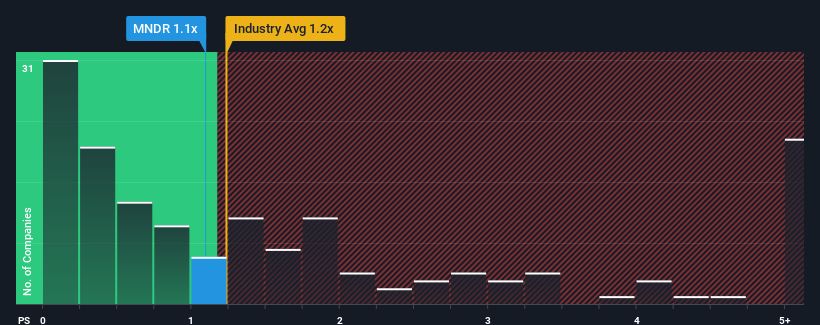

Even after such a large drop in price, it's still not a stretch to say that Mobile-health Network Solutions' price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Healthcare industry in the United States, where the median P/S ratio is around 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Mobile-health Network Solutions Has Been Performing

Mobile-health Network Solutions certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Mobile-health Network Solutions' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Mobile-health Network Solutions?

The only time you'd be comfortable seeing a P/S like Mobile-health Network Solutions' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 77% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 7.8%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Mobile-health Network Solutions' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Mobile-health Network Solutions' P/S

With its share price dropping off a cliff, the P/S for Mobile-health Network Solutions looks to be in line with the rest of the Healthcare industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mobile-health Network Solutions currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Mobile-health Network Solutions is showing 3 warning signs in our investment analysis, and 1 of those is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.